- Germany

- /

- Hospitality

- /

- XTRA:DHER

Delivery Hero SE's (ETR:DHER) Popularity With Investors Under Threat As Stock Sinks 31%

To the annoyance of some shareholders, Delivery Hero SE (ETR:DHER) shares are down a considerable 31% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 70% share price decline.

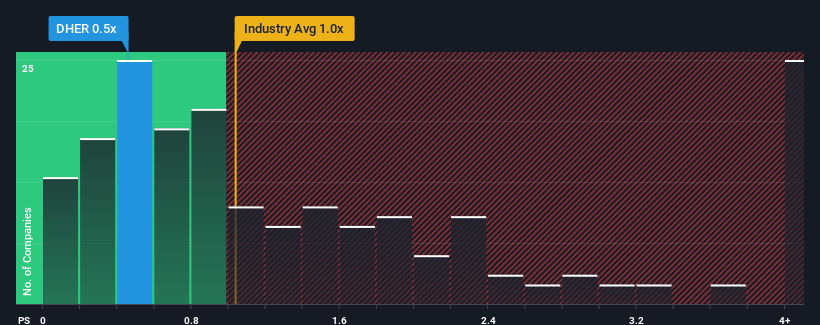

Although its price has dipped substantially, it's still not a stretch to say that Delivery Hero's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Hospitality industry in Germany, where the median P/S ratio is around 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Delivery Hero

What Does Delivery Hero's Recent Performance Look Like?

Recent times have been advantageous for Delivery Hero as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Delivery Hero's future stacks up against the industry? In that case, our free report is a great place to start.How Is Delivery Hero's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Delivery Hero's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the analysts watching the company. With the industry predicted to deliver 377% growth per annum, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Delivery Hero's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Following Delivery Hero's share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that Delivery Hero's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - Delivery Hero has 2 warning signs (and 1 which is significant) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DHER

Undervalued with high growth potential.