- Switzerland

- /

- Capital Markets

- /

- SWX:GAM

GAM Holding And 2 Other Penny Stocks Worth Watching

Reviewed by Simply Wall St

Global markets have experienced a turbulent week, with U.S. stocks declining amid cautious commentary from the Federal Reserve and concerns over potential government shutdowns affecting investor confidence. In such a climate, identifying promising investment opportunities requires careful consideration of financial health and growth potential. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies that can offer unique value propositions. By focusing on those with strong balance sheets and clear growth trajectories, investors might uncover opportunities in this niche sector worth exploring further.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.71 | MYR420.07M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,854 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

GAM Holding (SWX:GAM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GAM Holding AG is a publicly owned asset management holding company with a market cap of CHF14.00 million.

Operations: The company generates revenue of CHF101.4 million from its Investment Management Solutions and Products segment.

Market Cap: CHF14M

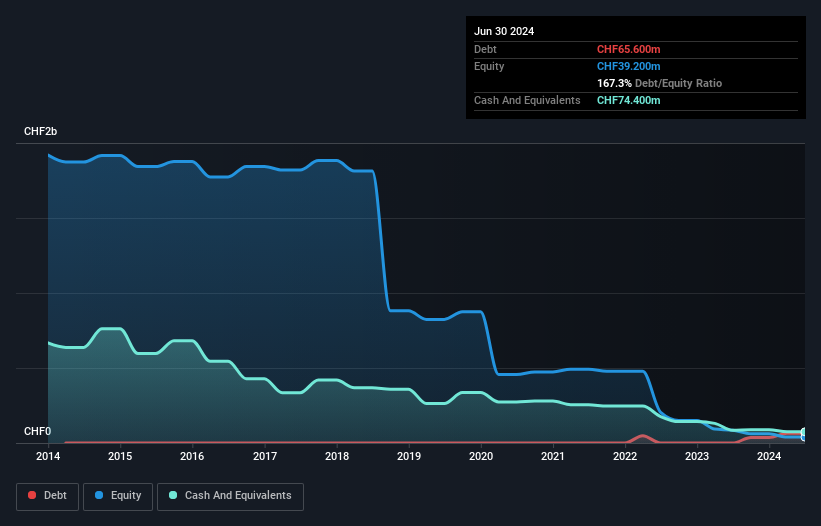

GAM Holding AG, with a market cap of CHF14 million, is navigating financial challenges typical of penny stocks. Despite being unprofitable, it has reduced losses by 34.9% annually over the past five years. The company's recent follow-on equity offering raised CHF99.49 million, potentially bolstering its cash position which already exceeds total debt and supports a cash runway exceeding one year based on current free cash flow. However, GAM faces high share price volatility and short-term liabilities slightly surpassing short-term assets. Recent executive changes aim to strengthen client relationships and business growth in key regions.

- Unlock comprehensive insights into our analysis of GAM Holding stock in this financial health report.

- Examine GAM Holding's past performance report to understand how it has performed in prior years.

VRG (WSE:VRG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VRG S.A. is a company that designs, manufactures, and distributes jewelry and fashion collections for both women and men in Poland and internationally, with a market cap of PLN752.60 million.

Operations: The company's revenue is primarily derived from its jeweler segment, which generated PLN743.79 million, and its clothing segment, which brought in PLN588.98 million.

Market Cap: PLN752.6M

VRG S.A., with a market cap of PLN752.60 million, shows mixed financial health typical of penny stocks. Its third-quarter sales rose to PLN311.48 million from the previous year, yet net income for the nine months decreased to PLN40.59 million from PLN51.84 million a year ago, indicating challenges in maintaining profit growth. Despite this, VRG's short-term assets comfortably cover both short and long-term liabilities, and its debt-to-equity ratio has improved over five years to 12.5%. The company benefits from stable earnings quality and experienced management but faces lower return on equity at 8.9%.

- Jump into the full analysis health report here for a deeper understanding of VRG.

- Assess VRG's future earnings estimates with our detailed growth reports.

HomeToGo (XTRA:HTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HomeToGo SE operates a marketplace for vacation rentals, connecting users searching for accommodations in Luxembourg and internationally, with a market cap of €236.73 million.

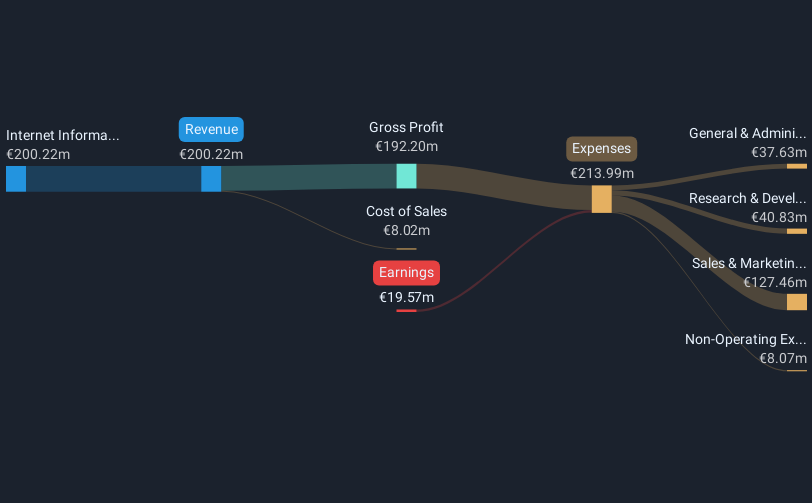

Operations: The company generates revenue from its Internet Information Providers segment, totaling €200.22 million.

Market Cap: €236.73M

HomeToGo SE, with a market cap of €236.73 million, displays characteristics common to penny stocks. Its recent third-quarter sales increased to €87.38 million from the previous year, although it remains unprofitable with reduced losses over five years at 19% annually. The company is in discussions to acquire Interhome Group, which could influence its strategic direction but remains uncertain. HomeToGo's short-term assets exceed both short and long-term liabilities, providing some financial stability despite its negative return on equity of -5.83%. While volatile, the stock trades significantly below estimated fair value and has not diluted shareholders recently.

- Get an in-depth perspective on HomeToGo's performance by reading our balance sheet health report here.

- Gain insights into HomeToGo's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Dive into all 5,854 of the Penny Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GAM

Adequate balance sheet and slightly overvalued.