- Germany

- /

- Capital Markets

- /

- XTRA:DBAN

November 2024's Leading Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets navigate the uncertainty surrounding the incoming Trump administration's policies, investors are closely watching sector performances and policy implications for corporate earnings. With U.S. stocks experiencing a partial pullback of recent gains and interest rates showing signs of potential shifts, identifying growth companies with high insider ownership can be particularly appealing in such fluctuating environments. In this context, insider ownership often signals confidence in a company's prospects, making it an important factor to consider when evaluating potential investments amidst current market dynamics.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| On Holding (NYSE:ONON) | 31% | 29.7% |

| Medley (TSE:4480) | 34% | 31.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here's a peek at a few of the choices from the screener.

Swedencare (OM:SECARE)

Simply Wall St Growth Rating: ★★★★☆☆

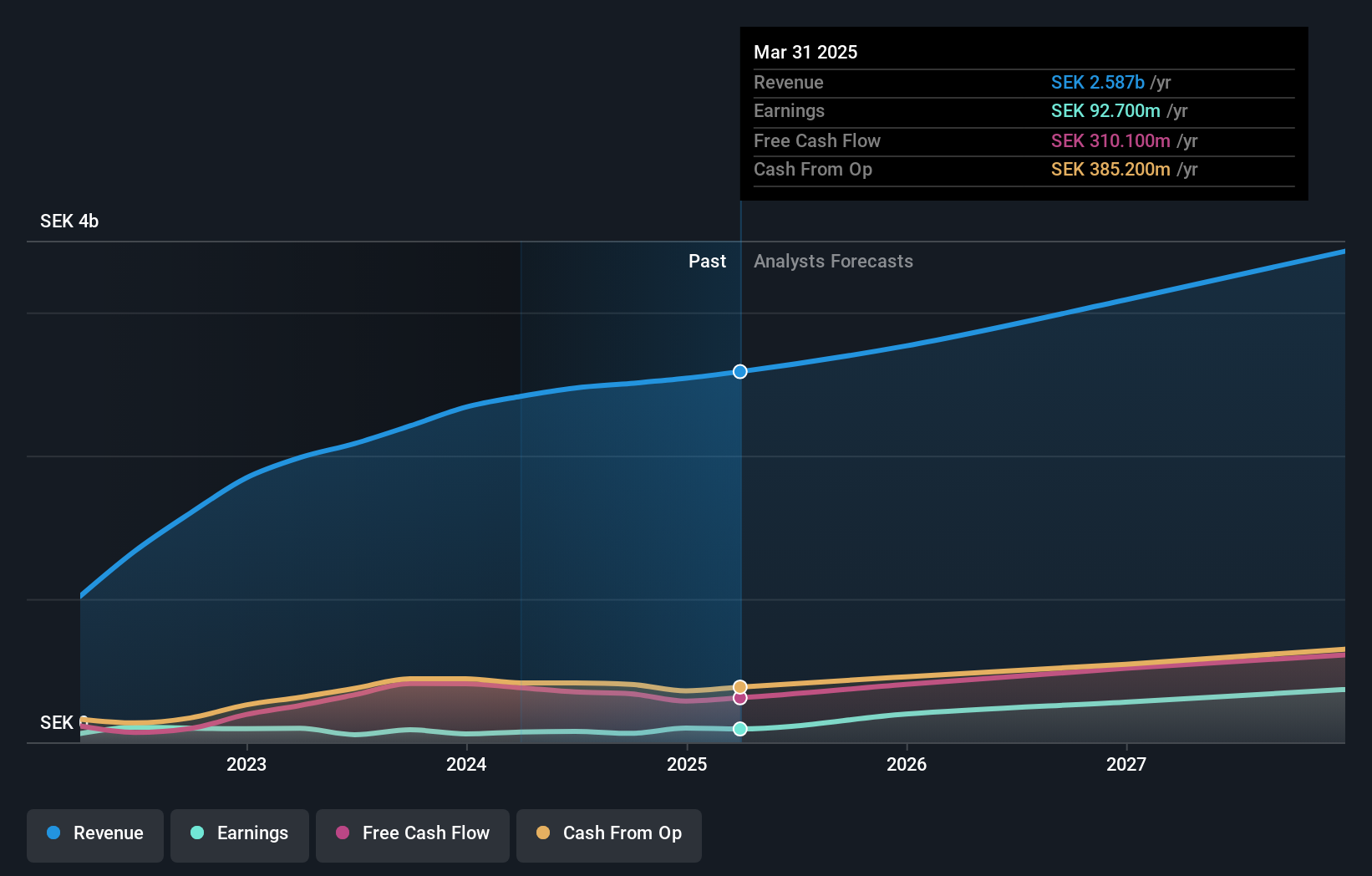

Overview: Swedencare AB (publ) develops, manufactures, markets, and sells animal healthcare products for cats, dogs, and horses across Sweden, the United Kingdom, the rest of Europe, North America, Asia, and internationally with a market cap of approximately SEK7.12 billion.

Operations: The company's revenue segments include SEK397.40 million from Europe, SEK659 million from Production, and SEK1.66 billion from North America.

Insider Ownership: 12.2%

Swedencare demonstrates characteristics of a growth company with high insider ownership, evidenced by substantial insider buying in the past three months. Despite a decline in profit margins from 4% to 2.5% year-over-year, earnings are forecast to grow significantly at 64.17% annually over the next three years, outpacing the Swedish market's expected growth. Trading at 68.6% below estimated fair value and with analysts predicting a potential stock price increase of 31%, Swedencare presents an intriguing investment profile.

- Take a closer look at Swedencare's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Swedencare is priced lower than what may be justified by its financials.

JTOWER (TSE:4485)

Simply Wall St Growth Rating: ★★★★☆☆

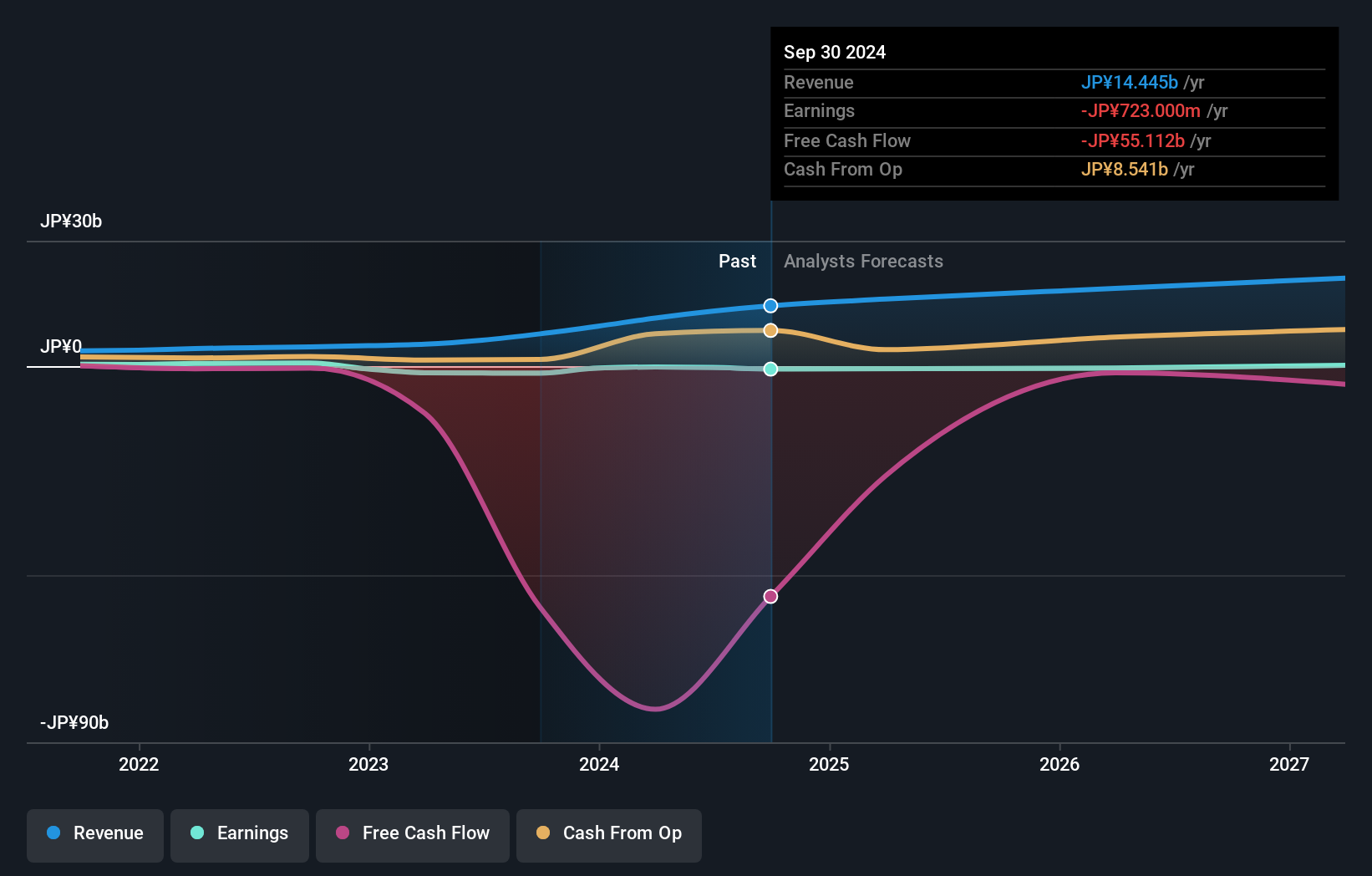

Overview: JTOWER Inc. offers infrastructure sharing services in Japan with a market capitalization of ¥92.16 billion.

Operations: The company generates revenue from its Telecommunications Infrastructure Sharing Business, amounting to ¥13.15 billion.

Insider Ownership: 18.2%

JTOWER's recent acquisition by DigitalBridge Group, taking it private, indicates a strategic shift in ownership structure. Despite high volatility and past shareholder dilution, JTOWER is expected to achieve profitability within three years with earnings growth forecasted at 63.79% annually. Although revenue growth of 16.1% per year is slower than some benchmarks, it surpasses the broader Japanese market's expectations. The impending delisting from the Tokyo Stock Exchange underscores significant insider involvement and potential restructuring impacts.

- Dive into the specifics of JTOWER here with our thorough growth forecast report.

- According our valuation report, there's an indication that JTOWER's share price might be on the expensive side.

Deutsche Beteiligungs (XTRA:DBAN)

Simply Wall St Growth Rating: ★★★★★☆

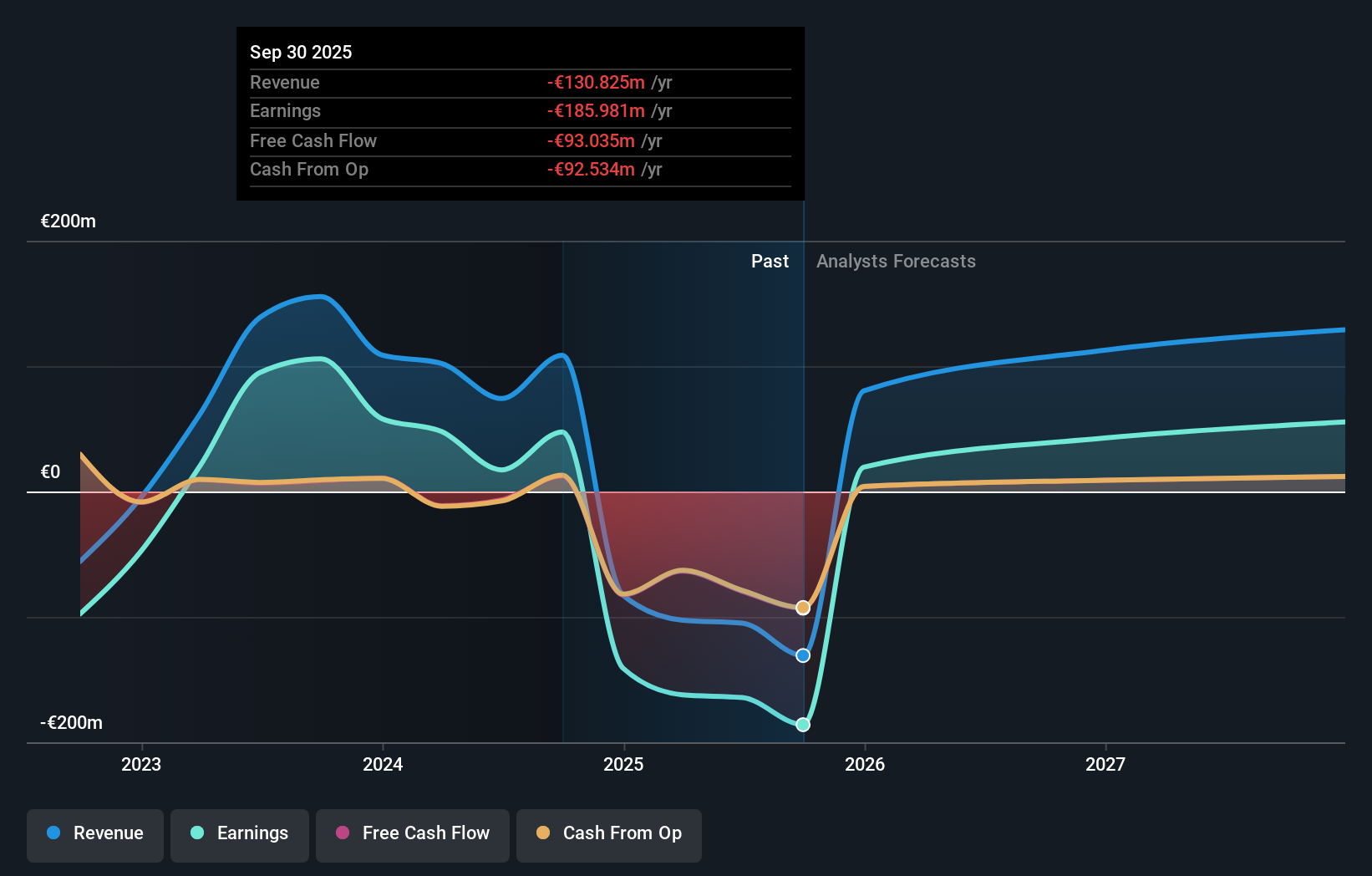

Overview: Deutsche Beteiligungs AG is a private equity and venture capital firm specializing in direct and fund of fund investments, with a market cap of €420.63 million.

Operations: The firm's revenue segments include Fund Investment Services at €48.00 million and Private Equity Investments at €27.01 million.

Insider Ownership: 39.6%

Deutsche Beteiligungs is trading significantly below its estimated fair value, with earnings and revenue growth forecasted to outpace the German market substantially—earnings by 54.1% and revenue by 41.7% annually. However, profit margins have decreased markedly from last year, and dividends are not well-covered by earnings or cash flow. Despite low expected return on equity in three years, analysts agree on a potential price increase of 88.2%.

- Navigate through the intricacies of Deutsche Beteiligungs with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Deutsche Beteiligungs shares in the market.

Key Takeaways

- Investigate our full lineup of 1546 Fast Growing Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DBAN

Deutsche Beteiligungs

A private equity and venture capital firm specializing in direct and fund of fund investments.

Very undervalued with high growth potential.