- Germany

- /

- Capital Markets

- /

- XTRA:DBK

Deutsche Bank (XTRA:DBK): Valuation Snapshot as Major Leadership Shifts and New Bond Issuances Draw Focus

Reviewed by Simply Wall St

If you have been watching Deutsche Bank (XTRA:DBK), you have probably noticed a lot happening all at once. Recent days brought a wave of major leadership changes, including a new global co-head for corporate banking, appointments in emerging markets and the Americas, and the launch of several high-yield senior notes. These are not minor tweaks but strategic moves that could reshape the bank’s direction and, naturally, spark a round of debate for anyone weighing next steps with the stock.

All this activity has not gone unnoticed in the market. Deutsche Bank’s share price is up strongly over the past year, building on momentum that has accelerated over the past 3 months. The combination of organizational shifts and new fixed income offerings appears to be feeding investor optimism about future growth and risk management, especially when compared to its performance earlier in the year.

With this much change, the question is front and center: is Deutsche Bank’s stock now undervalued given this momentum, or are investors getting ahead of themselves and pricing in growth that may still be taking shape?

Most Popular Narrative: 9% Overvalued

According to the most widely followed narrative, Deutsche Bank may be slightly ahead of its fundamentals. While recent momentum is significant, the bank is considered overvalued against analyst forecasts based on current discounted cash flow models and future profit assumptions.

"The imminent large-scale German fiscal stimulus and structural reforms (including the 'Made for Germany' initiative) are expected to drive significant increases in corporate, infrastructure, and defense investment activity from 2026 onward. Deutsche Bank is poised to benefit due to its leading market position, strong corporate client relationships, and global reach. This should generate higher lending volumes, advisory, and fee-based revenues over time."

Curious how this bullish outlook squares with the current price tag? Analysts may be factoring in bigger future growth, profit margin expansion, and shrinking share count. But what exactly are those optimistic assumptions? There could be a gap between the market’s hopes and the reality revealed by deeper analysis. Want to see what numbers are hiding behind this valuation?

Result: Fair Value of €28.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing litigation risk or persistent credit losses, especially in U.S. commercial real estate, could quickly change this seemingly optimistic outlook.

Find out about the key risks to this Deutsche Bank narrative.Another View: What Do Earnings Multiples Reveal?

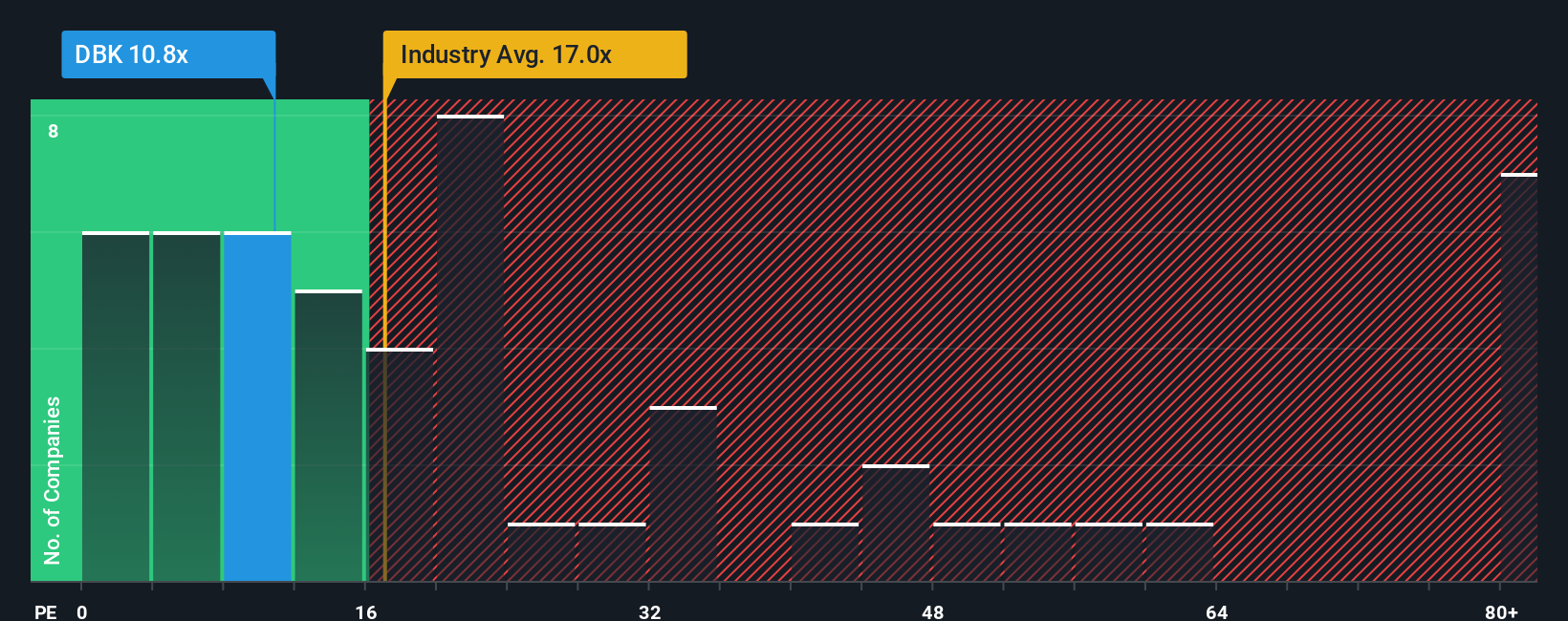

Looking at valuation from a different perspective, Deutsche Bank’s current earnings are priced attractively compared to the industry average. This suggests the market may not be fully reflecting its recent momentum. Is this the real value driver, or does the share price still run ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Deutsche Bank to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Deutsche Bank Narrative

If these views do not quite align with your own, you can always dig into the data and craft a unique story in just a few minutes. Do it your way.

A great starting point for your Deutsche Bank research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Expand your opportunities today. Three fresh screens are ready to help you target market-beating stocks and spot hidden gems before others catch on.

- Spot opportunity in overlooked small-caps trading with strong fundamentals by checking out penny stocks with strong financials.

- Find tomorrow’s tech leaders at the heart of artificial intelligence innovation when you use our AI penny stocks.

- Strengthen your portfolio with solid companies priced below their intrinsic value by uncovering picks through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DBK

Deutsche Bank

A stock corporation, provides corporate and investment banking, private clients, and asset management products and services in Germany, the United Kingdom, rest of Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives