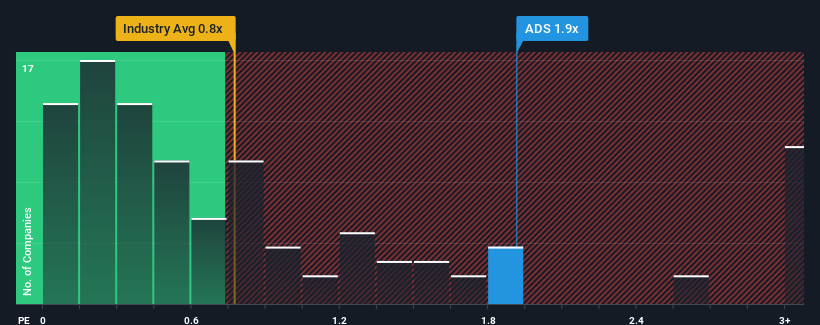

adidas AG's (ETR:ADS) price-to-sales (or "P/S") ratio of 1.9x may not look like an appealing investment opportunity when you consider close to half the companies in the Luxury industry in Germany have P/S ratios below 0.7x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for adidas

How adidas Has Been Performing

Recent revenue growth for adidas has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think adidas' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For adidas?

adidas' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.2%. The solid recent performance means it was also able to grow revenue by 6.1% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 9.4% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 6.9% each year, which is noticeably less attractive.

With this information, we can see why adidas is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From adidas' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into adidas shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for adidas with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on adidas, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ADS

adidas

Designs, develops, produces, and markets athletic and sports lifestyle products in Europe, North America, Greater China, Latin America, Japan, and South Korea.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives