- Germany

- /

- Consumer Durables

- /

- XTRA:H5E

Here's Why I Think HELMA Eigenheimbau (ETR:H5E) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like HELMA Eigenheimbau (ETR:H5E). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for HELMA Eigenheimbau

How Quickly Is HELMA Eigenheimbau Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, HELMA Eigenheimbau has grown EPS by 9.0% per year. That's a pretty good rate, if the company can sustain it.

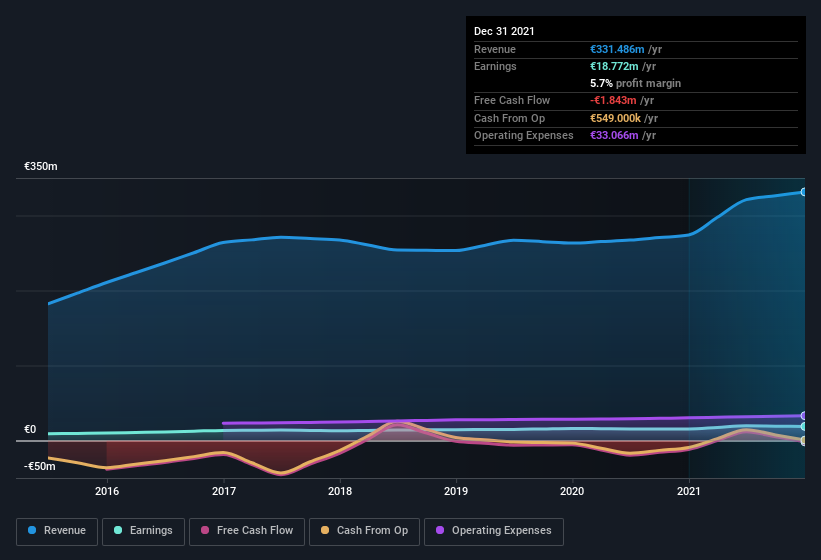

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note HELMA Eigenheimbau's EBIT margins were flat over the last year, revenue grew by a solid 21% to €331m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for HELMA Eigenheimbau?

Are HELMA Eigenheimbau Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that HELMA Eigenheimbau insiders have a significant amount of capital invested in the stock. Given insiders own a small fortune of shares, currently valued at €58m, they have plenty of motivation to push the business to succeed. That holding amounts to 30% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

Does HELMA Eigenheimbau Deserve A Spot On Your Watchlist?

One positive for HELMA Eigenheimbau is that it is growing EPS. That's nice to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for HELMA Eigenheimbau (1 can't be ignored) you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if HELMA Eigenheimbau might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:H5E

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives