- Germany

- /

- Food and Staples Retail

- /

- XTRA:HAW

Here's Why Hawesko Holding (ETR:HAW) Can Manage Its Debt Responsibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Hawesko Holding AG (ETR:HAW) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out the opportunities and risks within the DE Consumer Retailing industry.

What Is Hawesko Holding's Debt?

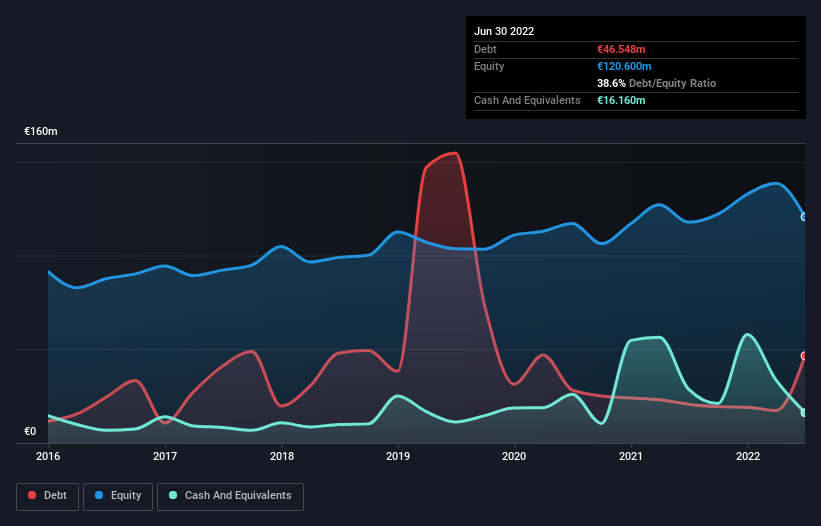

You can click the graphic below for the historical numbers, but it shows that as of June 2022 Hawesko Holding had €46.5m of debt, an increase on €20.7m, over one year. However, because it has a cash reserve of €16.2m, its net debt is less, at about €30.4m.

A Look At Hawesko Holding's Liabilities

We can see from the most recent balance sheet that Hawesko Holding had liabilities of €161.7m falling due within a year, and liabilities of €133.8m due beyond that. Offsetting this, it had €16.2m in cash and €41.6m in receivables that were due within 12 months. So it has liabilities totalling €237.7m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of €345.9m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Hawesko Holding has a low net debt to EBITDA ratio of only 0.53. And its EBIT covers its interest expense a whopping 13.6 times over. So we're pretty relaxed about its super-conservative use of debt. In fact Hawesko Holding's saving grace is its low debt levels, because its EBIT has tanked 29% in the last twelve months. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Hawesko Holding's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Hawesko Holding generated free cash flow amounting to a very robust 82% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

Hawesko Holding's EBIT growth rate was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we are dazzled with its interest cover. When we consider all the factors mentioned above, we do feel a bit cautious about Hawesko Holding's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example - Hawesko Holding has 2 warning signs we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking to trade Hawesko Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hawesko Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HAW

Hawesko Holding

Trades in and sells wines, champagnes, and spirits in Germany, Austria, Switzerland, and the Czech Republic, Sweden, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives