- Germany

- /

- Hospitality

- /

- XTRA:EMH

pferdewetten.de AG's (ETR:EMH) 26% Cheaper Price Remains In Tune With Revenues

Unfortunately for some shareholders, the pferdewetten.de AG (ETR:EMH) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

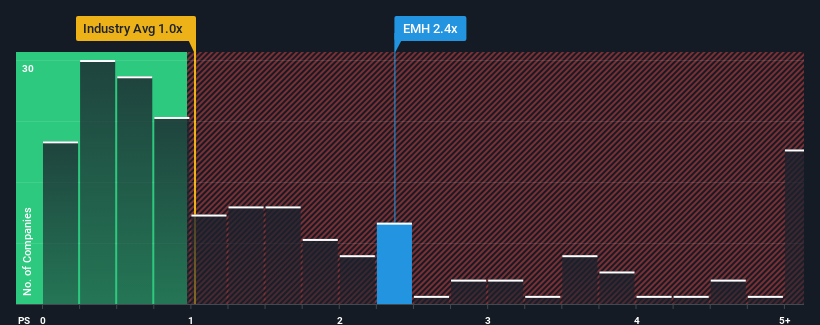

In spite of the heavy fall in price, when almost half of the companies in Germany's Hospitality industry have price-to-sales ratios (or "P/S") below 0.7x, you may still consider pferdewetten.de as a stock probably not worth researching with its 2.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for pferdewetten.de

What Does pferdewetten.de's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, pferdewetten.de has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think pferdewetten.de's future stacks up against the industry? In that case, our free report is a great place to start.How Is pferdewetten.de's Revenue Growth Trending?

In order to justify its P/S ratio, pferdewetten.de would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. Pleasingly, revenue has also lifted 38% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 61% per year during the coming three years according to the three analysts following the company. With the industry only predicted to deliver 12% per annum, the company is positioned for a stronger revenue result.

In light of this, it's understandable that pferdewetten.de's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From pferdewetten.de's P/S?

There's still some elevation in pferdewetten.de's P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that pferdewetten.de maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Hospitality industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for pferdewetten.de that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EMH

pferdewetten.de

Engages in the online horse betting business in Germany and internationally.

High growth potential with low risk.

Market Insights

Community Narratives