Has InnoTec TSS AG's (FRA:TSS) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

Most readers would already be aware that InnoTec TSS' (FRA:TSS) stock increased significantly by 23% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on InnoTec TSS' ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for InnoTec TSS

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for InnoTec TSS is:

10% = €8.0m ÷ €78m (Based on the trailing twelve months to June 2020).

The 'return' is the income the business earned over the last year. So, this means that for every €1 of its shareholder's investments, the company generates a profit of €0.10.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

InnoTec TSS' Earnings Growth And 10% ROE

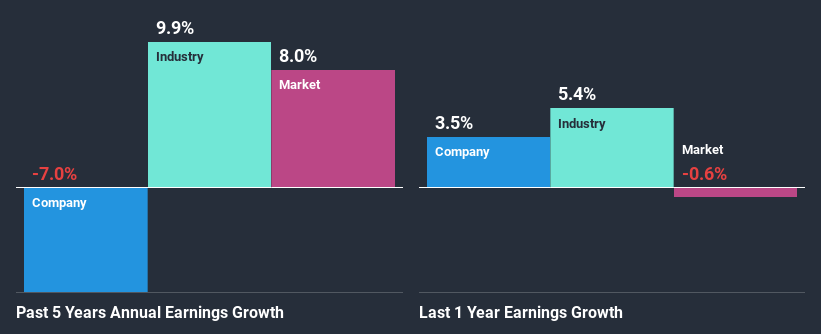

To begin with, InnoTec TSS seems to have a respectable ROE. And on comparing with the industry, we found that the the average industry ROE is similar at 12%. However, while InnoTec TSS has a pretty respectable ROE, its five year net income decline rate was 7.0% . We reckon that there could be some other factors at play here that are preventing the company's growth. These include low earnings retention or poor allocation of capital.

However, when we compared InnoTec TSS' growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 9.1% in the same period. This is quite worrisome.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about InnoTec TSS''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is InnoTec TSS Using Its Retained Earnings Effectively?

With a high three-year median payout ratio of 85% (implying that 15% of the profits are retained), most of InnoTec TSS' profits are being paid to shareholders, which explains the company's shrinking earnings. The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run. You can see the 2 risks we have identified for InnoTec TSS by visiting our risks dashboard for free on our platform here.

Additionally, InnoTec TSS has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Conclusion

In total, it does look like InnoTec TSS has some positive aspects to its business. However, while the company does have a high ROE, its earnings growth number is quite disappointing. This can be blamed on the fact that it reinvests only a small portion of its profits and pays out the rest as dividends. Up till now, we've only made a short study of the company's growth data. You can do your own research on InnoTec TSS and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

When trading InnoTec TSS or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DB:TSS

InnoTec TSS

Through its subsidiaries, produces and sells exterior door panels for the construction industry in Germany, Europe, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.