- Germany

- /

- Commercial Services

- /

- DB:TUR

A Piece Of The Puzzle Missing From Turbon AG's (FRA:TUR) 30% Share Price Climb

Turbon AG (FRA:TUR) shares have had a really impressive month, gaining 30% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.9% over the last year.

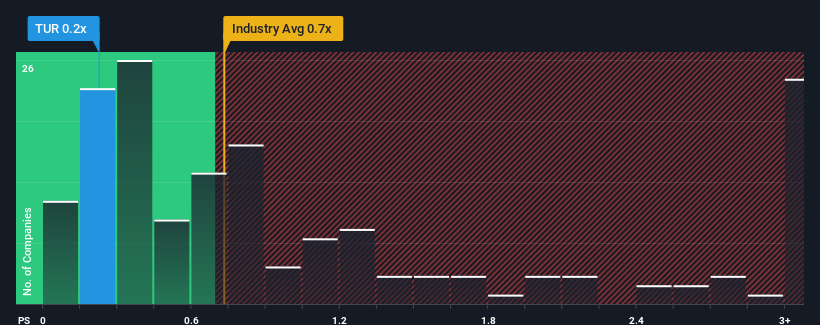

In spite of the firm bounce in price, there still wouldn't be many who think Turbon's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Germany's Commercial Services industry is similar at about 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Turbon

How Has Turbon Performed Recently?

Turbon has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Turbon will help you shine a light on its historical performance.How Is Turbon's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Turbon's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 3.9%. The latest three year period has also seen an excellent 37% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 8.0% shows it's noticeably more attractive.

In light of this, it's curious that Turbon's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Turbon's P/S?

Turbon's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, Turbon revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Turbon that you need to be mindful of.

If these risks are making you reconsider your opinion on Turbon, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Turbon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:TUR

Turbon

Engages in the development, production, and sale of typeface printing accessories in Europe, the United States, and Asia.

Flawless balance sheet moderate.