- Germany

- /

- Aerospace & Defense

- /

- XTRA:RHM

Is Rheinmetall’s Multibillion-Euro Armoured Vehicle Order Shifting the Investment Case for Rheinmetall (XTRA:RHM)?

Reviewed by Sasha Jovanovic

- Earlier this week, Rheinmetall announced that its joint venture secured a substantial order for armoured vehicles valued at several billions of euros, strengthening its role in Europe's defense supply chain.

- This major contract highlights both the scale of ongoing defense procurement in the region and Rheinmetall's ability to participate in multibillion-euro projects through strategic partnerships.

- We’ll explore how winning this large-scale armored vehicle order may influence Rheinmetall’s future revenue outlook and position in European defense contracts.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Rheinmetall Investment Narrative Recap

To consider owning Rheinmetall, an investor needs confidence in sustained European defense spending and the company’s ability to grow its defense backlog through successful contract wins and partnerships. The recently announced multibillion-euro armored vehicle order is a clear short-term catalyst, directly supporting Rheinmetall’s order pipeline and near-term revenue outlook, yet the company’s reliance on large regional procurement cycles remains a key risk should political priorities shift or budgets tighten.

Among relevant developments, Rheinmetall's recent plan to divest its civilian businesses and concentrate entirely on land, sea, and air defense aligns closely with this armored vehicle contract win. This shift reinforces the company’s focus on core military sectors, supporting its efforts to capture larger, recurring contracts in Europe at a time when defense budgets and project sizes are expanding.

By contrast, investors should also be aware of the risks tied to Rheinmetall’s heavy dependence on timely governmental approvals in the region, especially if...

Read the full narrative on Rheinmetall (it's free!)

Rheinmetall's outlook anticipates €26.4 billion in revenue and €3.4 billion in earnings by 2028. This scenario is based on 35.3% annual revenue growth and a €2.6 billion earnings increase from the current €845.0 million level.

Uncover how Rheinmetall's forecasts yield a €2162 fair value, a 21% upside to its current price.

Exploring Other Perspectives

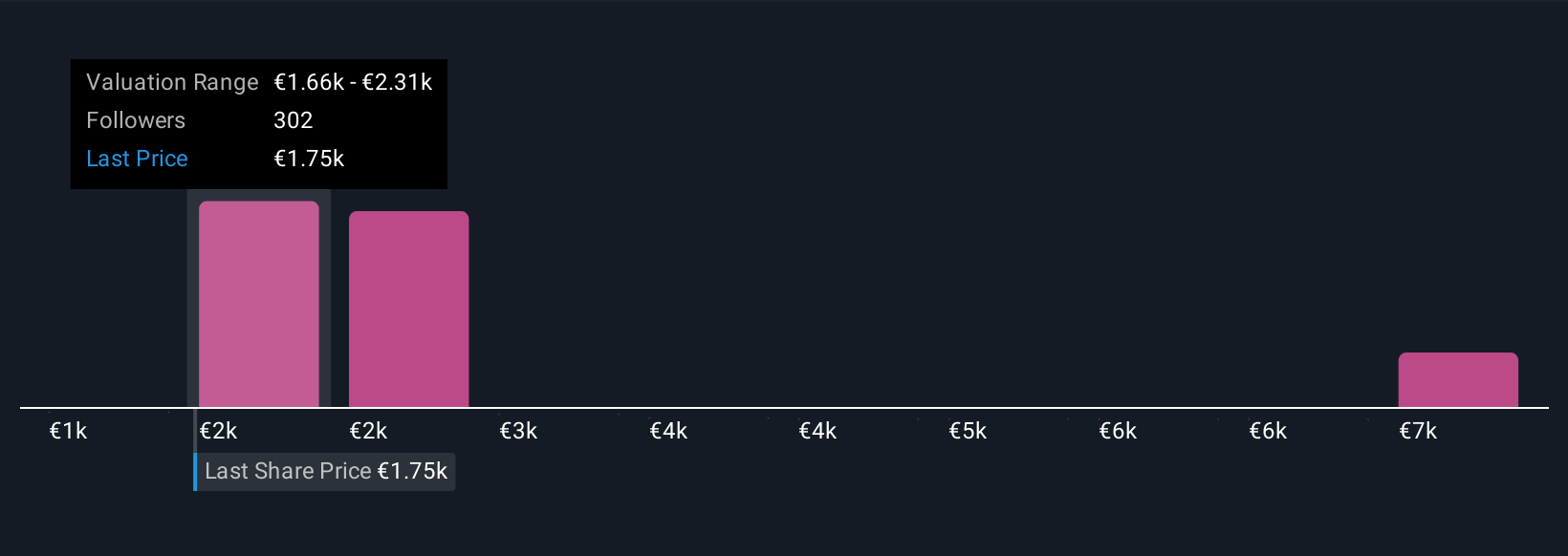

Forty Simply Wall St Community members estimate fair value from €1,000 to €7,569.50 per share, reflecting sharply differing outlooks on Rheinmetall. While optimism centers on momentum from large defense orders, the risk of shifting government priorities may affect future earnings and growth, so consider several viewpoints before making any decision.

Explore 40 other fair value estimates on Rheinmetall - why the stock might be worth over 4x more than the current price!

Build Your Own Rheinmetall Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rheinmetall research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Rheinmetall research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rheinmetall's overall financial health at a glance.

No Opportunity In Rheinmetall?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RHM

Rheinmetall

Provides mobility and security technologies in Germany, Rest of Europe, North, Middle, and South America, Asia and the Near East, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives