The 123fahrschule SE (FRA:123F) share price has fared very poorly over the last month, falling by a substantial 31%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 64% loss during that time.

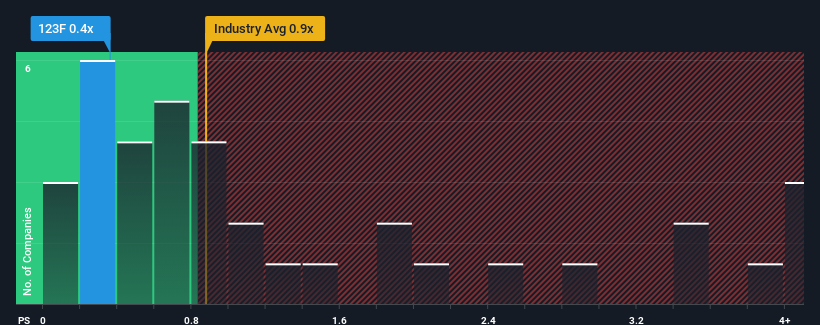

Since its price has dipped substantially, 123fahrschule's price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Consumer Services industry in Germany, where around half of the companies have P/S ratios above 0.9x and even P/S above 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for 123fahrschule

What Does 123fahrschule's P/S Mean For Shareholders?

Recent times have been advantageous for 123fahrschule as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think 123fahrschule's future stacks up against the industry? In that case, our free report is a great place to start.How Is 123fahrschule's Revenue Growth Trending?

In order to justify its P/S ratio, 123fahrschule would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 15% per annum as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 3.9% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that 123fahrschule's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

123fahrschule's recently weak share price has pulled its P/S back below other Consumer Services companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems 123fahrschule currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for 123fahrschule (3 are significant) you should be aware of.

If you're unsure about the strength of 123fahrschule's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:123F

123fahrschule

Engages in driving license training in the German driving school market.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives