Shareholders Are Thrilled That The va-Q-tec (ETR:VQT) Share Price Increased 113%

It might be of some concern to shareholders to see the va-Q-tec AG (ETR:VQT) share price down 28% in the last month. Despite this, the stock is a strong performer over the last year, no doubt about that. Like an eagle, the share price soared 113% in that time. So it may be that the share price is simply cooling off after a strong rise. The real question is whether the business is trending in the right direction.

Check out our latest analysis for va-Q-tec

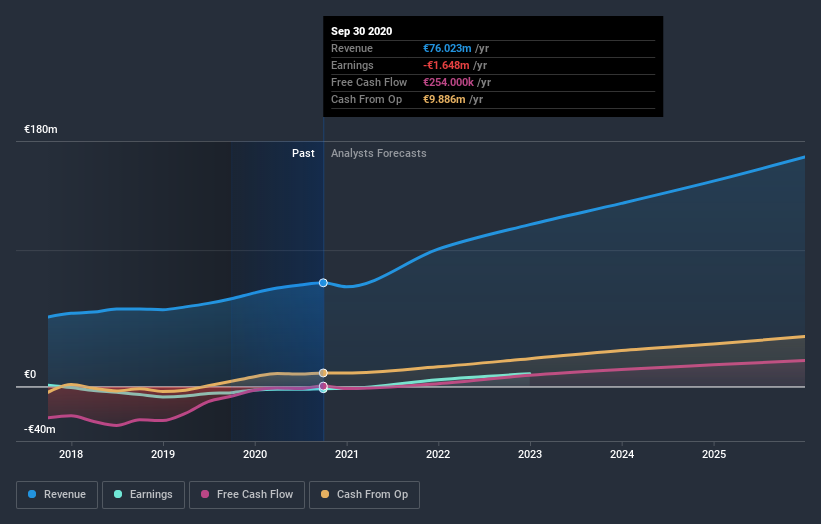

va-Q-tec isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year va-Q-tec saw its revenue grow by 18%. We respect that sort of growth, no doubt. The revenue growth is decent but the share price had an even better year, gaining 113%. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on va-Q-tec's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that va-Q-tec rewarded shareholders with a total shareholder return of 113% over the last year. So this year's TSR was actually better than the three-year TSR (annualized) of 19%. Given the track record of solid returns over varying time frames, it might be worth putting va-Q-tec on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for va-Q-tec that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

When trading va-Q-tec or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade va-Q-tec, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:VQT

va-Q-tec

Develops, produces, and markets vacuum insulation panels and phase change materials in Germany, rest of European Union, and internationally.

Worrying balance sheet with weak fundamentals.

Market Insights

Community Narratives