adidas (XTRA:ADS) Valuation in Focus as Digital Weakness Highlights Competitive Risks

Reviewed by Kshitija Bhandaru

adidas (XTRA:ADS) is facing new pressure following a recent Catchpoint report highlighting the company’s lag behind competitors in digital experience and website reliability. The findings have important implications for adidas’ online revenues and brand loyalty.

See our latest analysis for adidas.

Recent launches like the new PG x Adidas Adizero Impact Shades Cleats and the long-term move into safety footwear with GLO point to adidas making strategic plays outside traditional sportswear. However, while these events grabbed headlines, the share price has not yet shown a positive reaction. The stock is still down 19% year-to-date and the one-year total shareholder return sits at -15%. Momentum has faded in recent months despite some short-lived rallies.

If the competitive landscape in sportswear has you looking for fresh opportunities, now’s a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares still trading well below their analyst price target and recent momentum muted, one big question looms for investors: is the current weakness a rare buying opportunity, or is the market already factoring in future growth?

Most Popular Narrative: 19.4% Undervalued

Based on the most-followed valuation narrative, adidas’s fair value estimate points much higher than the last close at €191.4. The sizable gap between current share price and narrative fair value highlights bold growth expectations and stimulates discussion around underlying assumptions.

Accelerating demand for performance and athleisure products, global diversification, and expanded D2C channels are driving higher sales growth and improving margins. Product innovation, successful relaunches, and sustainability initiatives are enhancing brand equity, enabling premium pricing, and strengthening long-term customer loyalty.

Want to know the growth blueprint behind this valuation? The catalysts include game-changing product launches and ambitious profit margin targets, as well as revenue forecasts that extend beyond today’s fundamentals. Which critical business and financial levers really drive this calculation? Only a full dive into the narrative reveals the big assumptions behind the bullish price target.

Result: Fair Value of €237.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent U.S. tariff pressures and intensifying competition in North America could quickly challenge the current bullish outlook for adidas.

Find out about the key risks to this adidas narrative.

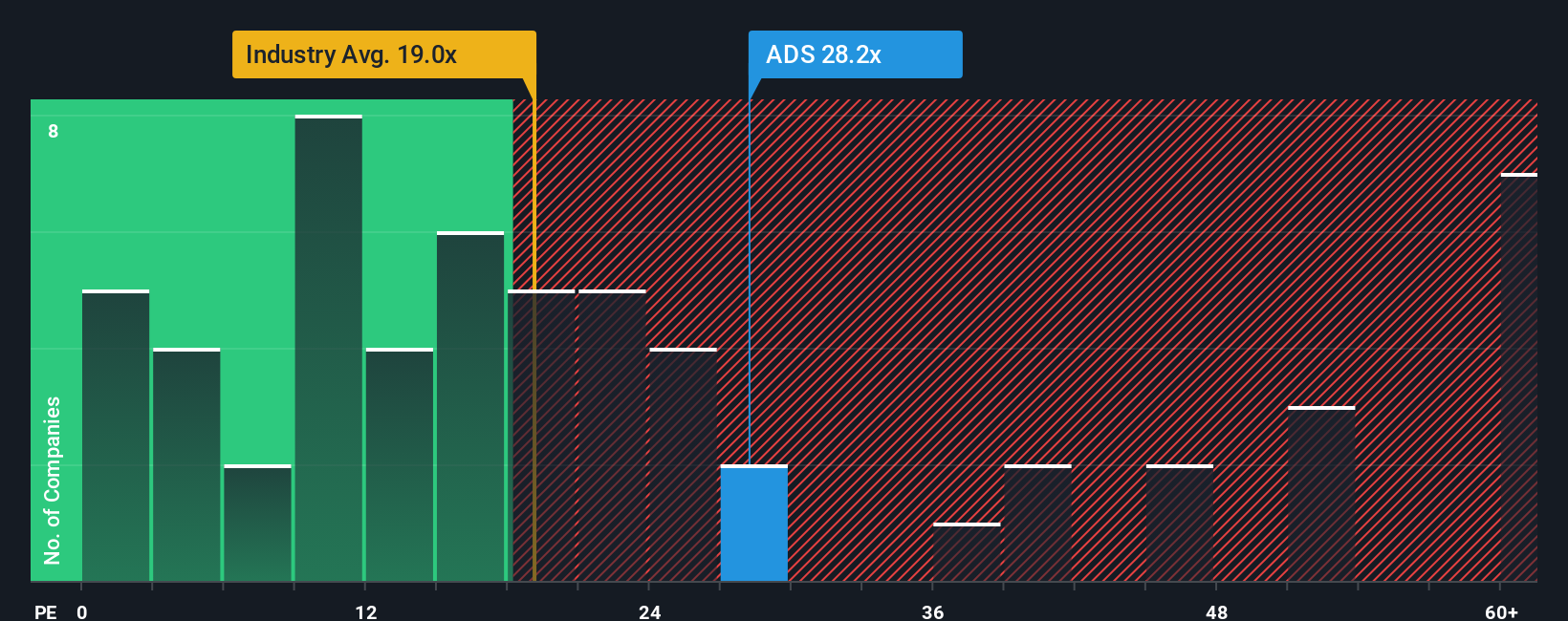

Another View: Valuation by Earnings Ratio

While the narrative suggests adidas shares are undervalued, a look at the earnings ratio paints a more cautious picture. The stock trades at 28.8 times earnings, which is well above both the European luxury industry average of 20.3x and the peer average of 23.2x. Compared to the fair ratio of 20.9x, this creates meaningful valuation risk if investor sentiment shifts. Will the market reward adidas’s growth story, or does this premium call for more scrutiny?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own adidas Narrative

If you approach adidas’s numbers with a different lens or want to build your own thesis, you can dig into the data and shape your own story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding adidas.

Looking for more investment ideas?

Don’t let smart opportunities pass you by. Widen your investment search and see where your capital could work harder using these powerful screens below.

- Uncover passive income potential with generous yields by tapping into these 18 dividend stocks with yields > 3%, which regularly reward their shareholders.

- Spot cutting-edge innovations and future market leaders among these 24 AI penny stocks, transforming industries with artificial intelligence breakthroughs.

- Seize value plays others overlook by targeting these 878 undervalued stocks based on cash flows, generating strong cash flows and trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets athletic and sports lifestyle products in Europe, North America, Greater China, Latin America, Japan, and South Korea.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives