Investors Appear Satisfied With Koenig & Bauer AG's (ETR:SKB) Prospects As Shares Rocket 28%

Koenig & Bauer AG (ETR:SKB) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 29% over that time.

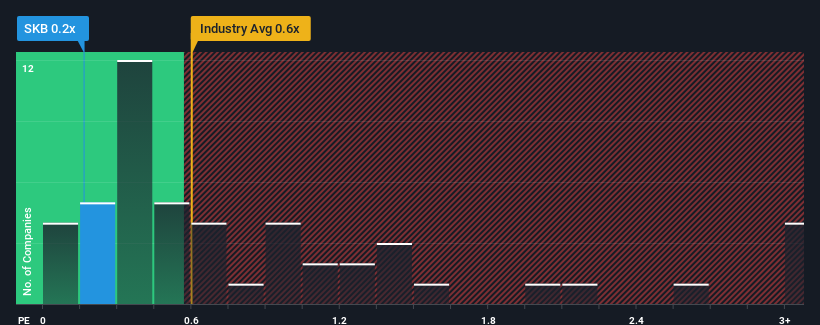

Although its price has surged higher, you could still be forgiven for feeling indifferent about Koenig & Bauer's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Germany is also close to 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Koenig & Bauer

What Does Koenig & Bauer's P/S Mean For Shareholders?

There hasn't been much to differentiate Koenig & Bauer's and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Keen to find out how analysts think Koenig & Bauer's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Koenig & Bauer?

Koenig & Bauer's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 4.2% per annum over the next three years. That's shaping up to be similar to the 3.6% each year growth forecast for the broader industry.

In light of this, it's understandable that Koenig & Bauer's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Koenig & Bauer's P/S Mean For Investors?

Its shares have lifted substantially and now Koenig & Bauer's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Koenig & Bauer's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Koenig & Bauer with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Koenig & Bauer, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Koenig & Bauer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:SKB

Koenig & Bauer

Develops and manufactures printing and postprint systems worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives