- Germany

- /

- Capital Markets

- /

- BST:GBQ

What GBK Beteiligungen AG's (BST:GBQ) 29% Share Price Gain Is Not Telling You

GBK Beteiligungen AG (BST:GBQ) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 9.1% isn't as attractive.

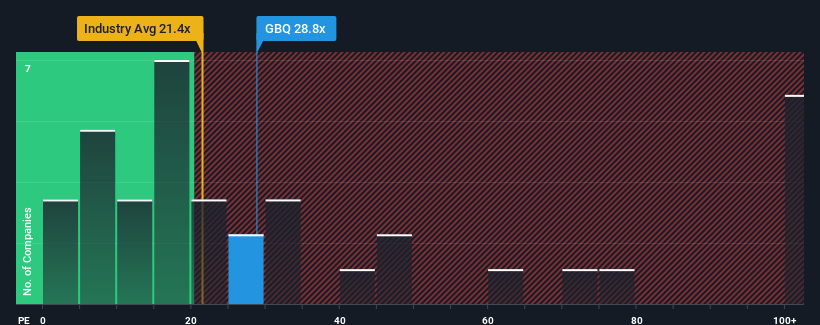

Since its price has surged higher, GBK Beteiligungen may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 28.8x, since almost half of all companies in Germany have P/E ratios under 18x and even P/E's lower than 10x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, GBK Beteiligungen has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for GBK Beteiligungen

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like GBK Beteiligungen's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 176%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 19% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that GBK Beteiligungen is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Shares in GBK Beteiligungen have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of GBK Beteiligungen revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 5 warning signs for GBK Beteiligungen you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BST:GBQ

GBK Beteiligungen

A private equity firm specializing in later stage, middle market, management buyouts, ownership buyouts, management buy-ins, spin offs as well as expansion financing, succession, emerging growth and bridge financing.

Flawless balance sheet moderate.