- Italy

- /

- Food and Staples Retail

- /

- BIT:MARR

3 European Dividend Stocks Yielding Up To 6%

Reviewed by Simply Wall St

Amidst a backdrop of mixed performances across European indices, the pan-European STOXX Europe 600 Index managed a modest gain, buoyed by hopes for increased government spending despite concerns over impending U.S. tariffs. As central banks navigate the delicate balance between growth and inflationary pressures, dividend stocks continue to attract investors seeking stable income in uncertain times. In this context, selecting dividend stocks with robust fundamentals and consistent payout histories becomes crucial for those looking to capitalize on potential yields of up to 6%.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.48% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.17% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.61% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.81% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.29% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.32% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.52% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.00% | ★★★★★★ |

| VERBUND (WBAG:VER) | 6.32% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.55% | ★★★★★★ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

MARR (BIT:MARR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MARR S.p.A. is involved in the marketing and distribution of fresh, dried, and frozen food products for catering across Italy, the European Union, and internationally, with a market cap of €642.16 million.

Operations: MARR S.p.A. generates its revenue primarily from the distribution of food products, amounting to €2.03 billion.

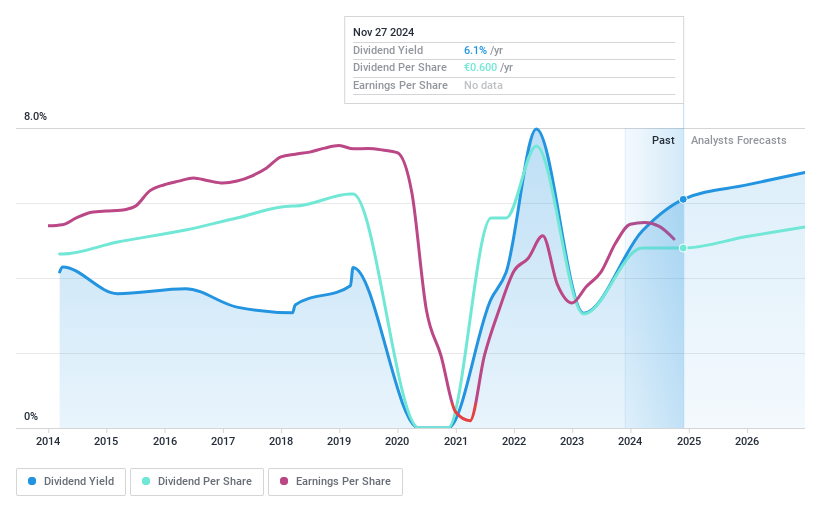

Dividend Yield: 6.1%

MARR offers a dividend yield of 6.06%, placing it in the top 25% of Italian dividend payers, yet its dividends have been volatile and unreliable over the past decade. The payout ratio is high at 84.9%, indicating coverage by earnings but not well-supported by free cash flows, with a cash payout ratio of 104.5%. Despite these concerns, MARR's Price-To-Earnings ratio is favorable at 15x compared to industry averages. Recent announcements confirmed an annual dividend of €0.60 per share payable in May 2025.

- Click to explore a detailed breakdown of our findings in MARR's dividend report.

- According our valuation report, there's an indication that MARR's share price might be on the cheaper side.

Industria de Diseño Textil (BME:ITX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Industria de Diseño Textil, S.A., with a market cap of €145.55 billion, operates through its subsidiaries in the retail and online distribution of clothing, footwear, accessories, and household products across Spain and internationally.

Operations: Industria de Diseño Textil, S.A.'s revenue segments include Zara / Zara Home at €27.96 billion and Bershka at €2.94 billion.

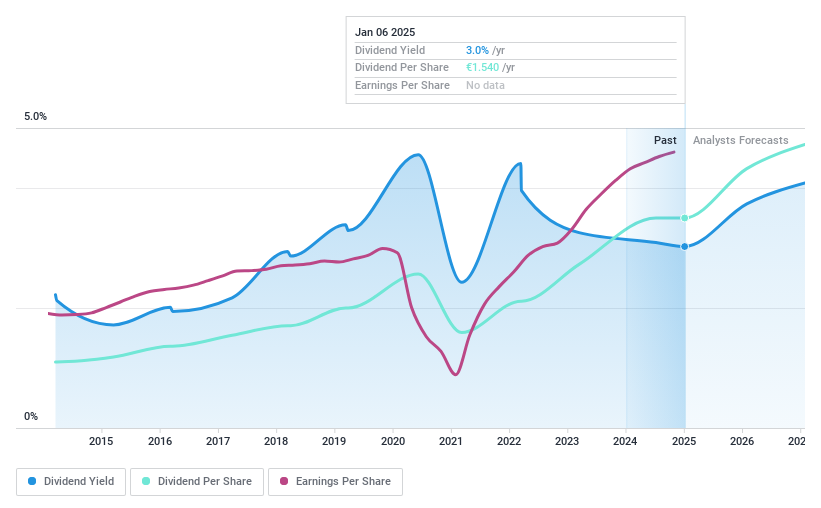

Dividend Yield: 3.6%

Industria de Diseño Textil's dividend yield of 3.6% is below the top 25% of Spanish dividend payers, and its dividends have been volatile over the past decade. With a payout ratio of 60%, dividends are covered by earnings, while a cash payout ratio of 79.1% indicates coverage by cash flows. Recent earnings reported sales at €11.21 billion and net income at €1.42 billion for Q4 ending January 31, 2025, reflecting stable financial performance supporting future payouts despite past volatility concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Industria de Diseño Textil.

- Our valuation report unveils the possibility Industria de Diseño Textil's shares may be trading at a premium.

technotrans (XTRA:TTR1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: technotrans SE is a global technology and services company with a market cap of €116.05 million.

Operations: technotrans SE generates revenue through its Services segment, which accounts for €62.84 million, and its Technology segment, contributing €177.05 million.

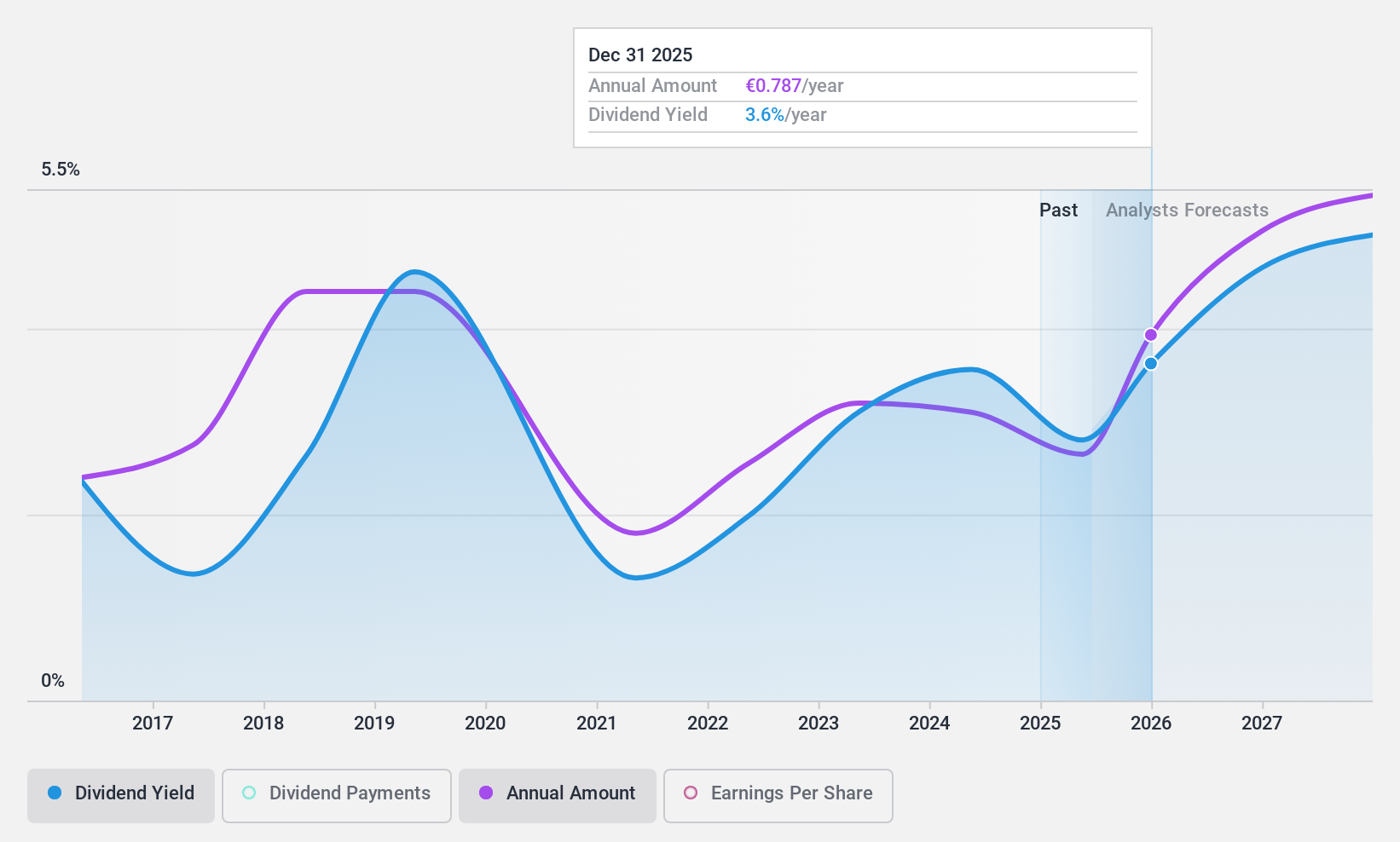

Dividend Yield: 3.7%

technotrans' dividend yield of 3.69% is lower than the top 25% of German dividend payers, and its dividends have been volatile over the past decade. However, a payout ratio of 57.1% and a cash payout ratio of 42.9% suggest dividends are well-covered by earnings and cash flows. Recent business expansions, including a significant property acquisition in Sassenberg and a major order from an electric bus manufacturer, may support future growth prospects despite past volatility concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of technotrans.

- The analysis detailed in our technotrans valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Discover the full array of 237 Top European Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MARR

MARR

Engages in marketing and distribution of fresh, dried, and frozen food products for catering in Italy, the European Union, and internationally.

Excellent balance sheet average dividend payer.