- Germany

- /

- Capital Markets

- /

- XTRA:DBK

Is It Too Late To Consider Deutsche Bank After Its 84% 2025 Rally?

Reviewed by Bailey Pemberton

- Wondering if Deutsche Bank is still a bargain after its big run, or if you might be late to the party? This breakdown will help you decide whether the current price makes sense or is getting ahead of itself.

- The stock is up 1.4% over the last week and 84.3% year to date, with a massive 87.7% gain over the past year and 279.4% over five years, so the market has clearly re-rated the bank's prospects.

- Recent headlines have focused on Deutsche Bank's ongoing restructuring progress and renewed focus on core banking operations, as well as shifting expectations around European interest rates and capital requirements. Together, these themes have given investors a fresh lens on both the bank's risk profile and its long term earnings power.

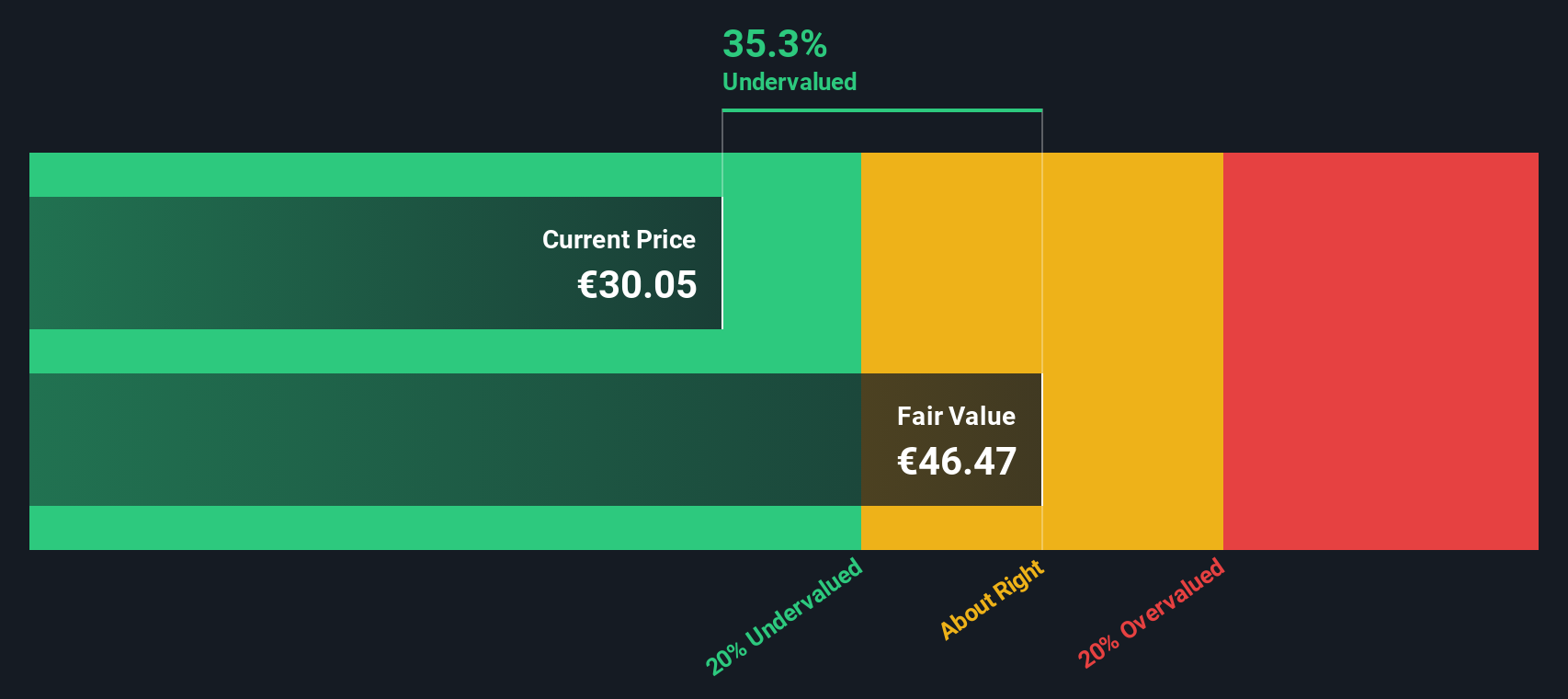

- Despite those gains, Deutsche Bank currently scores 4/6 on our undervaluation checks, which suggests there may still be value on the table, depending on the lens you use. Next, we will walk through the main valuation approaches, and then finish with a more holistic way to think about what the market might really be pricing in.

Approach 1: Deutsche Bank Excess Returns Analysis

The Excess Returns model evaluates how efficiently Deutsche Bank converts its equity base into profits by comparing the return it generates with the return investors require. If the bank consistently earns more than its cost of equity, that excess value can help justify a higher share price.

For Deutsche Bank, the model uses a Book Value of €40.49 per share and a Stable EPS of €3.61 per share, based on weighted future Return on Equity estimates from 11 analysts. The implied Cost of Equity is €3.79 per share, resulting in a slightly negative Excess Return of €-0.17 per share, despite an Average Return on Equity of 9.53%. The Stable Book Value is estimated at €37.93 per share, informed by forecasts from 7 analysts.

Even with this marginal shortfall versus the cost of equity, the Excess Returns framework still points to an intrinsic value of about €35.89 per share. This implies the stock is around 13.7% undervalued versus the current market price, suggesting that the recent rally may not have fully exhausted the upside.

Result: UNDERVALUED

Our Excess Returns analysis suggests Deutsche Bank is undervalued by 13.7%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

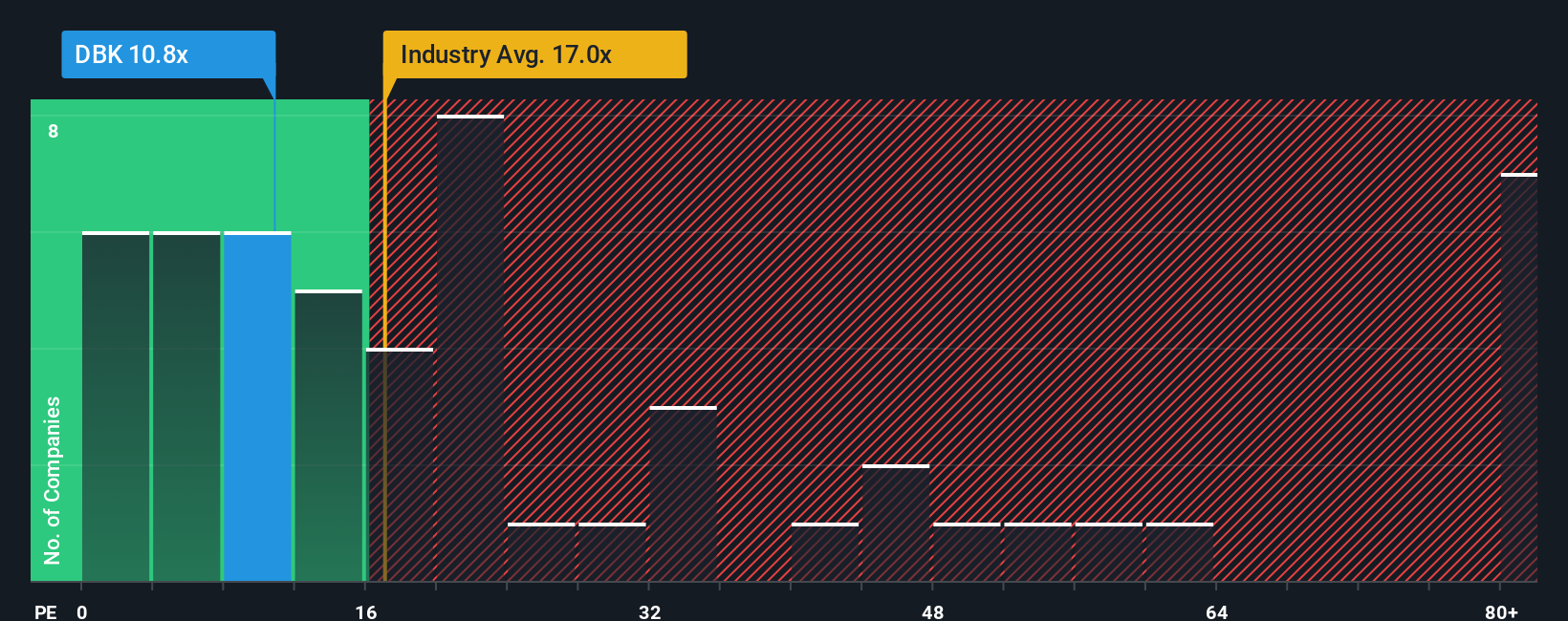

Approach 2: Deutsche Bank Price vs Earnings

For a profitable bank like Deutsche Bank, the price to earnings ratio is a practical way to gauge how much investors are willing to pay for each euro of earnings today. In general, faster earnings growth and lower perceived risk justify a higher PE, while slower growth or higher risk usually means the multiple should sit closer to, or below, market and industry norms.

Deutsche Bank currently trades on a PE of 11.45x, which is below both the Capital Markets industry average of about 14.49x and the broader peer group average of roughly 17.80x. At first glance, that discount suggests the market is still cautious about the bank’s long term earnings resilience despite its recent turnaround.

Simply Wall St’s Fair Ratio framework takes this a step further. Instead of only comparing Deutsche Bank with peers, it estimates what a more appropriate multiple might be after accounting for the company’s earnings growth profile, profitability, risk factors, industry characteristics and market cap. On that basis, Deutsche Bank’s Fair Ratio is 24.93x, well above its current 11.45x. This indicates the shares are still pricing in a significant safety margin relative to their fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Deutsche Bank Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to put your own story about Deutsche Bank into numbers by linking what you believe about its future revenues, earnings and margins to a concrete financial forecast and fair value estimate. On Simply Wall St’s Community page, Narratives are an easy, accessible tool used by millions of investors to map a company’s story into a forecast and then compare that Fair Value to the current Price, so you can quickly see whether your view says “buy”, “hold”, or “sell” and watch that call update dynamically as fresh news, earnings and guidance arrive. For Deutsche Bank, one investor might build a bullish Narrative around digital expansion, capital strength and higher margin fee businesses and arrive at a fair value closer to the optimistic €35.0 target, while another who focuses on credit losses, litigation and regulation could land nearer the cautious €10.93, and Narratives help you see exactly how each path from assumptions to valuation differs.

Do you think there's more to the story for Deutsche Bank? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DBK

Deutsche Bank

A stock corporation, provides corporate and investment banking, private clients, and asset management products and services in Germany, the United Kingdom, rest of Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026