A Piece Of The Puzzle Missing From LEWAG Holding Aktiengesellschaft's (FRA:KGR) 26% Share Price Climb

LEWAG Holding Aktiengesellschaft (FRA:KGR) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

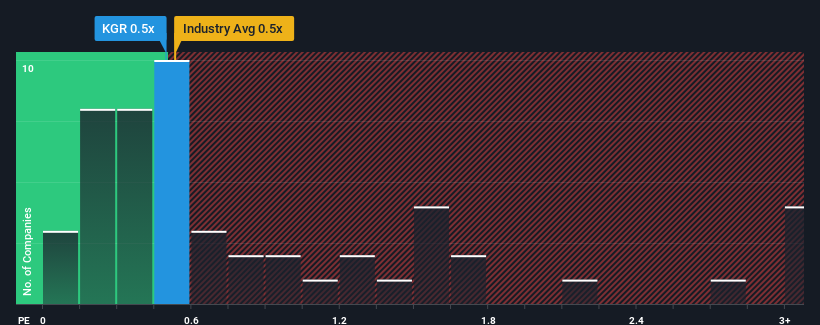

Although its price has surged higher, there still wouldn't be many who think LEWAG Holding's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when it essentially matches the median P/S in Germany's Machinery industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for LEWAG Holding

How Has LEWAG Holding Performed Recently?

The recent revenue growth at LEWAG Holding would have to be considered satisfactory if not spectacular. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. Those who are bullish on LEWAG Holding will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on LEWAG Holding will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For LEWAG Holding?

In order to justify its P/S ratio, LEWAG Holding would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.9%. Pleasingly, revenue has also lifted 83% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 3.1% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that LEWAG Holding's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does LEWAG Holding's P/S Mean For Investors?

Its shares have lifted substantially and now LEWAG Holding's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision LEWAG Holding's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 3 warning signs for LEWAG Holding (1 makes us a bit uncomfortable!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:KGR

LEWAG Holding

Engages in the manufacture and sale of machines and systems, storage and logistics systems, and vehicle bodies in Germany, France, Poland, the United States, Canada, Mexico, and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives