- Germany

- /

- Capital Markets

- /

- XTRA:ADE

Should Bitcoin Group (ETR:ADE) Be Disappointed With Their 92% Profit?

Passive investing in index funds can generate returns that roughly match the overall market. But investors can boost returns by picking market-beating companies to own shares in. For example, the Bitcoin Group SE (ETR:ADE) share price is up 92% in the last year, clearly besting the market return of around 6.1% (not including dividends). So that should have shareholders smiling. The longer term returns have not been as good, with the stock price only 5.4% higher than it was three years ago.

Check out our latest analysis for Bitcoin Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

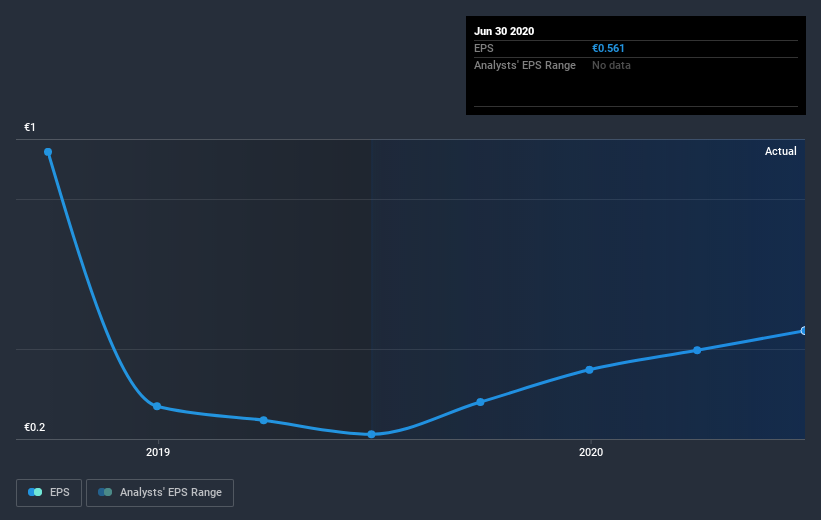

During the last year Bitcoin Group grew its earnings per share (EPS) by 159%. This EPS growth is significantly higher than the 92% increase in the share price. So it seems like the market has cooled on Bitcoin Group, despite the growth. Interesting. Having said that, the market is still optimistic, given the P/E ratio of 99.79.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Bitcoin Group's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Bitcoin Group rewarded shareholders with a total shareholder return of 92% over the last year. That gain actually surpasses the 1.8% TSR it generated (per year) over three years. The improving returns to shareholders suggests the stock is becoming more popular with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Bitcoin Group you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you decide to trade Bitcoin Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bitcoin Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:ADE

Bitcoin Group

An investment holding company, engages in the cryptocurrency and blockchain businesses worldwide.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success