- Germany

- /

- Industrials

- /

- XTRA:SIE

Does Siemens Still Offer Upside After 25.8% Rally and Strong Q2 Earnings in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Siemens stock right now? You are not alone. Plenty of investors are weighing their options after recent price swings, from a mild 1.8% dip over the past week to a steady 5.6% climb this month. The bigger picture is even more eye-catching: Siemens has returned 25.8% year-to-date and a remarkable 148.1% over five years. Those solid gains have left investors wondering whether the stock remains a value opportunity or if it is reaching its limits.

At the heart of the debate is how Siemens measures up against classic valuation yardsticks. According to a recent assessment, Siemens scores a 3 out of 6 on our value checklist, which means it appears undervalued on half of the major tests we use to spot bargains. That is something worth paying attention to, especially after recent market developments have nudged risk perceptions and growth expectations for major European industrial names like Siemens.

In this article, we will break down the numbers using some of the most common valuation approaches to see what they reveal about Siemens today. And just in case you think you have heard it all before, stick around. We will finish with a more revealing perspective that goes beyond the usual ratios and multiples.

Why Siemens is lagging behind its peers

Approach 1: Siemens Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future free cash flows and then discounting those amounts back to their present value. This approach attempts to answer what Siemens is worth today based on how much cash it is expected to generate over time.

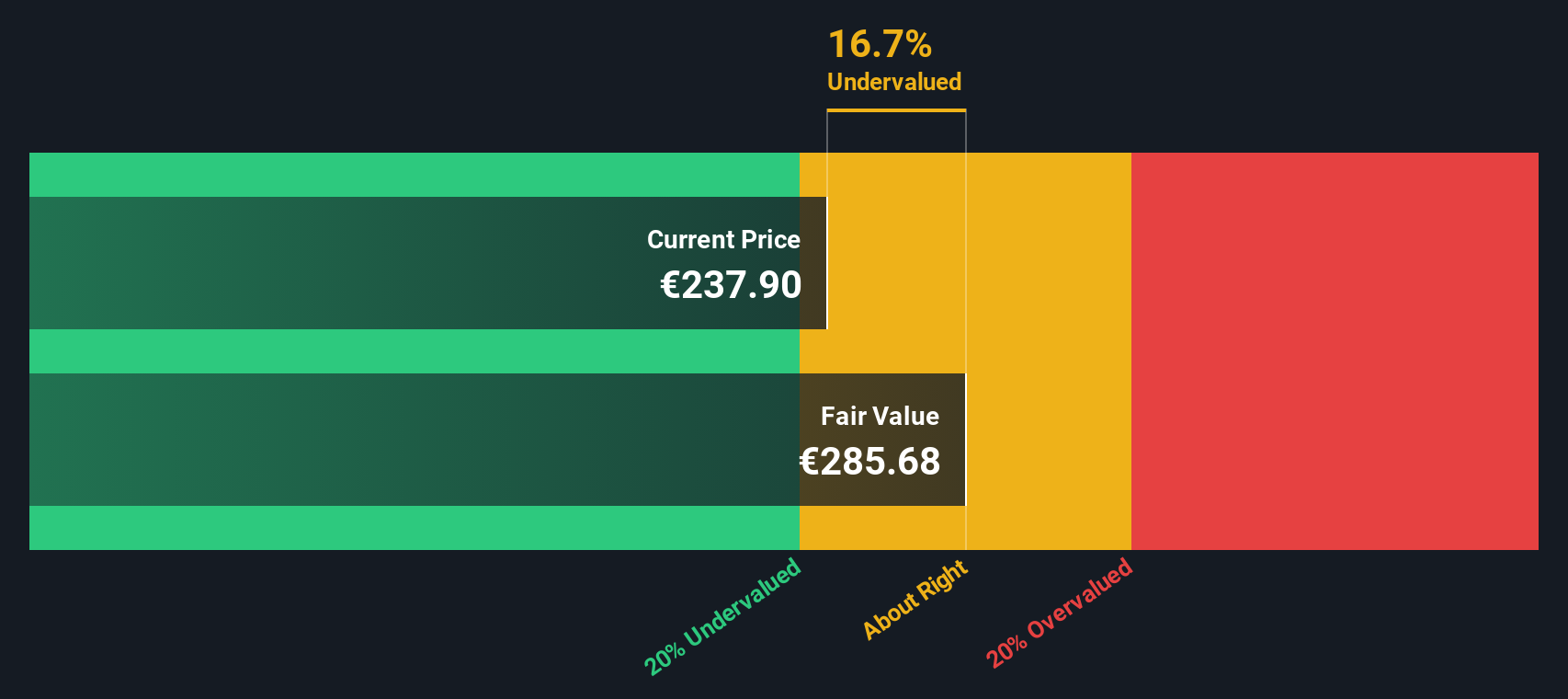

For Siemens, the latest twelve months saw free cash flow of €10.58 Billion. Analyst estimates suggest cash flows will continue to grow, with projections reaching €11.12 Billion by 2030. The model uses a 2 Stage Free Cash Flow to Equity approach, where the first five years are shaped by analyst forecasts and later years are extrapolated by Simply Wall St.

On this basis, the DCF approach assigns Siemens an intrinsic value of €286.56 per share. This implies the shares are trading at a 17.0% discount to their fair value, indicating the stock is currently undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Siemens is undervalued by 17.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Siemens Price vs Earnings (PE)

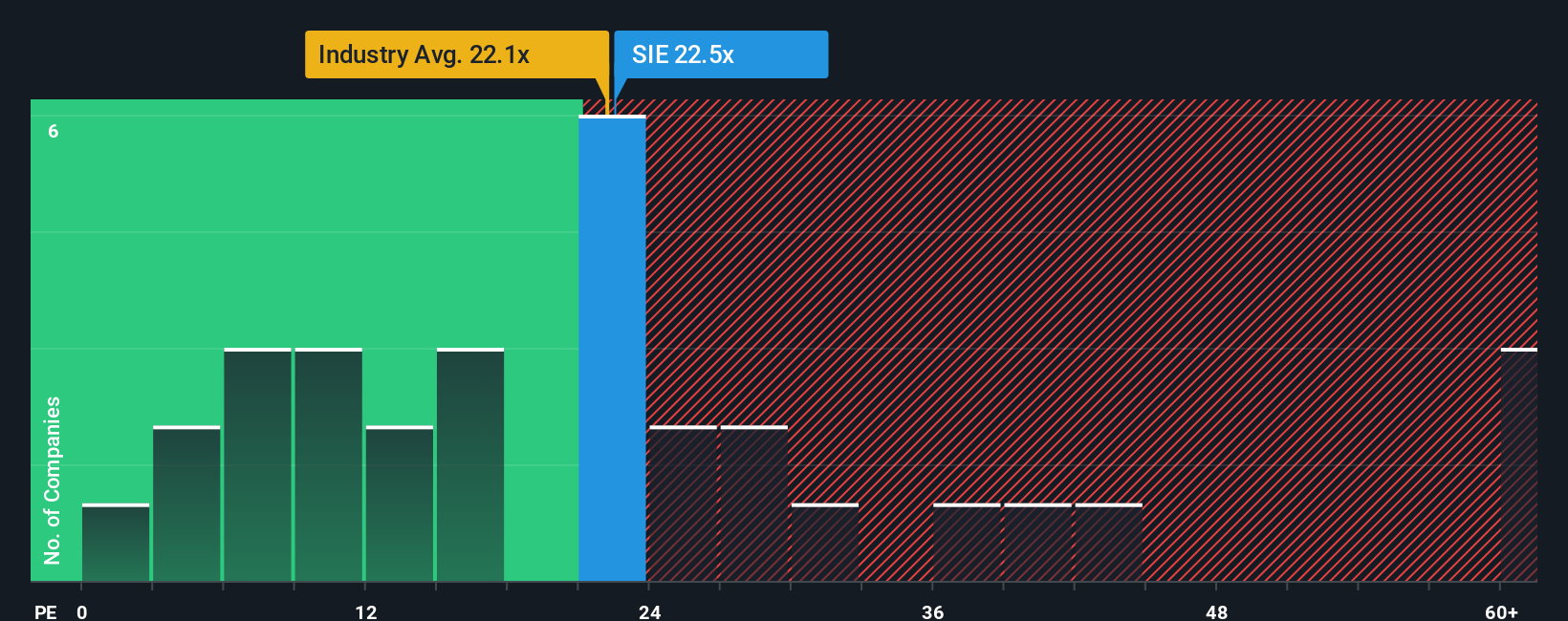

The Price-to-Earnings (PE) ratio is one of the most widely used tools for valuing profitable companies like Siemens. Since it relates a company's share price to its current earnings, the PE ratio helps investors gauge whether a stock is cheap or expensive compared to its profits.

A "normal" or "fair" PE ratio is not set in stone; it depends on factors such as expected earnings growth, risk profile, market sentiment, and industry conditions. Higher growth companies or those seen as less risky usually command higher PE multiples, while slower growth or riskier firms trade at lower PEs.

Currently, Siemens trades on a PE ratio of 23.4x. Compared to the Industrials industry average of 13.0x and the average for its closest peers at 53.5x, Siemens is positioned somewhere in the middle. However, Simply Wall St’s proprietary Fair Ratio for Siemens is 27.0x. This Fair Ratio is a more precise benchmark than just looking at industry averages or peers because it incorporates the company's own growth prospects, profit margins, size, and risk factors alongside sector realities.

With Siemens’ current PE of 23.4x and a Fair Ratio of 27.0x, the stock looks slightly undervalued from this angle. While it is above the broader industry average, Siemens' growth and quality warrant a higher multiple. Its valuation appears justified based on a holistic view.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Siemens Narrative

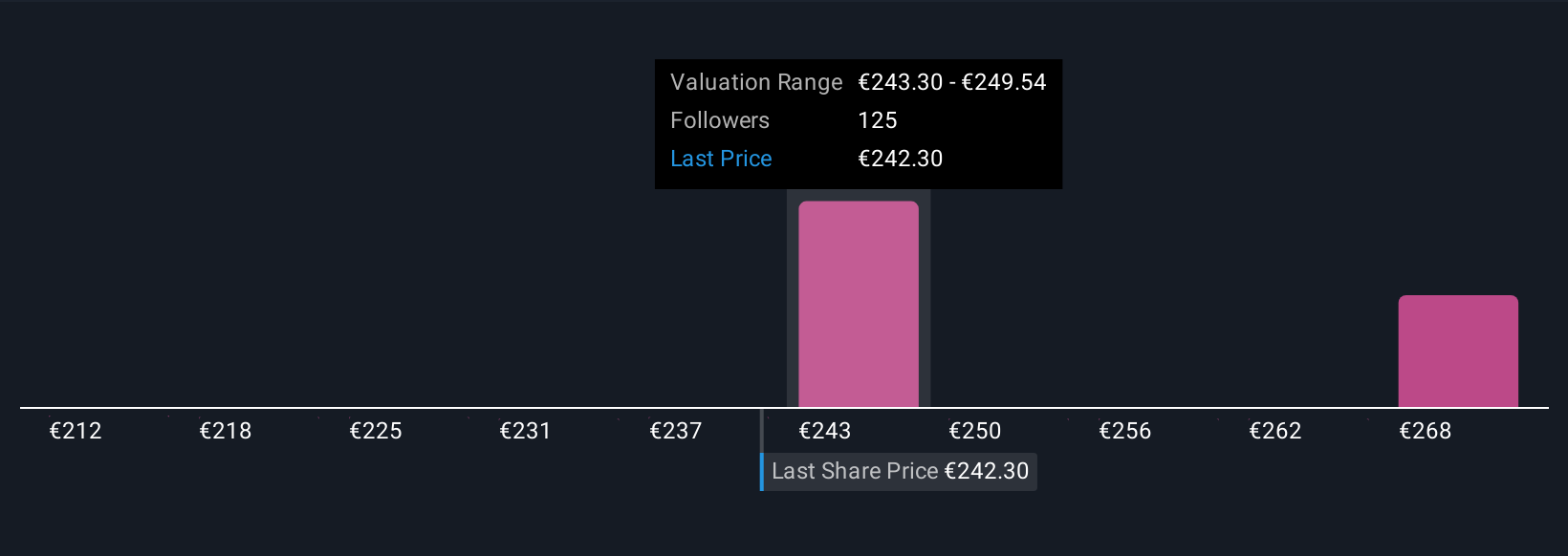

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own story or thesis about a company. It connects your reasoning and assumptions about Siemens’s future (like estimated revenue, earnings, and profit margins) with the numbers these assumptions produce, including your idea of fair value for the stock.

Instead of relying only on standard ratios, Narratives help you blend qualitative insights with financial forecasts, building a clear bridge between what you believe about Siemens and what its shares are really worth. This feature is easy to use and available within the Simply Wall St Community page, where millions of investors refine and share their viewpoints every day.

Narratives make it simple to decide when to buy or sell by letting you compare your Fair Value directly to the current market price, and they stay relevant because they update automatically as new news or earnings reports come out.

For instance, some Siemens Narratives use bullish forecasts and target a price as high as €300.0, while more conservative ones set fair value nearer to €185.0. This highlights how investors with different stories about the same business can arrive at very different conclusions.

Do you think there's more to the story for Siemens? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SIE

Siemens

A technology company, focuses in the areas of automation and digitalization in Europe, Commonwealth of Independent States, Africa, the Middle East, the Americas, Asia, and Australia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives