We're Not Very Worried About ROY Asset Holding's (ETR:RY8) Cash Burn Rate

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for ROY Asset Holding (ETR:RY8) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for ROY Asset Holding

How Long Is ROY Asset Holding's Cash Runway?

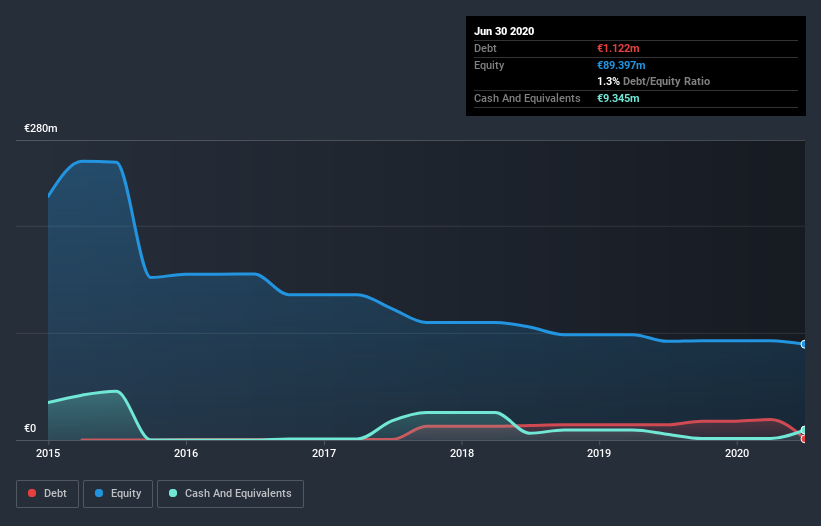

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. ROY Asset Holding has such a small amount of debt that we'll set it aside, and focus on the €9.3m in cash it held at June 2020. Importantly, its cash burn was €4.1m over the trailing twelve months. Therefore, from June 2020 it had 2.3 years of cash runway. Arguably, that's a prudent and sensible length of runway to have. The image below shows how its cash balance has been changing over the last few years.

Is ROY Asset Holding's Revenue Growing?

Given that ROY Asset Holding actually had positive free cash flow last year, before burning cash this year, we'll focus on its operating revenue to get a measure of the business trajectory. The good news is that operating revenue growth was as flash as a rat with a gold tooth, up 1,302% in that time. In reality, this article only makes a short study of the company's growth data. You can take a look at how ROY Asset Holding is growing revenue over time by checking this visualization of past revenue growth.

Can ROY Asset Holding Raise More Cash Easily?

While ROY Asset Holding's revenue growth truly does shine bright, it's important not to ignore the possibility that it might need more cash, at some point, even if only to optimise its growth plans. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of €17m, ROY Asset Holding's €4.1m in cash burn equates to about 24% of its market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

So, Should We Worry About ROY Asset Holding's Cash Burn?

On this analysis of ROY Asset Holding's cash burn, we think its revenue growth was reassuring, while its cash burn relative to its market cap has us a bit worried. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. Separately, we looked at different risks affecting the company and spotted 3 warning signs for ROY Asset Holding (of which 2 are a bit unpleasant!) you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading ROY Asset Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:RY8

ROY Asset Holding

An investment holding company, engages in the ceramic ware and real estate businesses.

Weak fundamentals or lack of information.