- Germany

- /

- Diversified Financial

- /

- XTRA:CSQ

creditshelf (ETR:CSQ) shareholders are up 20% this past week, but still in the red over the last three years

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term creditshelf Aktiengesellschaft (ETR:CSQ) shareholders, since the share price is down 47% in the last three years, falling well short of the market return of around 23%. And the ride hasn't got any smoother in recent times over the last year, with the price 32% lower in that time.

On a more encouraging note the company has added €7.8m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for creditshelf

Given that creditshelf didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, creditshelf saw its revenue grow by 30% per year, compound. That's well above most other pre-profit companies. The share price drop of 14% per year over three years would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. It seems likely that actual growth fell short of shareholders' expectations. Still, with high hopes now tempered, now might prove to be an opportunity to buy.

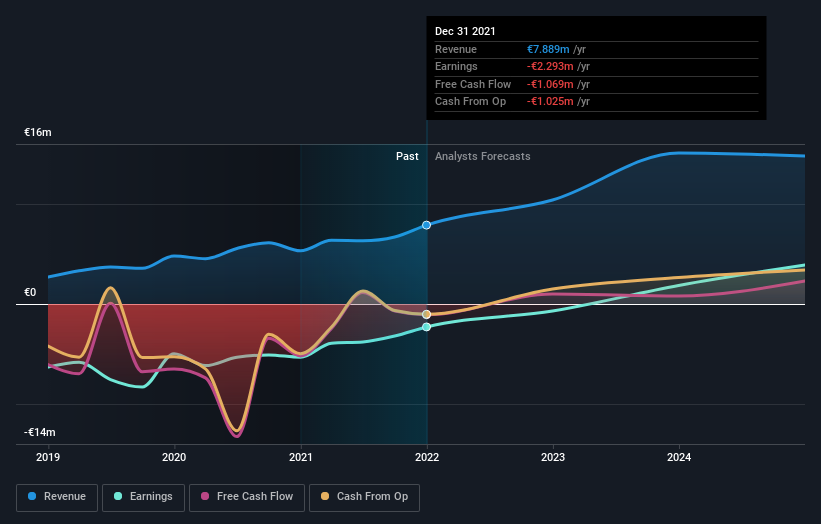

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

creditshelf shareholders are down 32% for the year, falling short of the market return. The market shed around 7.1%, no doubt weighing on the stock price. Shareholders have lost 14% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand creditshelf better, we need to consider many other factors. For example, we've discovered 2 warning signs for creditshelf that you should be aware of before investing here.

Of course creditshelf may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

Valuation is complex, but we're here to simplify it.

Discover if creditshelf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:CSQ

creditshelf

Operates as a digital small and medium-sized enterprises financing company in Germany.

Slightly overvalued with worrying balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026