- Germany

- /

- Hospitality

- /

- XTRA:EMH

Why We're Not Concerned About pferdewetten.de AG's (ETR:EMH) Share Price

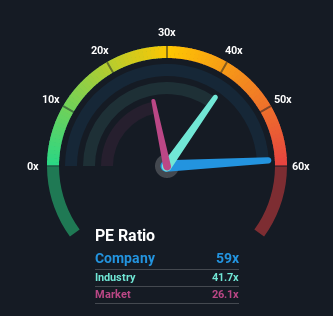

With a price-to-earnings (or "P/E") ratio of 59x pferdewetten.de AG (ETR:EMH) may be sending very bearish signals at the moment, given that almost half of all companies in Germany have P/E ratios under 26x and even P/E's lower than 14x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

pferdewetten.de could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for pferdewetten.de

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like pferdewetten.de's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 56% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 44% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 46% per year during the coming three years according to the twin analysts following the company. With the market only predicted to deliver 20% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that pferdewetten.de's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On pferdewetten.de's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of pferdewetten.de's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with pferdewetten.de, and understanding these should be part of your investment process.

If you're unsure about the strength of pferdewetten.de's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

When trading pferdewetten.de or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:EMH

pferdewetten.de

Engages in the online horse betting business in Germany and internationally.

High growth potential very low.

Market Insights

Community Narratives