- Germany

- /

- Diversified Financial

- /

- XTRA:DFTK

DF Deutsche Forfait AG's (ETR:DFTK) Share Price Is Matching Sentiment Around Its Earnings

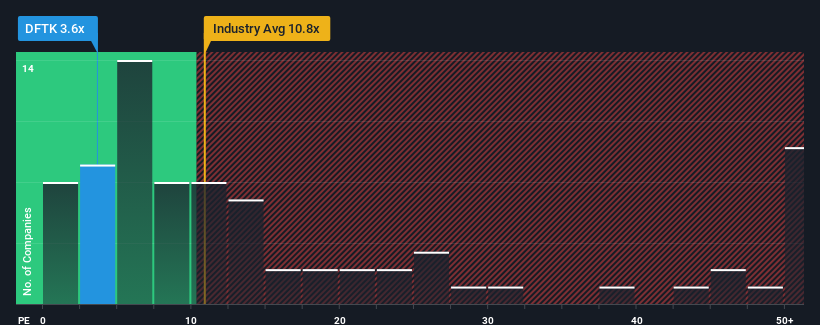

When close to half the companies in Germany have price-to-earnings ratios (or "P/E's") above 17x, you may consider DF Deutsche Forfait AG (ETR:DFTK) as a highly attractive investment with its 3.6x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For instance, DF Deutsche Forfait's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for DF Deutsche Forfait

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as DF Deutsche Forfait's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 26%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 18% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 15% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why DF Deutsche Forfait is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From DF Deutsche Forfait's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of DF Deutsche Forfait revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware DF Deutsche Forfait is showing 4 warning signs in our investment analysis, and 1 of those is significant.

If these risks are making you reconsider your opinion on DF Deutsche Forfait, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DFTK

DF Deutsche Forfait

Provides foreign trade finance and related services for exporters, importers, and other financial companies in the Middle East and Eastern Europe.

Medium-low risk with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026