- Germany

- /

- Basic Materials

- /

- XTRA:HEI

3 German Dividend Stocks With Yields Up To 7.3%

Reviewed by Simply Wall St

Amid a generally positive week for European markets, with Germany's DAX index showing notable gains, investors might find appealing opportunities in German dividend stocks. Given the current economic landscape and recent market performances, stocks offering robust dividends could be particularly attractive as they may provide potential income stability amidst fluctuating market conditions.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.32% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.91% | ★★★★★★ |

| Brenntag (XTRA:BNR) | 3.27% | ★★★★★☆ |

| Talanx (XTRA:TLX) | 3.18% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 6.52% | ★★★★★☆ |

| MLP (XTRA:MLP) | 4.72% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.37% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.25% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.33% | ★★★★★☆ |

| Deutsche Lufthansa (XTRA:LHA) | 5.24% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Heidelberg Materials (XTRA:HEI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Heidelberg Materials AG operates globally, producing and distributing cement, aggregates, ready-mixed concrete, and asphalt, with a market capitalization of approximately €17.15 billion.

Operations: Heidelberg Materials AG generates €11.21 billion from cement, €4.88 billion from aggregates, and €5.90 billion from ready-mixed concrete and asphalt.

Dividend Yield: 3.2%

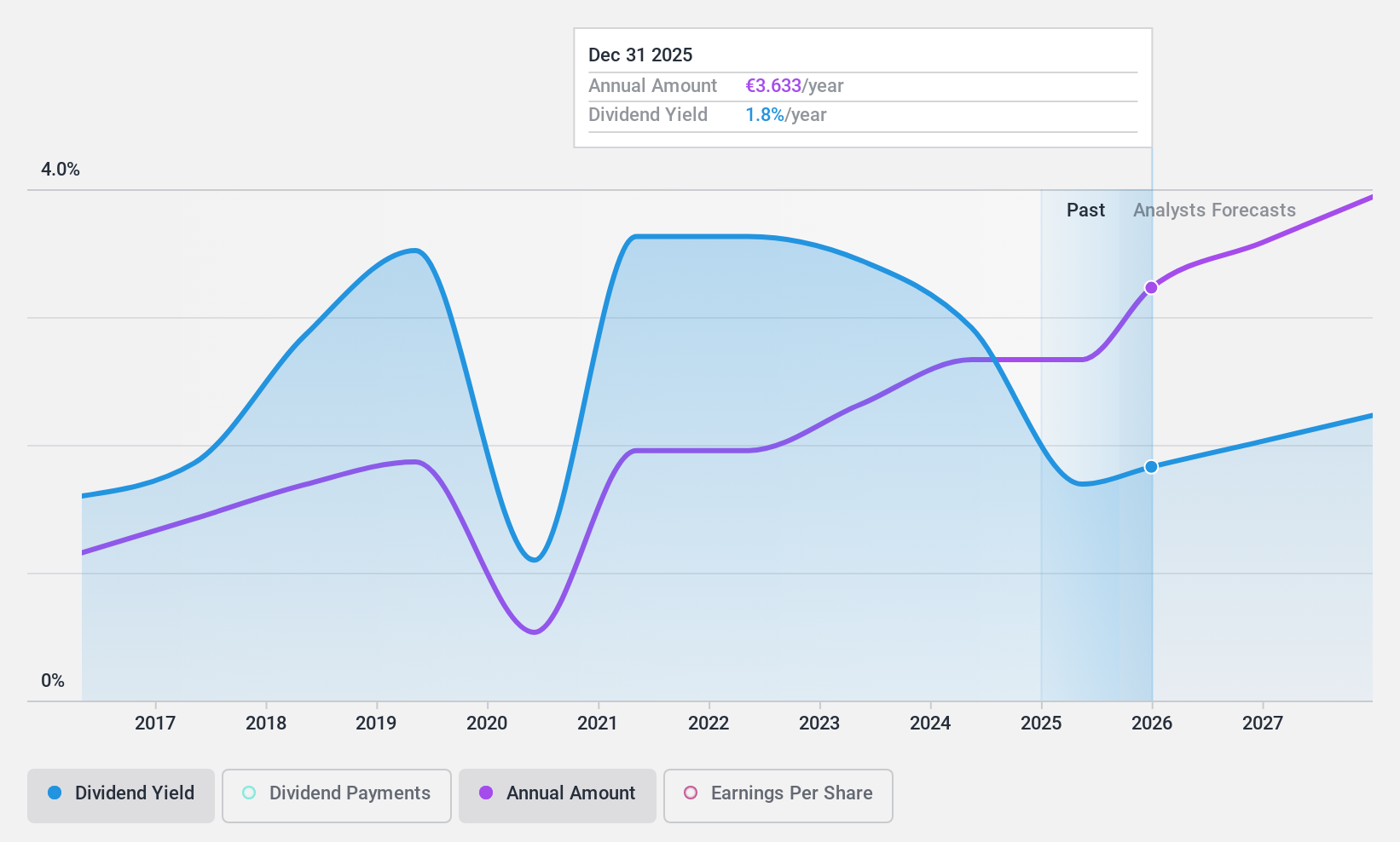

Heidelberg Materials has a history of unstable dividends, with payments fluctuating significantly over the past decade. Despite this, the dividends are supported by a low payout ratio of 27.3% from earnings and 29% from cash flows, indicating sustainability from current financials. However, its dividend yield at 3.17% is below the German market's top quartile average of 4.71%. Recently, Heidelberg announced a dividend increase to €3 per share and initiated a substantial share buyback program valued at up to €1.2 billion through 2026, reflecting confidence in financial stability and commitment to returning value to shareholders.

- Delve into the full analysis dividend report here for a deeper understanding of Heidelberg Materials.

- Our comprehensive valuation report raises the possibility that Heidelberg Materials is priced lower than what may be justified by its financials.

INDUS Holding (XTRA:INH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: INDUS Holding AG is a private equity firm focused on mergers, acquisitions, and corporate spin-offs, with a market capitalization of approximately €0.69 billion.

Operations: INDUS Holding AG generates its revenue primarily through three segments: Materials (€601.79 million), Engineering (€588.82 million), and Infrastructure (€572.78 million).

Dividend Yield: 4.7%

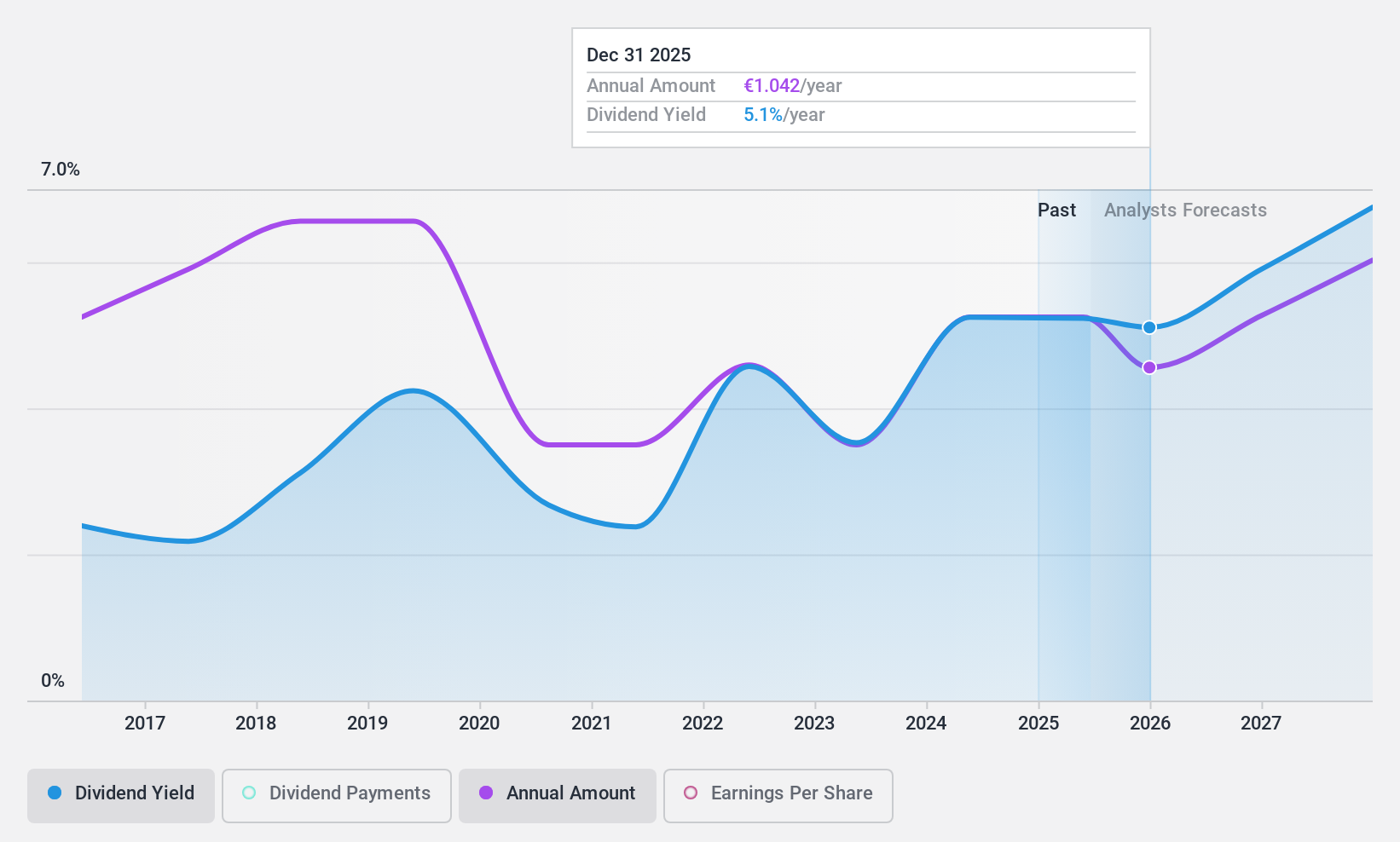

INDUS Holding AG's recent earnings reveal a downturn, with sales and net income decreasing from the previous year. Despite this, the company maintains a low payout ratio of 47% and a cash payout ratio of 21%, suggesting that its dividends are sustainably covered by both earnings and cash flows. However, dividend reliability is questionable due to historical volatility over the last decade. Trading at significant undervaluation relative to fair value estimates may offer an attractive entry point for investors considering long-term potential.

- Click here and access our complete dividend analysis report to understand the dynamics of INDUS Holding.

- According our valuation report, there's an indication that INDUS Holding's share price might be on the cheaper side.

Wacker Neuson (XTRA:WAC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wacker Neuson SE is a company that manufactures and distributes light and compact equipment across Germany, Austria, the United States, and other international markets, with a market capitalization of approximately €1.07 billion.

Operations: Wacker Neuson SE generates revenue through its Services segment (€490 million), Light Equipment segment (€500.70 million), and Compact Equipment segment (€1.61 billion).

Dividend Yield: 7.3%

Wacker Neuson SE, despite offering a high dividend yield of 7.32%, faces challenges with its dividend sustainability as it is not well covered by earnings or cash flows. The company's dividends have shown volatility and unreliability over the past decade, with significant annual fluctuations. Although trading at a 41.1% discount to its fair value and comparatively good value against industry peers, recent financials indicate a downturn, with Q1 sales and net income significantly lower than the previous year, impacting future dividend stability.

- Dive into the specifics of Wacker Neuson here with our thorough dividend report.

- Our expertly prepared valuation report Wacker Neuson implies its share price may be lower than expected.

Seize The Opportunity

- Unlock our comprehensive list of 31 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heidelberg Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HEI

Heidelberg Materials

Produces and distributes cement, aggregates, ready-mixed concrete, and asphalt worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives