- Switzerland

- /

- Construction

- /

- SWX:BRKN

European Dividend Stocks Yielding Up To 6.2%

Reviewed by Simply Wall St

As European markets grapple with the impact of higher-than-expected U.S. trade tariffs, major indices like the STOXX Europe 600 and Germany's DAX have experienced significant declines, reflecting broader concerns about economic growth and inflation. In such uncertain times, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking to navigate volatile market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.52% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 5.25% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.94% | ★★★★★★ |

| Mapfre (BME:MAP) | 6.15% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.35% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.89% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.67% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.56% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.90% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.76% | ★★★★★★ |

Click here to see the full list of 247 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

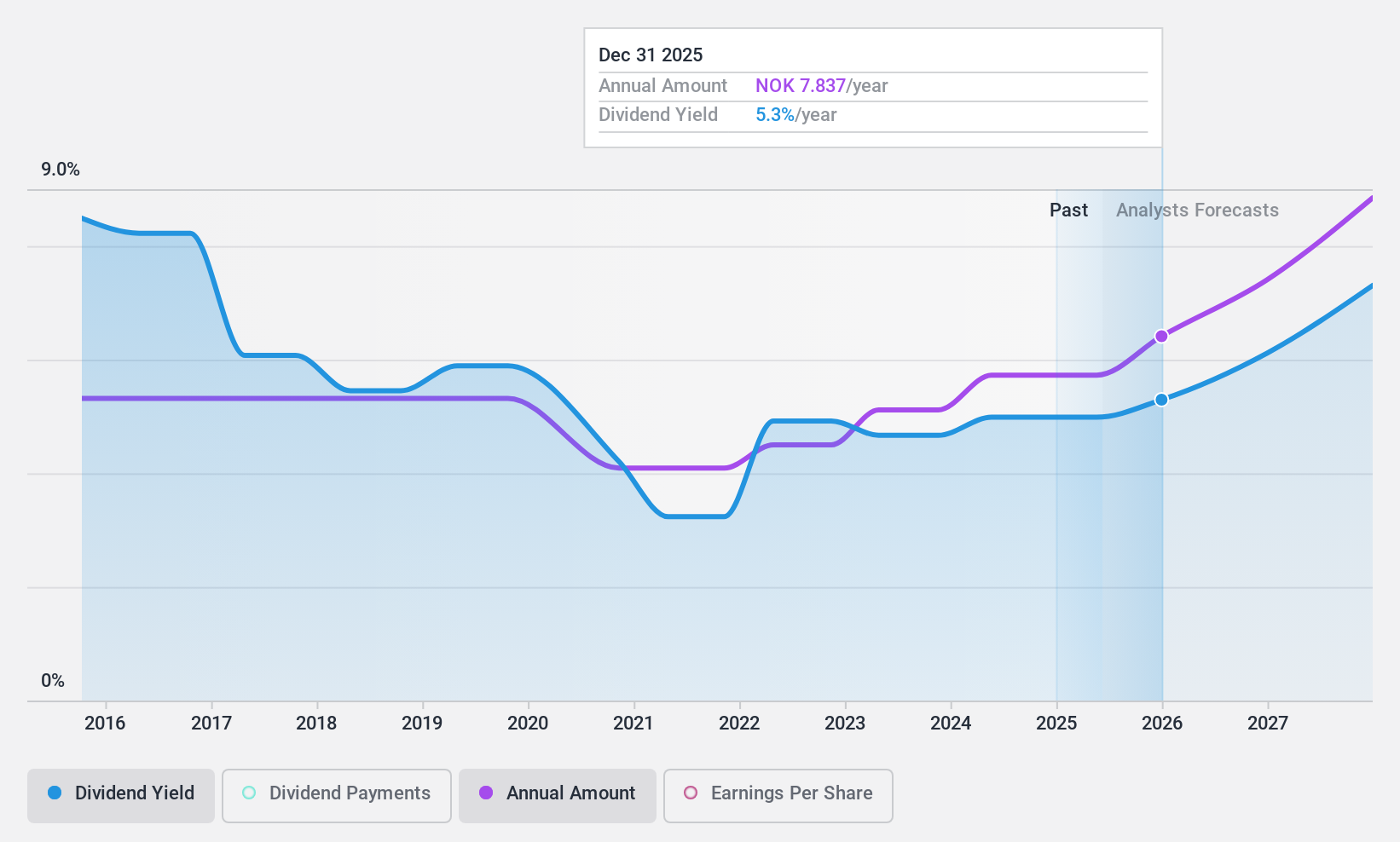

Atea (OB:ATEA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Atea ASA offers IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions, with a market cap of NOK14.03 billion.

Operations: Atea ASA generates revenue from several segments, including Norway (NOK8.80 billion), Sweden (NOK12.76 billion), Denmark (NOK7.86 billion), Finland (NOK3.58 billion), and The Baltics (NOK1.72 billion).

Dividend Yield: 5.6%

Atea's dividend payments, covered by a low cash payout ratio of 48.7%, have been stable and growing over the past decade, reflecting reliability. However, with a high payout ratio of 101.2%, dividends are not well covered by earnings, raising sustainability concerns. Despite trading at 45.9% below estimated fair value, Atea's dividend yield of 5.56% is modest compared to top Norwegian payers and recent earnings show slight declines in net income and EPS year-over-year.

- Delve into the full analysis dividend report here for a deeper understanding of Atea.

- Our valuation report unveils the possibility Atea's shares may be trading at a discount.

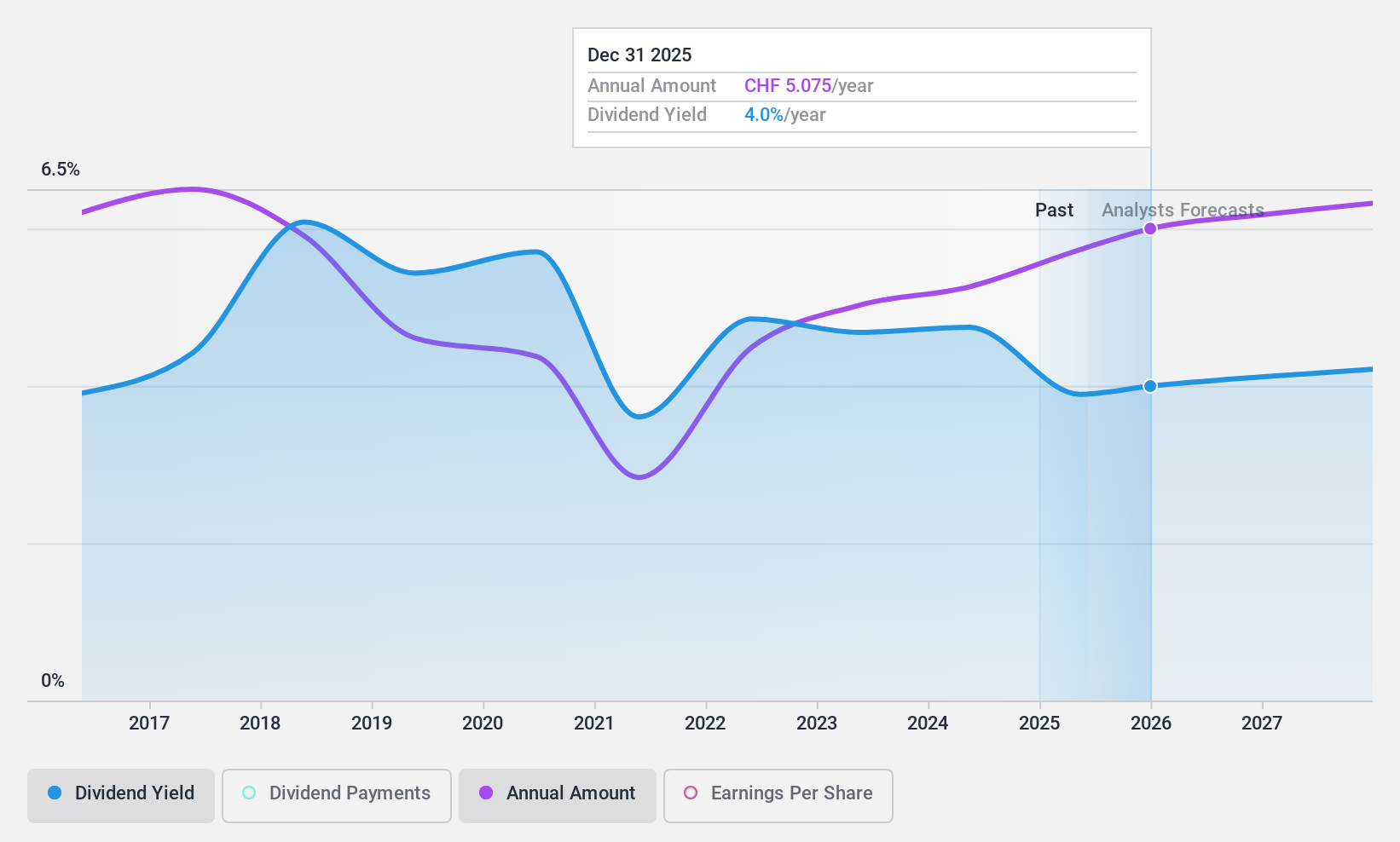

Burkhalter Holding (SWX:BRKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Burkhalter Holding AG, with a market cap of CHF1.11 billion, operates through its subsidiaries to deliver electrical engineering services to the construction sector mainly in Switzerland.

Operations: Burkhalter Holding AG generates revenue of CHF1.18 billion from its electrical engineering services primarily serving the construction sector in Switzerland.

Dividend Yield: 4.3%

Burkhalter Holding's dividend yield of 4.27% ranks in the top quartile among Swiss dividend payers, yet its dividends have been unreliable and volatile over the past decade. Despite a high payout ratio of 87.4%, indicating coverage by earnings, insufficient data on cash flow coverage raises sustainability concerns. The company faces financial challenges with high debt levels but has shown robust earnings growth averaging 26.2% annually over five years, suggesting potential for future stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Burkhalter Holding.

- Upon reviewing our latest valuation report, Burkhalter Holding's share price might be too optimistic.

WashTec (XTRA:WSU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WashTec AG offers car wash solutions across Germany, Europe, North America, and the Asia Pacific with a market cap of €517.90 million.

Operations: WashTec AG's revenue is primarily derived from its operations in Europe and Other regions, which account for €394.74 million, followed by North America contributing €85.20 million.

Dividend Yield: 6.2%

WashTec's dividend yield of 6.2% places it among the top German dividend payers, but sustainability concerns arise due to a high payout ratio of 103.5%, not covered by earnings. Despite this, dividends have increased over the past decade, although they've been volatile. Recent earnings showed improved net income at €31.03 million with guidance indicating revenue and EBIT growth in 2025, suggesting potential for future financial stability despite current challenges in dividend reliability.

- Unlock comprehensive insights into our analysis of WashTec stock in this dividend report.

- Our expertly prepared valuation report WashTec implies its share price may be lower than expected.

Make It Happen

- Gain an insight into the universe of 247 Top European Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Burkhalter Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Burkhalter Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BRKN

Burkhalter Holding

Through its subsidiaries, provides electrical engineering services to the construction sector primarily in Switzerland.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives