As European markets navigate a mixed landscape, with the STOXX Europe 600 Index inching higher amid dovish signals from the U.S. Federal Reserve and easing trade tensions, investors are keenly observing opportunities within the region. In this environment, identifying stocks trading below their estimated fair value can provide potential entry points for those looking to capitalize on market inefficiencies and economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sandoz Group (SWX:SDZ) | CHF48.17 | CHF95.44 | 49.5% |

| Mo-BRUK (WSE:MBR) | PLN293.50 | PLN580.57 | 49.4% |

| Mentice (OM:MNTC) | SEK9.80 | SEK19.58 | 50% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.17 | 49% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.359 | €0.70 | 49% |

| Dynavox Group (OM:DYVOX) | SEK105.50 | SEK209.11 | 49.5% |

| DSV (CPSE:DSV) | DKK1330.00 | DKK2646.51 | 49.7% |

| doValue (BIT:DOV) | €2.79 | €5.50 | 49.3% |

| ArcticZymes Technologies (OB:AZT) | NOK30.00 | NOK59.67 | 49.7% |

| Agilyx (OB:AGLX) | NOK19.10 | NOK38.13 | 49.9% |

Let's review some notable picks from our screened stocks.

Valmet Oyj (HLSE:VALMT)

Overview: Valmet Oyj is a company that develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries across various global regions, with a market cap of €5.16 billion.

Operations: The company's revenue is derived from three main segments: Services (€1.91 billion), Automation (€1.49 billion), and Process Technologies (€1.85 billion).

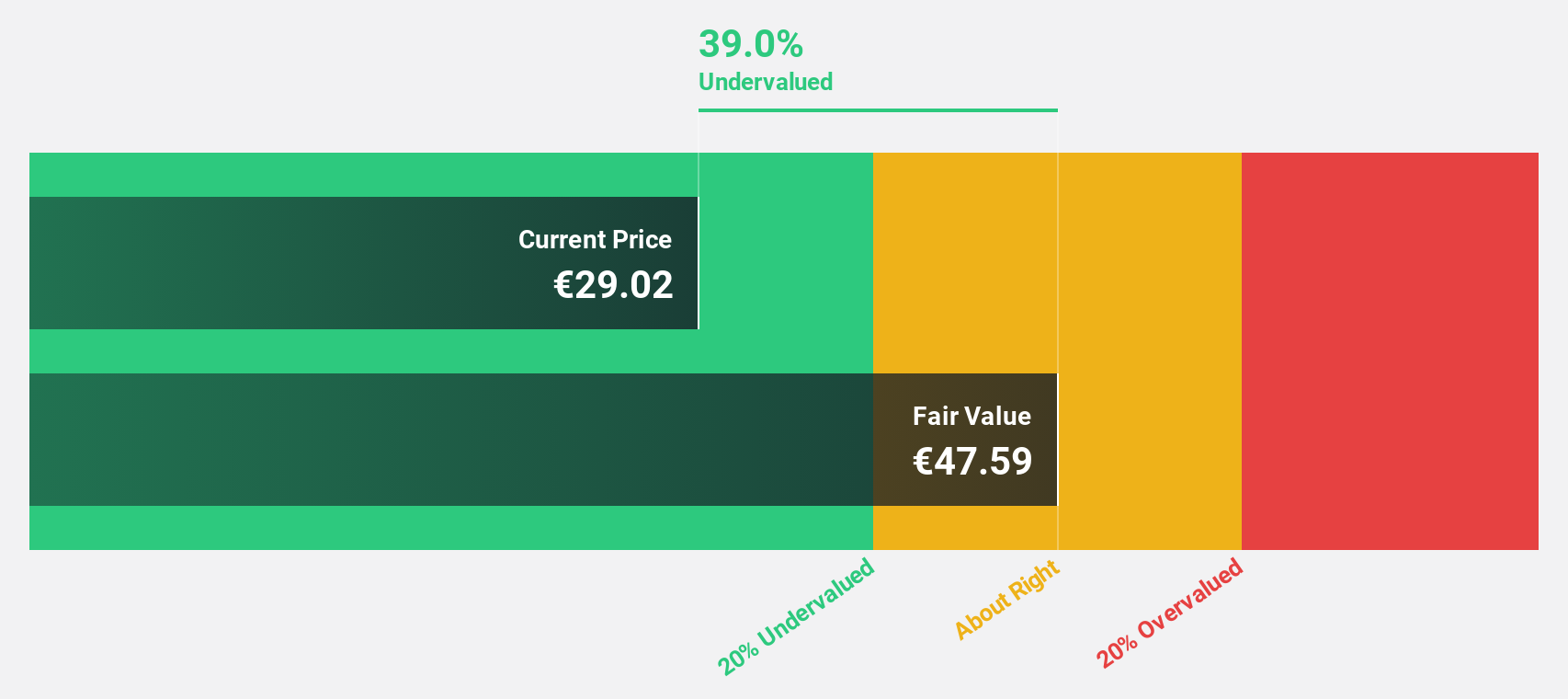

Estimated Discount To Fair Value: 40.8%

Valmet Oyj is trading significantly below its estimated fair value of €47.35, with a current price of €28.01, highlighting its potential as an undervalued stock based on cash flows. Despite earnings growth forecasted at 24.5% annually, which outpaces the Finnish market average, revenue growth remains modest at 4% per year. Recent strategic orders and partnerships like those with Altri Biotek and Petrobras bolster its operational outlook despite high dividend payout ratios challenging sustainability.

- Insights from our recent growth report point to a promising forecast for Valmet Oyj's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Valmet Oyj.

Alleima (OM:ALLEI)

Overview: Alleima AB (publ) is a company that manufactures and sells stainless steels, special alloys, medical wires and components, and electric heating systems across Europe, North America, Asia, and globally with a market cap of SEK19.91 billion.

Operations: Alleima AB (publ) generates revenue through the production and sale of stainless steels, special alloys, medical wires and components, and electric heating systems across various global markets including Europe, North America, and Asia.

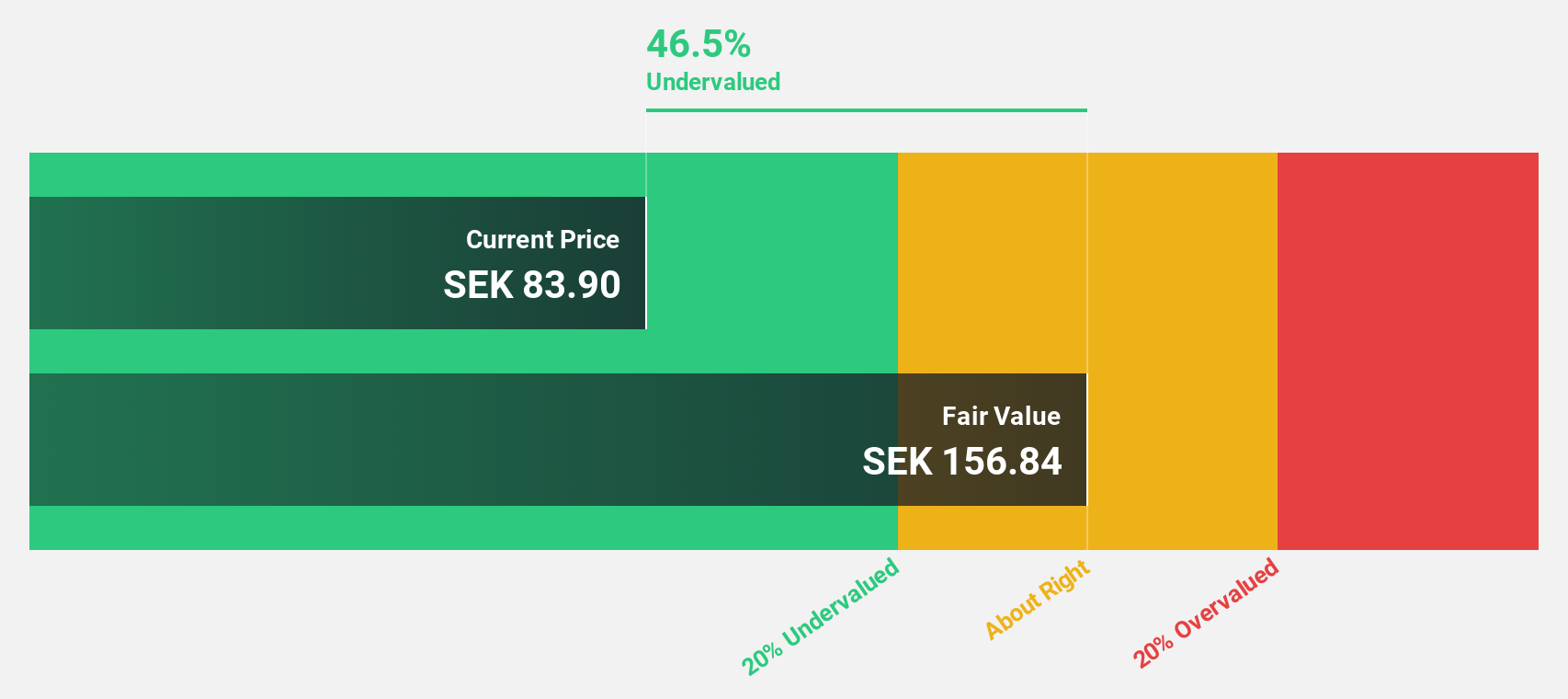

Estimated Discount To Fair Value: 44.3%

Alleima is trading at SEK 79.6, significantly below its estimated fair value of SEK 142.88, positioning it as undervalued based on cash flows. Earnings are expected to grow significantly at 21.3% annually, surpassing the Swedish market average, though revenue growth is more modest at 8.6% per year. Recent earnings reports show a decline in sales and net income compared to last year, which may concern investors despite the stock's attractive valuation metrics and strategic executive appointments enhancing governance expertise.

- The growth report we've compiled suggests that Alleima's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Alleima's balance sheet health report.

Rheinmetall (XTRA:RHM)

Overview: Rheinmetall AG is a company that offers mobility and security technologies across various regions, including Germany, Europe, the Americas, Asia and the Near East, with a market cap of €80.31 billion.

Operations: The company's revenue is derived from four main segments: Power Systems (€1.97 billion), Vehicle Systems (€4.39 billion), Electronic Solutions (€2.02 billion), and Weapon and Ammunition (€3.05 billion).

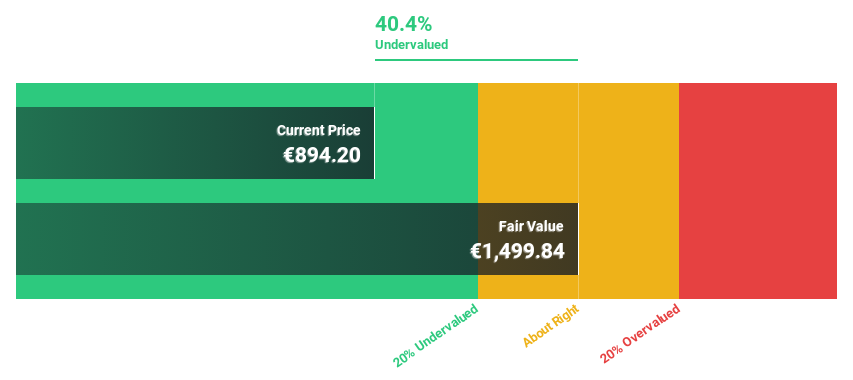

Estimated Discount To Fair Value: 38.8%

Rheinmetall, trading at €1,750.5, is undervalued based on cash flows with an estimated fair value of €2,862.23. The company's revenue and earnings are forecast to grow significantly at 25.6% and 33.1% per year respectively, outpacing the German market averages. Recent strategic moves include plans to divest civilian businesses and expand into shipbuilding through acquiring Naval Vessels Lürssen B.V., aiming to become a comprehensive defense supplier in Europe.

- The analysis detailed in our Rheinmetall growth report hints at robust future financial performance.

- Click here to discover the nuances of Rheinmetall with our detailed financial health report.

Summing It All Up

- Click here to access our complete index of 217 Undervalued European Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:VALMT

Valmet Oyj

Develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries in North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives