- Hong Kong

- /

- Diversified Financial

- /

- SEHK:818

Discover Nanoform Finland Oyj And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the new Trump administration and fluctuating interest rates, investors are keenly observing how these changes impact various sectors. Penny stocks, often representing smaller or newer companies, remain an intriguing area for those seeking potential growth opportunities. Despite being considered a niche investment category today, penny stocks can offer significant value when backed by strong financials. In this article, we will explore several promising penny stocks that exhibit noteworthy financial strength and long-term potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR133.38M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.40 | MYR2.35B | ★★★★★☆ |

| Seafco (SET:SEAFCO) | THB1.99 | THB1.61B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £365M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

Click here to see the full list of 5,808 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Nanoform Finland Oyj (HLSE:NANOFH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanoform Finland Oyj provides nanotechnology and drug particle engineering services to the pharmaceutical and biotech industries in Europe and the United States, with a market cap of €94.77 million.

Operations: Nanoform Finland Oyj has not reported any specific revenue segments.

Market Cap: €94.77M

Nanoform Finland Oyj, with a market cap of €94.77 million, operates in the nanotechnology sector and remains pre-revenue with sales totaling €3 million. Despite its innovative collaborations, such as the expanded partnership with Celanese Corporation for biologic drug delivery, Nanoform faces financial challenges marked by increasing losses and shareholder dilution over the past year. The company is debt-free and has sufficient cash runway for over three years if it continues to manage free cash flow effectively. While its revenue is projected to grow significantly at 52.06% annually, profitability remains elusive in the near term.

- Unlock comprehensive insights into our analysis of Nanoform Finland Oyj stock in this financial health report.

- Gain insights into Nanoform Finland Oyj's outlook and expected performance with our report on the company's earnings estimates.

BAUER (HMSE:B5A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BAUER Aktiengesellschaft, along with its subsidiaries, offers services, equipment, and products for ground and groundwater projects across various regions including Germany, Europe, the Middle East, the Asia Pacific, Africa, and the Americas with a market cap of €167.85 million.

Operations: The company's revenue is primarily derived from Geotechnical Solutions (€859.82 million), Equipment (€593.92 million), and Resources (€248.52 million).

Market Cap: €167.85M

BAUER Aktiengesellschaft, with a market cap of €167.85 million, has recently turned profitable, marking a significant shift in its financial trajectory. Its revenue streams are well-diversified across Geotechnical Solutions (€859.82 million), Equipment (€593.92 million), and Resources (€248.52 million). Despite stable weekly volatility and reduced debt levels over the past five years, challenges remain with high net debt to equity (62.7%) and insufficient interest coverage by EBIT (2x). However, short-term assets exceed both short-term (€927.2M) and long-term liabilities (€276.6M), indicating a solid liquidity position as it forecasts 38.25% annual earnings growth.

- Take a closer look at BAUER's potential here in our financial health report.

- Explore BAUER's analyst forecasts in our growth report.

Hi Sun Technology (China) (SEHK:818)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hi Sun Technology (China) Limited is an investment holding company that offers payment and digital, platform operation, and financial solutions both in Hong Kong and internationally, with a market cap of HK$1.14 billion.

Operations: The company's revenue segments include Fintech Services generating HK$131.51 million, Financial Solutions at HK$330.39 million, Payment and Digital Services contributing HK$1.86 billion, and Platform Operation Solutions with HK$164 million.

Market Cap: HK$1.14B

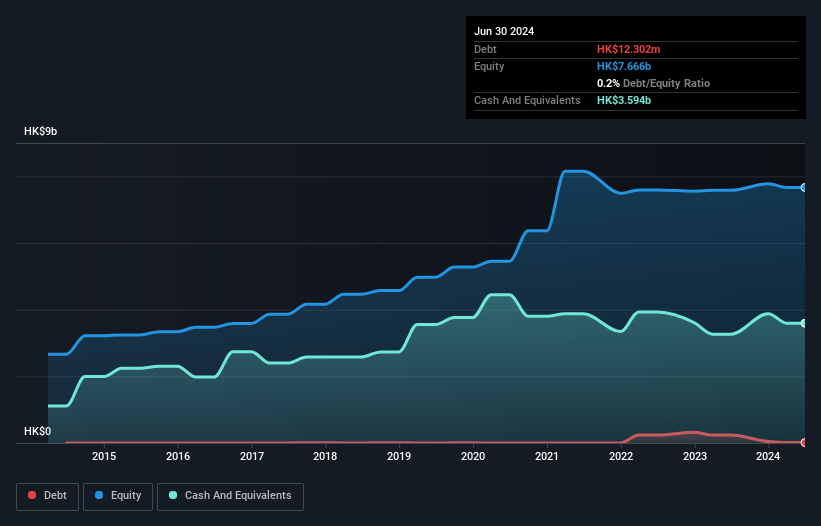

Hi Sun Technology (China) Limited, with a market cap of HK$1.14 billion, faces challenges as it navigates declining earnings and profitability issues. Recent financial results show sales of HK$1.18 billion for the half-year ended June 2024, down from HK$1.31 billion a year ago, and net income plummeting to HK$3.4 million from HK$316.3 million previously. Despite having more cash than debt and seasoned board members with an average tenure of 21.3 years, the company has been removed from the S&P Global BMI Index and struggles with low return on equity at 2.4%.

- Get an in-depth perspective on Hi Sun Technology (China)'s performance by reading our balance sheet health report here.

- Understand Hi Sun Technology (China)'s track record by examining our performance history report.

Make It Happen

- Explore the 5,808 names from our Penny Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hi Sun Technology (China) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:818

Hi Sun Technology (China)

An investment holding company, provides payment and digital, platform operation, and financial solutions in Hong Kong and internationally.

Good value with adequate balance sheet.