- Germany

- /

- Hospitality

- /

- XTRA:HTG

AFYREN SAS Leads The Pack With 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have experienced a turbulent week, with U.S. stocks mostly lower due to AI competition concerns and mixed corporate earnings reports, while European indices hit record highs following strong earnings and an ECB rate cut. In such fluctuating market conditions, investors often turn their attention to penny stocks—smaller or less-established companies that can offer unique opportunities for growth at lower price points. Despite being considered a somewhat outdated term, penny stocks remain relevant as they can present valuable investment prospects for those seeking potential upside with manageable risk profiles.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.69 | HK$42.39B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.89 | £482.95M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £178.85M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.10 | HK$698.27M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| China Lilang (SEHK:1234) | HK$3.92 | HK$4.69B | ★★★★★☆ |

Click here to see the full list of 5,722 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

AFYREN SAS (ENXTPA:ALAFY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AFYREN SAS offers solutions in France to substitute petroleum-based ingredients with products from non-food biomass, with a market cap of €43.21 million.

Operations: The company generates €2.79 million in revenue from its chemicals segment.

Market Cap: €43.21M

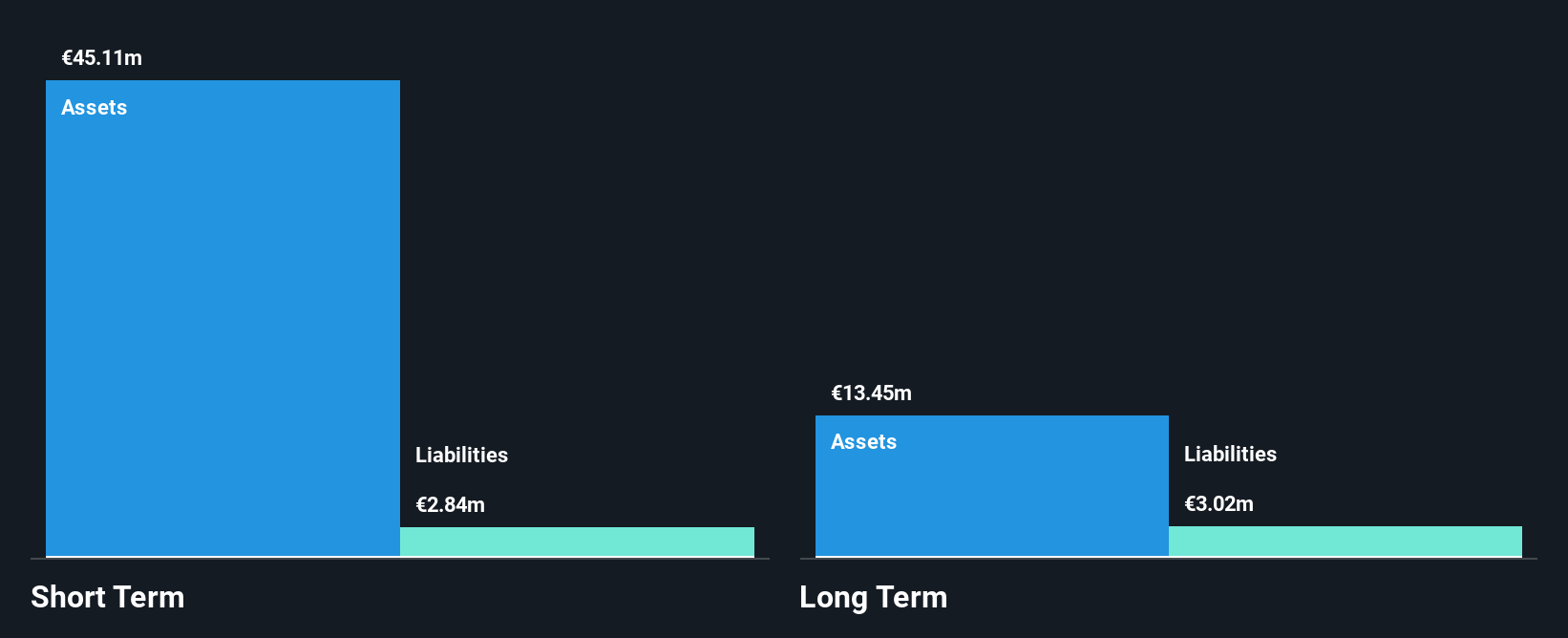

AFYREN SAS, with a market cap of €43.21 million, is navigating the penny stock landscape by offering innovative solutions in substituting petroleum-based ingredients. Despite generating €2.79 million in revenue from its chemicals segment, it remains unprofitable and faces high share price volatility. The company has more cash than debt and short-term assets exceeding liabilities, indicating financial prudence. However, its negative return on equity and increasing losses over the past five years highlight challenges ahead. Revenue is forecast to grow significantly annually, suggesting potential for future expansion if operational hurdles are overcome.

- Get an in-depth perspective on AFYREN SAS' performance by reading our balance sheet health report here.

- Evaluate AFYREN SAS' prospects by accessing our earnings growth report.

Oil Refineries (TASE:ORL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oil Refineries Ltd., with a market cap of ₪3.38 billion, operates in the production and sale of fuel products, intermediate materials, and aromatic products both in Israel and internationally.

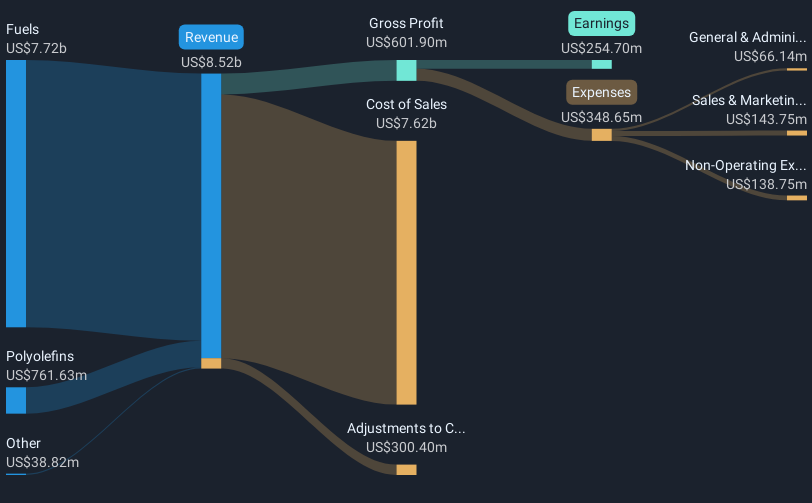

Operations: The company generates revenue primarily from fuels, amounting to $7.72 billion, and polyolefins, contributing $761.63 million.

Market Cap: ₪3.38B

Oil Refineries Ltd., with a market cap of ₪3.38 billion, generates substantial revenue from fuels ($7.72 billion) and polyolefins ($761.63 million). Despite a significant reduction in debt-to-equity ratio over five years, recent negative earnings growth (-61.6%) poses challenges compared to industry averages. The company's interest payments are well covered by EBIT (4.5x), and its short-term assets exceed liabilities, indicating solid liquidity management. However, current profit margins have declined to 3.1% from 6.9% last year, and the dividend track record remains unstable despite high-quality earnings and satisfactory net debt levels (36.7%).

- Jump into the full analysis health report here for a deeper understanding of Oil Refineries.

- Assess Oil Refineries' previous results with our detailed historical performance reports.

HomeToGo (XTRA:HTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HomeToGo SE operates a marketplace for vacation rentals, connecting users with accommodations in Luxembourg and internationally, with a market cap of €246.94 million.

Operations: The company's revenue is derived from its Internet Information Providers segment, totaling €200.22 million.

Market Cap: €246.94M

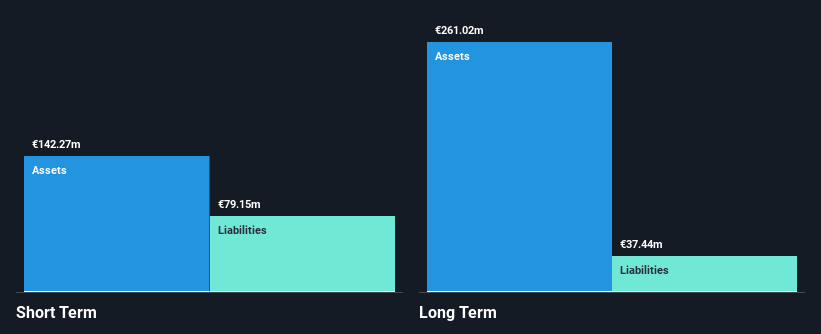

HomeToGo SE, with a market cap of €246.94 million, has shown revenue growth, reporting €87.38 million in Q3 2024 sales compared to €73.86 million the previous year. Despite being unprofitable, it reduced its net loss from €18.72 million to €10.01 million over nine months ending September 2024 and forecasts an 89% annual earnings growth rate. The company maintains a strong financial position with short-term assets exceeding liabilities and more cash than debt, while trading significantly below estimated fair value and exhibiting high share price volatility recently despite no significant shareholder dilution last year.

- Click here to discover the nuances of HomeToGo with our detailed analytical financial health report.

- Examine HomeToGo's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Take a closer look at our Penny Stocks list of 5,722 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HomeToGo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HTG

HomeToGo

Operates a marketplace for vacation rentals that connects users searching for a place to stay in Luxembourg and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives