- Germany

- /

- Aerospace & Defense

- /

- XTRA:OHB

Unveiling Undiscovered Gems In January 2025

Reviewed by Simply Wall St

As 2025 begins, global markets are navigating a complex landscape marked by stronger-than-expected U.S. labor market data and persistent inflation concerns, leading to choppy conditions and underperformance in small-cap stocks as evidenced by the Russell 2000 Index dipping into correction territory. In this environment, identifying promising small-cap stocks requires a focus on companies with resilient business models and strong fundamentals that can withstand economic uncertainties and potential interest rate fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Zhang Jia Gang Freetrade Science&Technology GroupLtd (SHSE:600794)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhang Jia Gang Freetrade Science & Technology Group Co., Ltd., through its subsidiaries, operates in the loading, unloading, and storage of petrochemical products in China with a market cap of CN¥4.27 billion.

Operations: The company generates revenue primarily from the loading, unloading, and storage of petrochemical products. It has a market cap of CN¥4.27 billion.

Zhang Jia Gang Freetrade Science & Technology Group Ltd. stands out with high-quality earnings and a recent 2.3% growth in earnings, outperforming the Trade Distributors industry, which saw a -16.9% downturn. The company boasts more cash than total debt, reflecting prudent financial management as its debt-to-equity ratio decreased from 19.3% to 7.4% over five years. Trading at 94% below estimated fair value suggests potential undervaluation in the market's eyes, while positive free cash flow further strengthens its position. Despite these strengths, recent shareholder meetings indicate active engagement in strategic decisions that could shape future directions and opportunities for growth.

Guangzhou Lingnan Group Holdings (SZSE:000524)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangzhou Lingnan Group Holdings Company Limited operates in the tourism, accommodation, exhibition, scenic spots, and travel sectors in China with a market capitalization of CN¥6.18 billion.

Operations: Lingnan Group generates revenue primarily from tourism-related services, accommodation, exhibitions, scenic spots, and travel activities in China. The company has a market capitalization of CN¥6.18 billion.

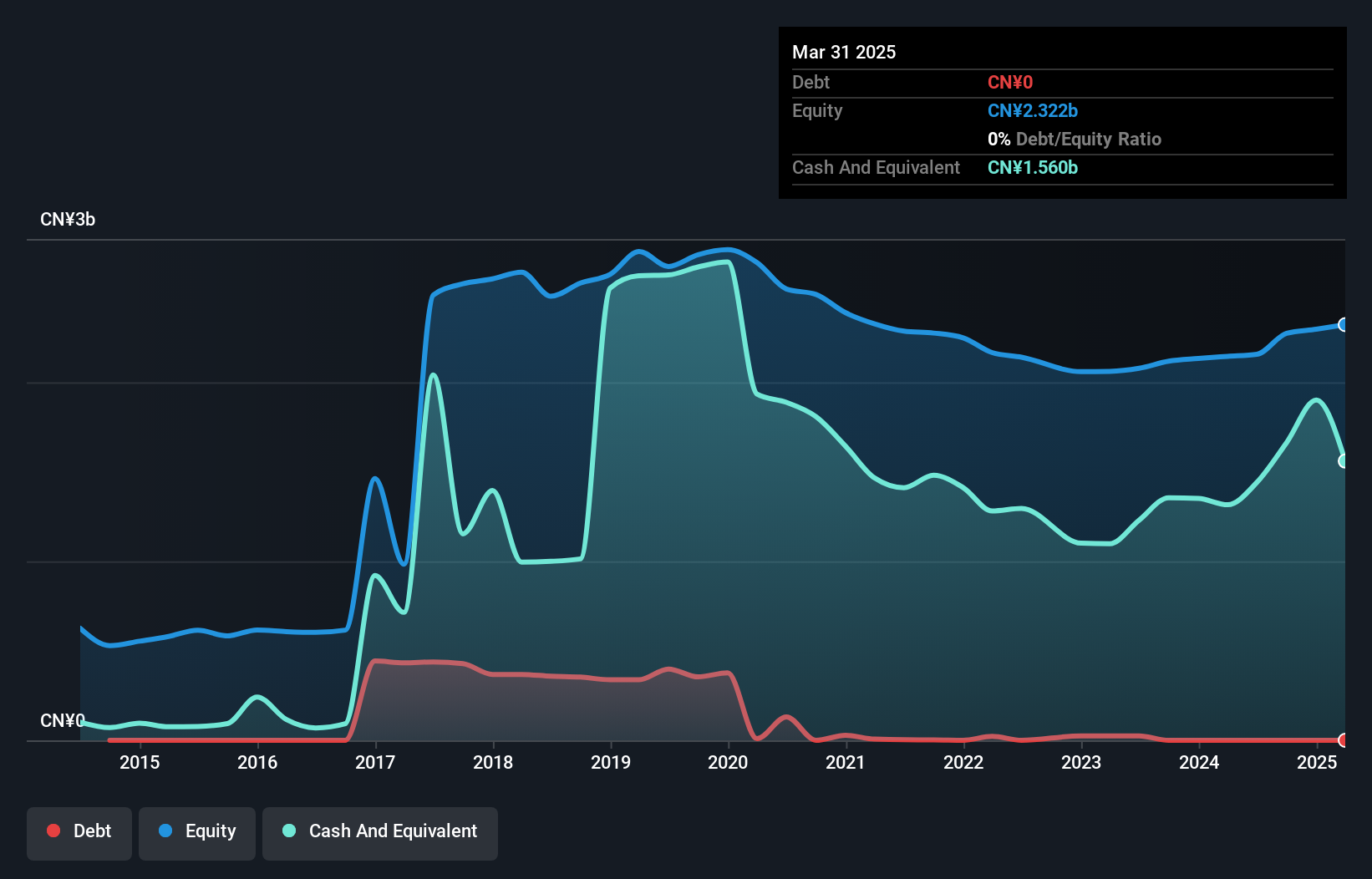

Lingnan Group, a smaller player in the hospitality sector, has shown significant progress with its recent profitability. The company reported CNY 3.27 billion in revenue for the first nine months of 2024, up from CNY 2.51 billion last year, while net income rose to CNY 135.23 million from CNY 57.8 million. Basic earnings per share increased to CNY 0.2 from CNY 0.09 previously, reflecting strong operational performance and high-quality earnings despite industry challenges (-8.5%). Lingnan's debt-free status enhances its financial stability and positions it well for future growth prospects as forecasted earnings are set to rise by over 22% annually.

OHB (XTRA:OHB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: OHB SE is a space and technology company operating in Germany, the rest of Europe, and internationally, with a market capitalization of approximately €909.74 million.

Operations: OHB SE generates revenue primarily from its Space Systems segment, contributing €818.74 million, followed by Aerospace at €129.26 million and Digital at €117.41 million.

OHB, a player in the Aerospace & Defense sector, has shown impressive earnings growth of 155% over the past year, surpassing industry averages. Despite this, its financial health presents mixed signals. The debt to equity ratio has improved significantly from 103% to 58% over five years, yet the net debt to equity remains high at 53%. Interest payments are well covered by EBIT at a healthy 12.6 times coverage. However, recent results reveal challenges with sales and revenue slightly down compared to last year but net income increased to €12M for Q3 from €5M previously.

- Click here to discover the nuances of OHB with our detailed analytical health report.

Evaluate OHB's historical performance by accessing our past performance report.

Seize The Opportunity

- Dive into all 4551 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:OHB

OHB

Operates as a space and technology company in Germany, rest of Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives