- Germany

- /

- Industrials

- /

- XTRA:SIE

Is Siemens’ Stock Surge Justified After €2B Northvolt Battery Gigafactory Investment?

Reviewed by Bailey Pemberton

Thinking about what to do with your Siemens shares? Or maybe you’re eyeing the stock for your next move. Siemens has been on quite a ride recently, offering investors both excitement and a reason to pause and reassess. Just over the past week, the stock jumped 6.0%, with a 6.3% gain in the last month, and a strong 29.7% return so far this year. If you zoom out a bit more, Siemens has delivered an even more impressive performance, boasting 36.1% growth in the past year and nearly doubling over both three and five years.

Many analysts attribute this steady momentum to broader market optimism for European industrials, as well as increased investment in energy infrastructure. These are both areas where Siemens shines. While short-term news headlines come and go, Siemens’ recent moves reflect a solid underlying confidence in the company’s direction and its ability to adapt in a dynamic sector.

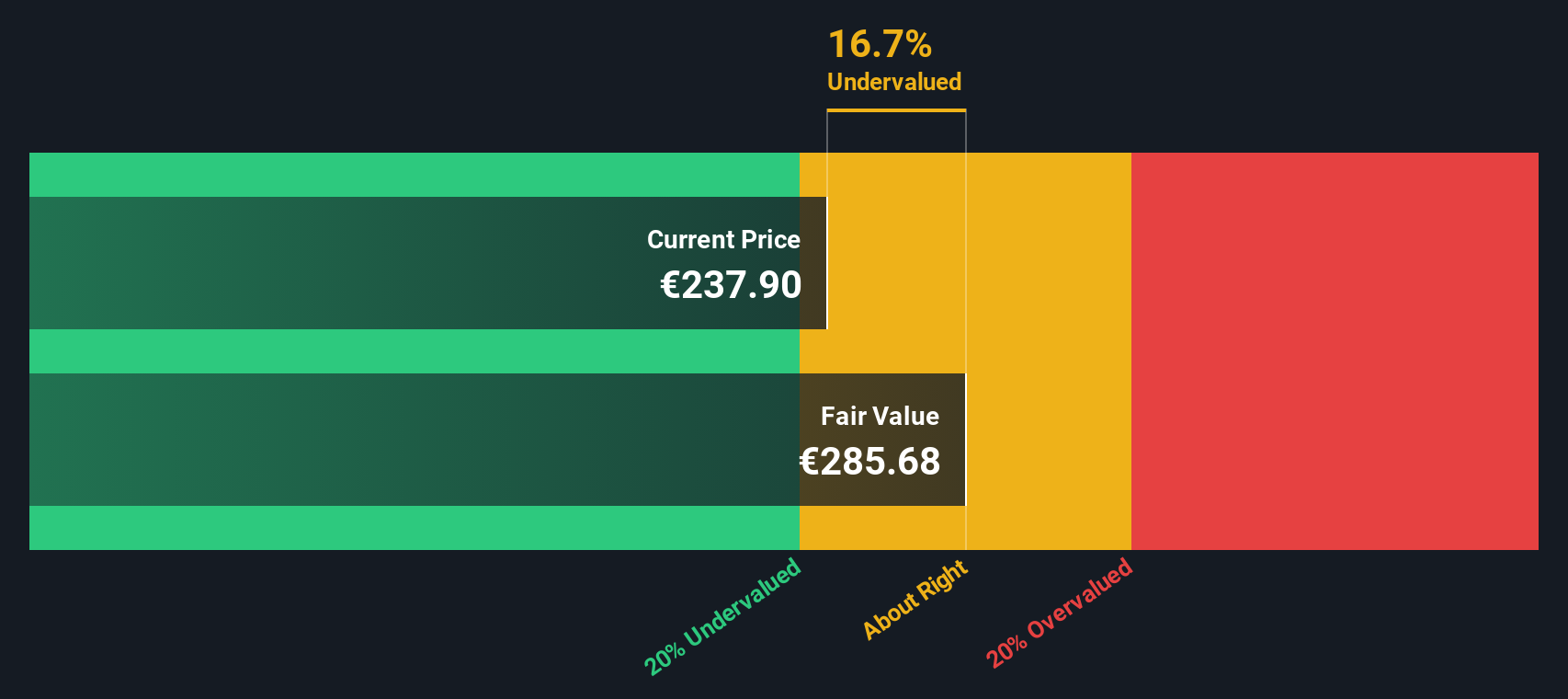

Of course, with gains like these, the big question is whether Siemens is still attractively priced, or if it’s already run too far ahead of its value. In fact, by our own analysis, Siemens is undervalued in 4 out of 6 key areas, giving it a robust value score of 4. That gives us a compelling starting point to dig into how we measure value for a company like this. Before you make your next decision, let’s walk through some of the best-known valuation approaches and then stick with me for a final, even sharper way to gauge if Siemens is truly undervalued.

Approach 1: Siemens Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used approach that estimates what a company's shares should be worth today, based on projections of future cash flows. It forecasts how much money Siemens is expected to generate and then discounts those amounts back to present value, making adjustments for uncertainties along the way.

For Siemens, the current Free Cash Flow stands at approximately €10.58 billion. Analyst estimates provide projections for the next five years, and using those as a foundation, further estimates are extended out to 2035. By 2030, Siemens’ Free Cash Flow is expected to reach about €11.12 billion, according to current forecasts. These steadily rising cash flows reflect the company’s long-term prospects in its core markets.

According to this DCF approach, Siemens’ intrinsic value comes in at €274.90 per share. Given where the stock is trading, this valuation implies that Siemens is about 10.8% undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Siemens is undervalued by 10.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

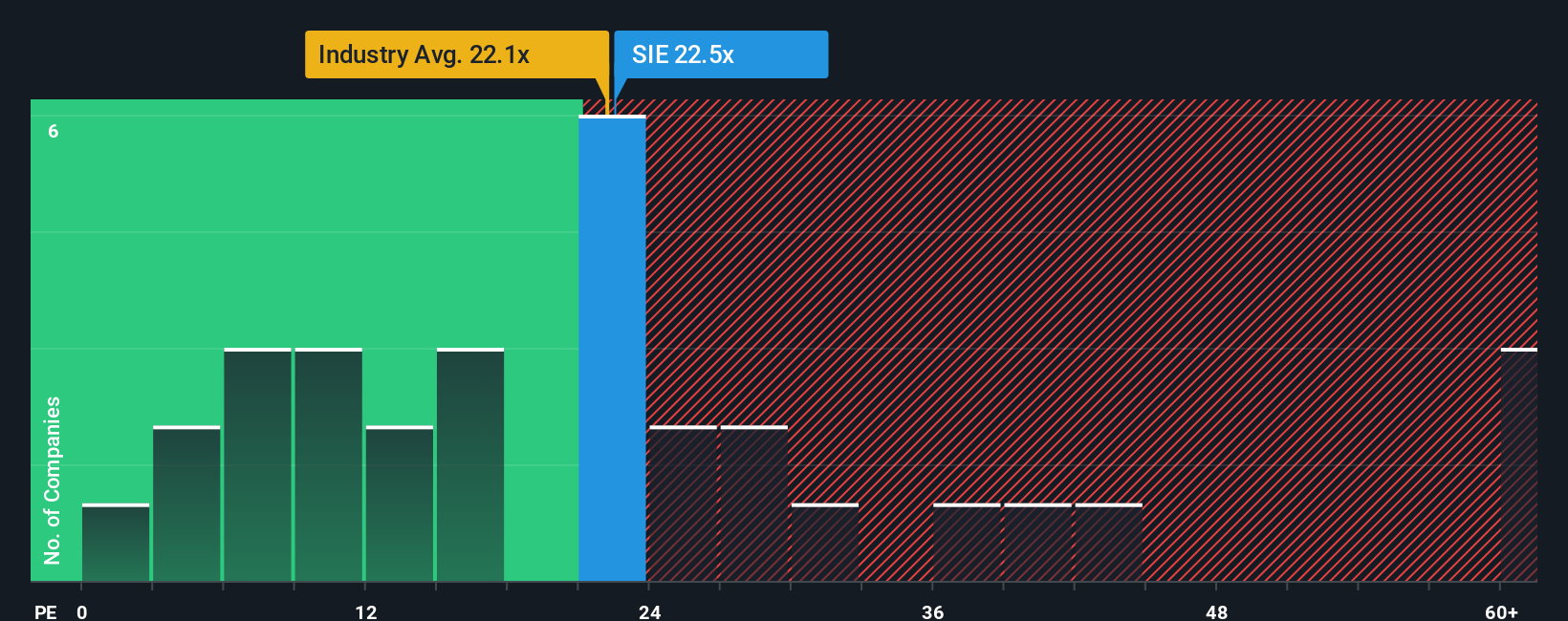

Approach 2: Siemens Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies like Siemens. It compares a company’s current share price to its earnings per share, quickly giving investors a sense of how much they’re paying for a unit of earnings. For established businesses with steady profits, the PE ratio is a straightforward way to benchmark valuation.

When deciding what counts as a “normal” or “fair” PE ratio, investors look at growth expectations and risks. Faster-growing or lower-risk companies typically deserve higher PE multiples, while slower growers or riskier outfits trade at lower ratios. Right now, Siemens trades at a PE of 24.2x. This is a premium to the Industrials industry average of 13.1x, but actually a discount compared to major peers, which average 59.6x.

To provide a more tailored view, Simply Wall St calculates a proprietary “Fair Ratio”, which is the PE multiple Siemens should have based on its earnings growth, industry, profit margin, company size and risk profile. This is more insightful than a simple peer or industry comparison because it recognizes what truly sets Siemens apart. For Siemens, the Fair PE Ratio is 27.0x, just a touch above its present 24.2x. This is a pretty tight gap, suggesting the market price lines up closely with the company’s fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Siemens Narrative

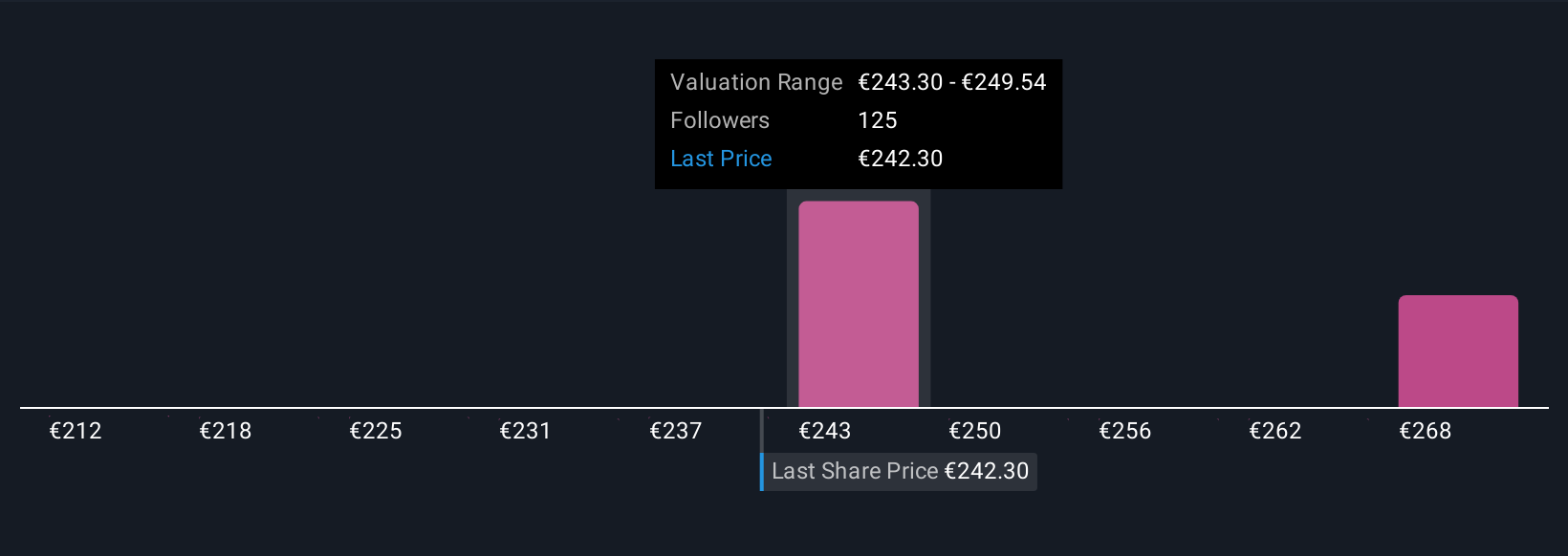

Earlier, we hinted at a more powerful way to think about value. Let’s introduce Narratives, an innovative approach that lets you tell your own story of what Siemens is worth based on your unique perspective, not just the numbers. In simple terms, a Narrative links your view of Siemens’ future performance, such as revenue growth, earnings, and margins, to a financial forecast and then directly to a fair value. This allows you to see the logic behind your buy or sell decisions clearly and confidently.

With Narratives, available on the Simply Wall St Community page, millions of investors can easily create or explore real-time, data-driven scenarios that update as new facts and news emerge. This helps you quickly compare your own fair value for Siemens to its current market price, making your investment decisions smarter and more personal. For example, some investors see Siemens’ electrification and digitalization strategies as catalysts for sustained earnings growth and set bullish price targets as high as €300. More cautious users might focus on competitive or integration headwinds, landing on notably lower targets around €185. Narratives help you visualize these real-world perspectives with transparent assumptions, empowering you to decide what fits your investing style.

Do you think there's more to the story for Siemens? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SIE

Siemens

A technology company, focuses in the areas of automation and digitalization in Europe, Commonwealth of Independent States, Africa, the Middle East, the Americas, Asia, and Australia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives