- France

- /

- Consumer Durables

- /

- ENXTPA:RBO

European Growth Stocks Insiders Are Betting On

Reviewed by Simply Wall St

As the European market navigates through a mixed economic landscape, with the pan-European STOXX Europe 600 Index seeing modest gains amid dovish signals from U.S. Fed Chair Jerome Powell and easing trade tensions, investors are keenly observing sectors poised for growth. In this context, stocks with high insider ownership often attract attention as they suggest confidence from those closest to the company’s operations; this can be particularly compelling in uncertain times where insider bets may signal potential resilience or growth opportunities.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| KebNi (OM:KEBNI B) | 36.3% | 74% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 97.9% |

| Egetis Therapeutics (OM:EGTX) | 10.4% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 41.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Roche Bobois (ENXTPA:RBO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Roche Bobois S.A. is involved in the design and distribution of furniture globally, with a market cap of €363.46 million.

Operations: The company's revenue is derived from several segments, including Roche Bobois USA/Canada (€138.48 million), Roche Bobois France (€108.61 million), Roche Bobois Europe (Excluding France) (€101.65 million), Cuir Center (€42.37 million), and Roche Bobois Others (Overseas) (€20.80 million).

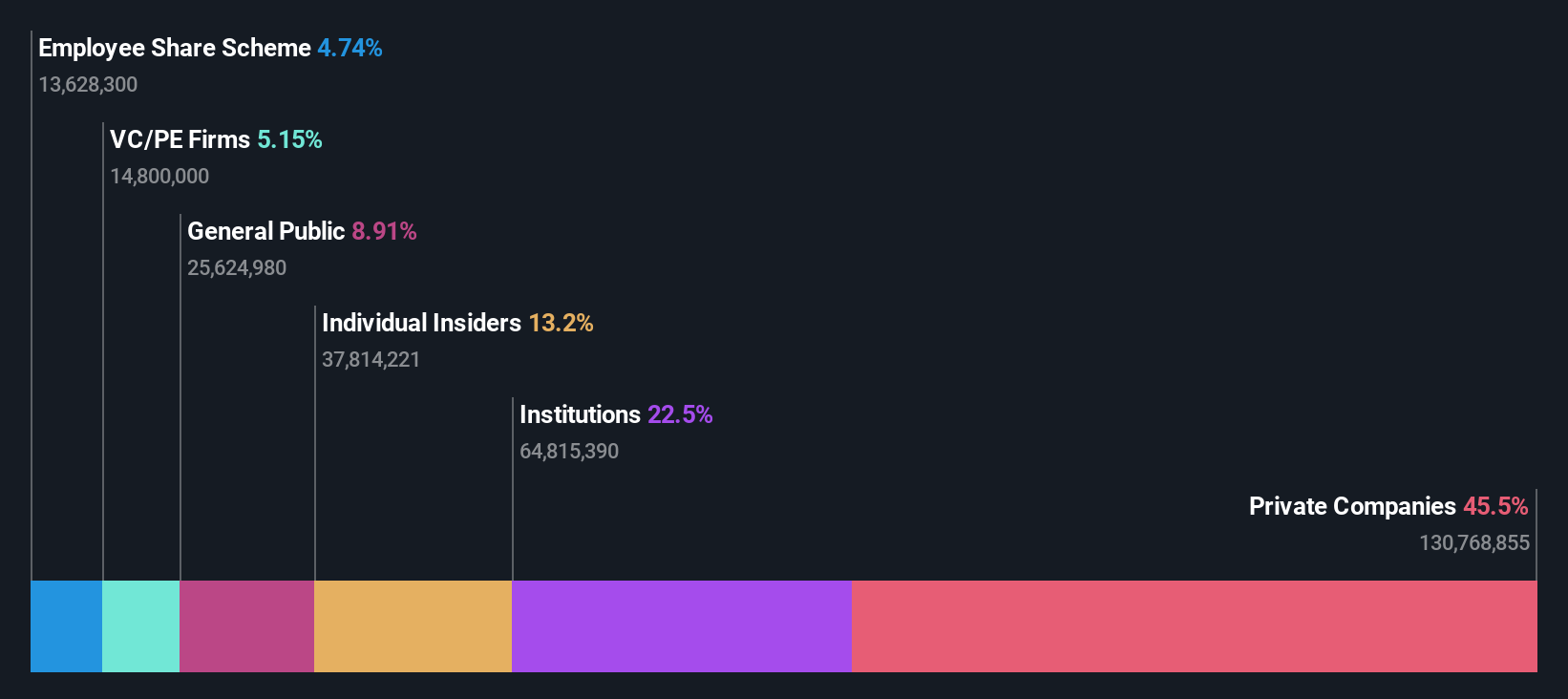

Insider Ownership: 32.7%

Earnings Growth Forecast: 23.6% p.a.

Roche Bobois, with substantial insider ownership, is trading significantly below its estimated fair value and is poised for strong earnings growth at 23.6% annually, outpacing the French market's average. Despite stable revenue forecasts and a recent dip in profit margins, the company continues expanding internationally with new store openings in North America and Luxembourg. However, its dividend yield of 3.46% isn't well covered by earnings, indicating potential sustainability concerns.

- Take a closer look at Roche Bobois' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Roche Bobois' current price could be inflated.

Peab (OM:PEAB B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Peab AB (publ) is a construction and civil engineering company operating in Sweden, Norway, Finland, Denmark, and internationally with a market cap of SEK21.85 billion.

Operations: Peab AB's revenue segments include Industry at SEK21.07 billion, Construction at SEK22.95 billion, Civil Engineering at SEK16.80 billion, Project Development - Housing Development at SEK3.50 billion, and Project Development - Property Development at SEK735 million.

Insider Ownership: 13.2%

Earnings Growth Forecast: 21.8% p.a.

Peab's substantial insider ownership aligns with its strong growth prospects, as earnings are expected to rise significantly at 21.8% annually, surpassing the Swedish market average. Recent contract extensions and new projects like road maintenance and office renovations bolster its revenue pipeline, although revenue growth is moderate at 4.2% per year. Despite trading well below estimated fair value, Peab faces challenges with interest coverage and an unstable dividend track record, suggesting financial prudence is necessary.

- Click here and access our complete growth analysis report to understand the dynamics of Peab.

- Upon reviewing our latest valuation report, Peab's share price might be too pessimistic.

Deutsche Beteiligungs (XTRA:DBAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Deutsche Beteiligungs AG is a private equity and venture capital firm focusing on direct and fund of fund investments, with a market cap of €425.72 million.

Operations: The company's revenue segments include Fund Investment Services generating €54.47 million and Private Equity Investments contributing -€159.49 million.

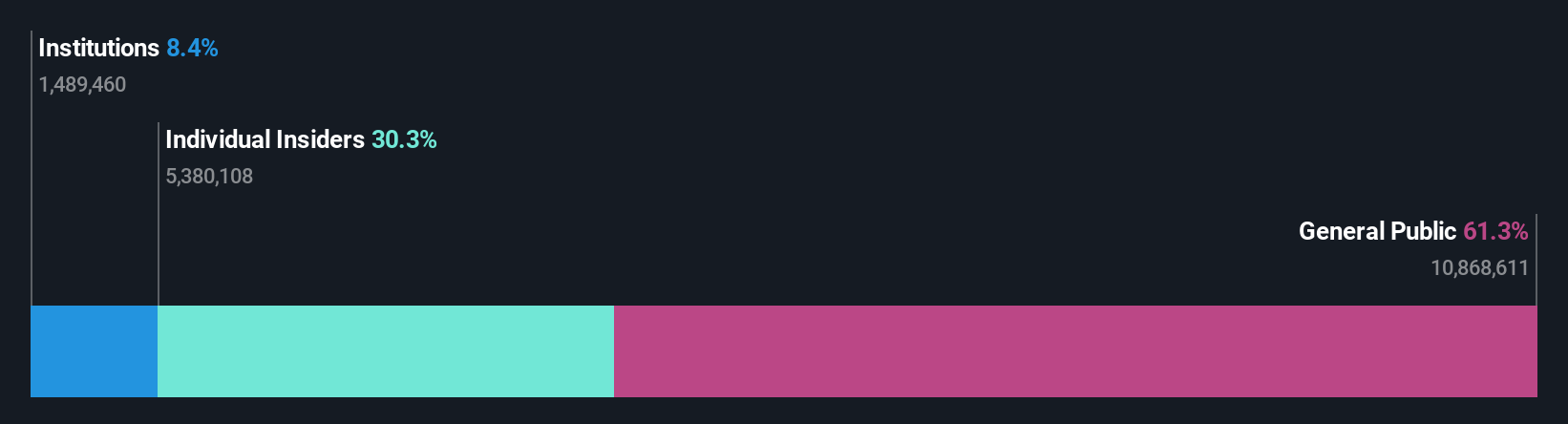

Insider Ownership: 30.3%

Earnings Growth Forecast: 97.5% p.a.

Deutsche Beteiligungs AG's high insider ownership aligns with its robust growth outlook, as revenue is forecast to grow 69.7% annually, outpacing the German market. Despite recent earnings declines—revenue fell to €38.67 million and net income to €8.2 million—the company anticipates becoming profitable within three years, reflecting above-market growth expectations. Recent share buybacks totaling €5.92 million indicate confidence in future performance, although dividend sustainability remains a concern due to insufficient earnings coverage.

- Navigate through the intricacies of Deutsche Beteiligungs with our comprehensive analyst estimates report here.

- The analysis detailed in our Deutsche Beteiligungs valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Dive into all 194 of the Fast Growing European Companies With High Insider Ownership we have identified here.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RBO

Roche Bobois

Engages in the furniture design and distribution business worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives