As global markets experience broad-based gains with U.S. indexes approaching record highs, investors are increasingly focusing on stable income sources amidst geopolitical tensions and economic uncertainties. In this context, dividend stocks like Wawel offer a compelling opportunity for those seeking consistent returns, as they can provide a reliable income stream even when market volatility is high.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.25% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.35% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1957 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Wawel (WSE:WWL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wawel S.A. is a Polish company that produces and sells cocoa, chocolate, and confectionery products, with a market cap of PLN782.86 million.

Operations: The primary revenue segment for Wawel S.A. is the production and sale of confectionery products, generating PLN672.94 million.

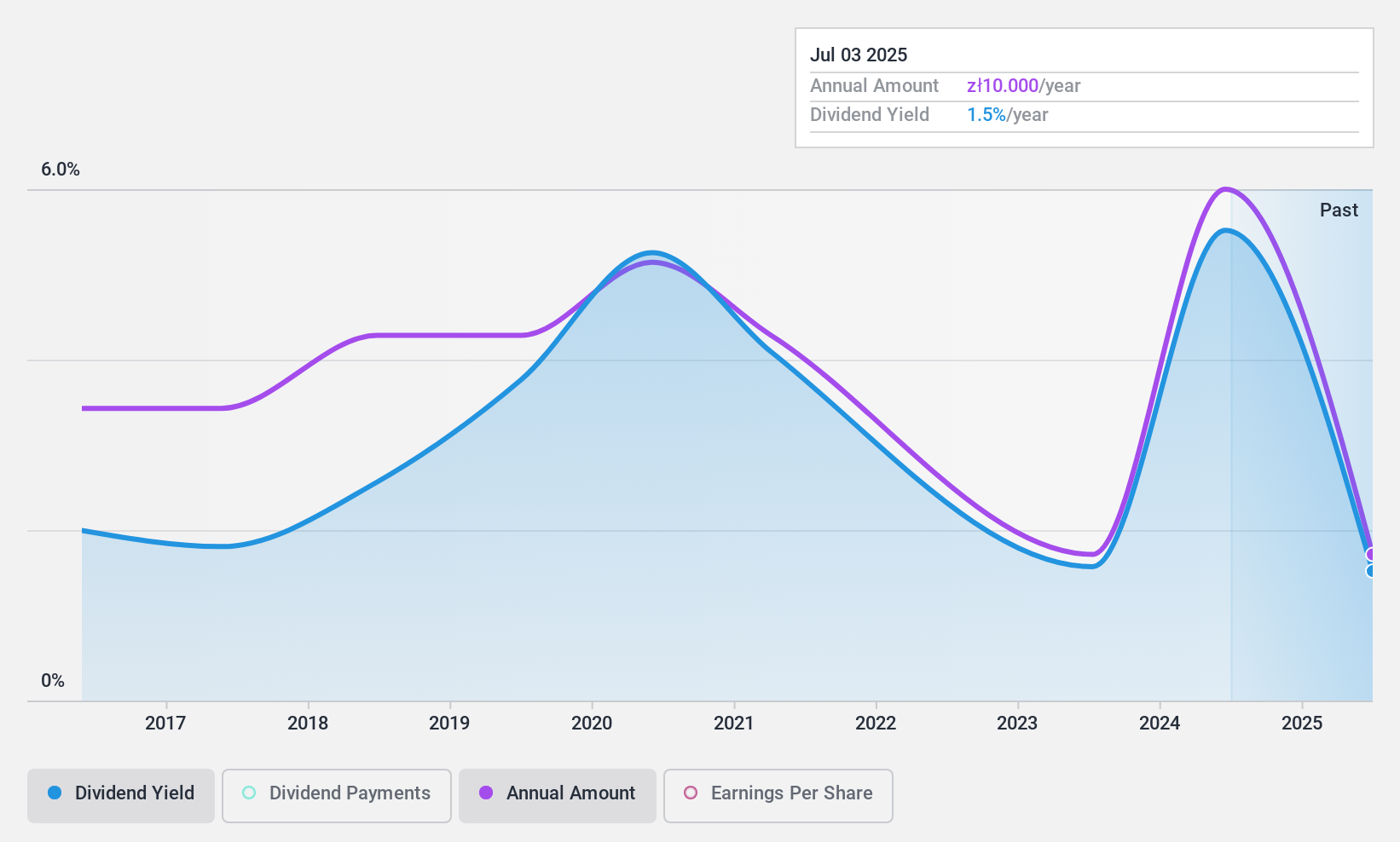

Dividend Yield: 5.8%

Wawel's dividend yield of 5.76% is below the top tier in Poland, but its payouts are well-covered by earnings and cash flows, with payout ratios of 63.9% and 58.4%, respectively. Despite a history of volatility, dividends have grown over the past decade. The stock trades significantly below its estimated fair value, though recent earnings showed slight declines in net income and EPS compared to last year, which could impact future dividend stability.

- Dive into the specifics of Wawel here with our thorough dividend report.

- Our expertly prepared valuation report Wawel implies its share price may be lower than expected.

technotrans (XTRA:TTR1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: technotrans SE is a global technology and services company with a market cap of €100.16 million.

Operations: technotrans SE generates its revenue from two primary segments: Technology, contributing €177.05 million, and Services, accounting for €62.84 million.

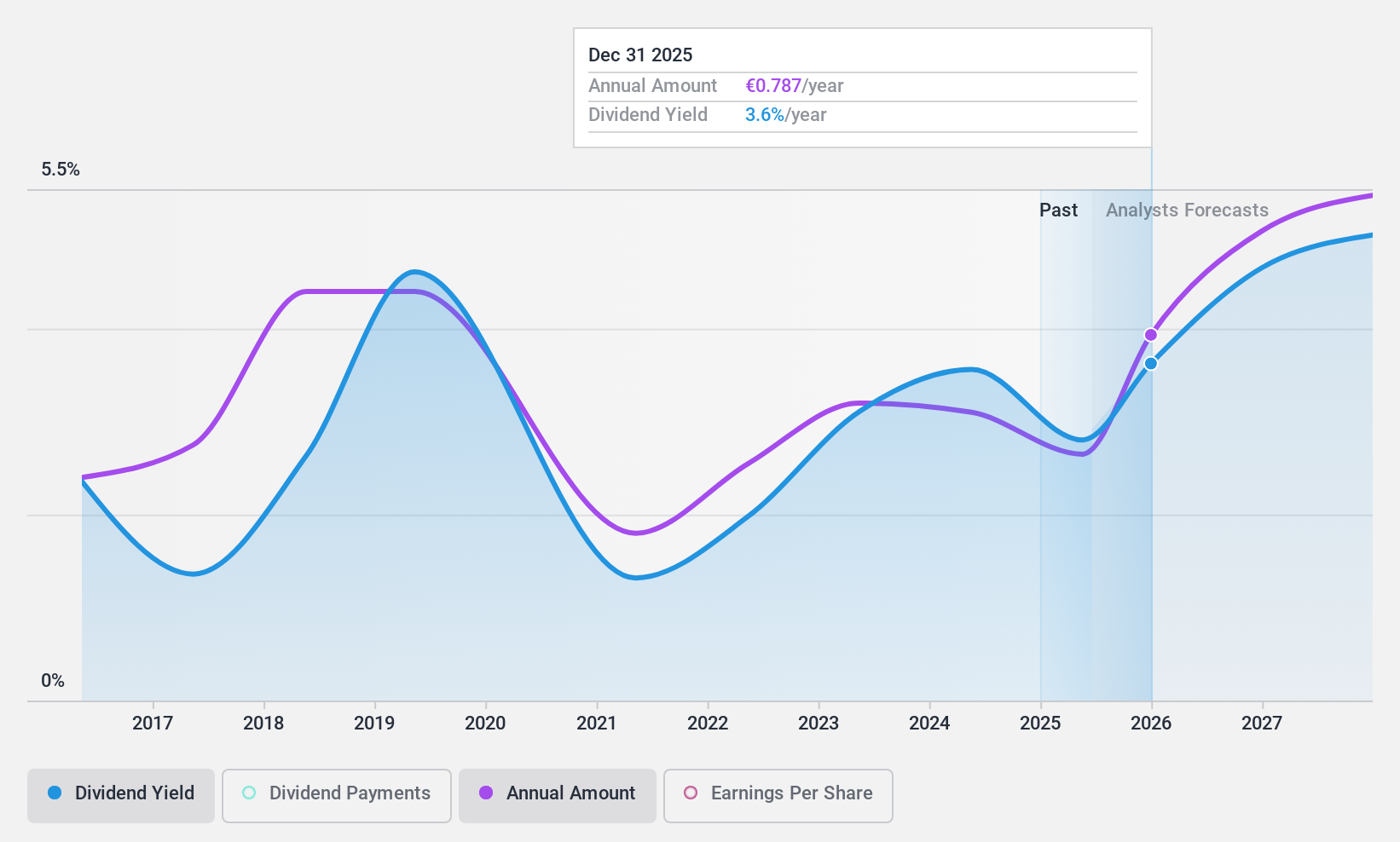

Dividend Yield: 4.1%

technotrans' dividend yield of 4.13% is lower than Germany's top payers, yet its payouts are well-covered by earnings and cash flows, with payout ratios of 57.1% and 42.9%, respectively. Despite a history of volatility, dividends have grown over the past decade. The stock trades significantly below estimated fair value, but recent earnings showed declines in revenue and net income, potentially affecting future dividend reliability amidst an unstable track record.

- Click to explore a detailed breakdown of our findings in technotrans' dividend report.

- Our valuation report unveils the possibility technotrans' shares may be trading at a discount.

Wacker Neuson (XTRA:WAC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wacker Neuson SE manufactures and distributes light and compact equipment across Germany, Austria, the United States, and internationally, with a market cap of approximately €916.85 million.

Operations: Wacker Neuson SE generates revenue through its Services segment (€506.20 million), Light Equipment (€459.80 million), and Compact Equipment (€1.41 billion).

Dividend Yield: 8.7%

Wacker Neuson's dividend yield of 8.7% ranks among the top in Germany, but its sustainability is questionable due to a high payout ratio of 95.8%, not covered by earnings. Despite a decade of dividend growth, the payments have been volatile and unreliable. Recent guidance revisions and declining earnings indicate financial pressure, with nine-month sales dropping to €1.72 billion from €2.01 billion year-on-year, potentially impacting future dividends amidst ongoing market challenges.

- Click here and access our complete dividend analysis report to understand the dynamics of Wacker Neuson.

- The valuation report we've compiled suggests that Wacker Neuson's current price could be quite moderate.

Summing It All Up

- Gain an insight into the universe of 1957 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wacker Neuson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:WAC

Wacker Neuson

Manufactures and distributes light and compact equipment in Germany, Austria, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.