Should Hugo Boss’s (XTRA:BOSS) Rising Profitability Despite Softer Sales Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Hugo Boss AG recently reported third quarter and nine-month earnings results, with sales reaching €989 million and €2.99 billion respectively, reflecting a year-over-year decline, while net income rose to €59 million and €141 million.

- Despite lower revenues compared to the previous year, the company achieved higher net income and basic earnings per share, indicating improved profitability through cost management.

- We'll examine how Hugo Boss's improved earnings despite softer sales figures influence its forward-looking investment narrative and future growth prospects.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Hugo Boss Investment Narrative Recap

Being a shareholder in Hugo Boss means believing in the resilience of its global brand and its ability to generate long-term growth by expanding direct-to-consumer and digital sales while managing operational costs. The recent earnings report, which revealed improved profitability despite a year-over-year decline in sales, supports optimism around cost control as a short-term catalyst. However, ongoing declines in key markets and softer brand revenue remain persistent risks; these results do not significantly change the balance between these two forces.

Among recent announcements, the August reaffirmation of earnings guidance remains most relevant. That guidance outlined stable top-line sales for 2025 and a higher EBIT margin, a benchmark now put into clearer context by the company’s continued ability to grow net income despite revenue pressure; cost discipline continues to underpin near-term performance.

Yet, despite stronger margins, investors should be aware that overreliance on cost controls may bring risks as savings opportunities diminish in later quarters...

Read the full narrative on Hugo Boss (it's free!)

Hugo Boss is projected to reach €4.6 billion in revenue and €287.5 million in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 2.8% and a €67 million increase in earnings from the current level of €220.5 million.

Uncover how Hugo Boss' forecasts yield a €43.73 fair value, a 17% upside to its current price.

Exploring Other Perspectives

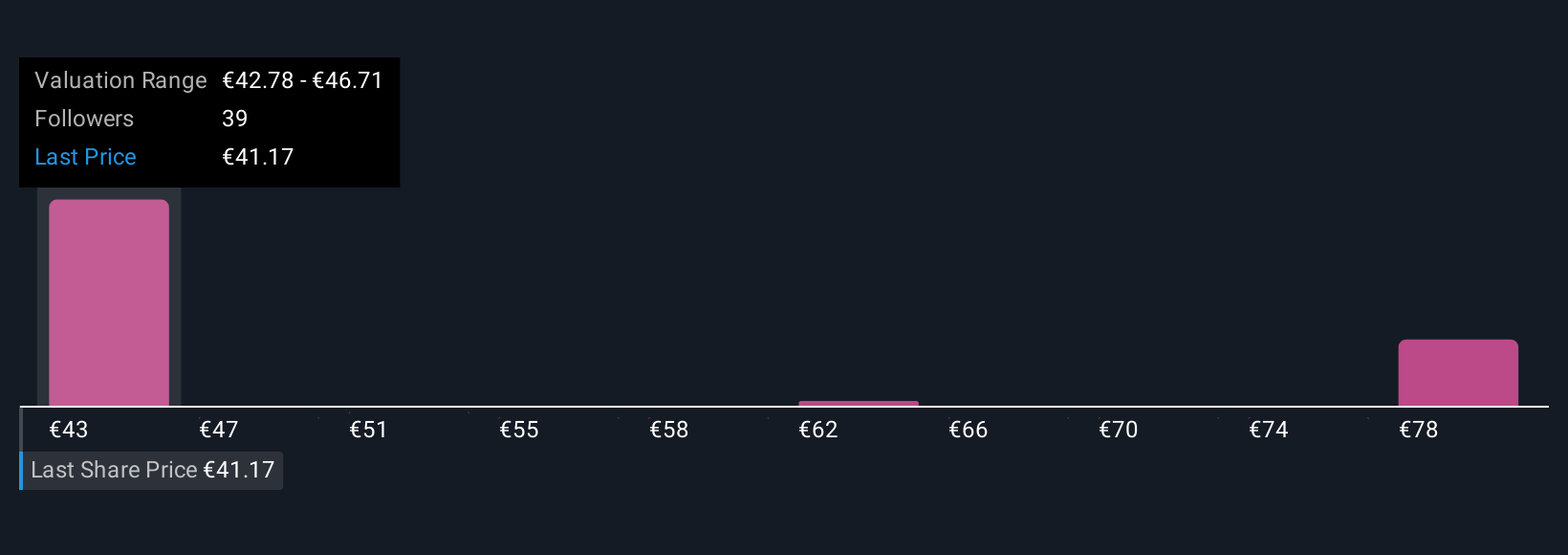

Simply Wall St Community fair value estimates for Hugo Boss span €42.78 to €75.40 based on four individual analyses. While many see upside, the ongoing challenge of reviving revenue growth remains in focus for several participants.

Explore 4 other fair value estimates on Hugo Boss - why the stock might be worth just €42.78!

Build Your Own Hugo Boss Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hugo Boss research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hugo Boss research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hugo Boss' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hugo Boss might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BOSS

Hugo Boss

Provides apparels, shoes, and accessories for men and women worldwide.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives