- Germany

- /

- Electrical

- /

- XTRA:NDX1

Major German and Ukrainian Orders Might Change The Case For Investing In Nordex (XTRA:NDX1)

Reviewed by Sasha Jovanovic

- In early October 2025, Nordex announced major orders from long-standing clients, including wpd in Germany for 21 turbines totaling 125.7 MW and OKKO Group in Ukraine for 32 turbines totaling 188.8 MW, both with multi-year service agreements and installations set for 2026 and 2027.

- These deals highlight Nordex’s ability to secure repeat business and long-term service contracts, reaffirming its important role in Europe’s ongoing renewable energy transition.

- We’ll explore how the addition of significant German and Ukrainian orders with long-term service contracts impacts Nordex’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Nordex Investment Narrative Recap

For investors interested in Nordex, the central narrative centers on the company’s ability to capture long-term, recurring revenues from service contracts, leveraging its strong presence in European renewables. The recent major wins in Germany and Ukraine with multi-year maintenance agreements reinforce this trend, potentially supporting earnings stability and margin expansion in the short term. However, the biggest risk remains Nordex’s continued reliance on its home European market, especially Germany, which still exposes the business to changing regional energy policies, auction volumes, or demand fluctuations more than this recent news event materially changes. Among the recent announcements, the October order from OKKO Group in Ukraine stands out due to its size, 32 turbines totaling 188.8 MW with a 20-year service agreement. This not only adds significant order book value but also shows Nordex’s ability to secure recurring, high-margin revenues beyond its core German base, supporting one of its most important growth catalysts: increasing service segment revenues with robust contract capture rates. But while these new contracts provide some reassurance, investors should also be mindful that...

Read the full narrative on Nordex (it's free!)

Nordex's narrative projects €9.0 billion revenue and €353.9 million earnings by 2028. This requires 8.0% annual revenue growth and an earnings increase of €293.6 million from €60.3 million currently.

Uncover how Nordex's forecasts yield a €23.11 fair value, in line with its current price.

Exploring Other Perspectives

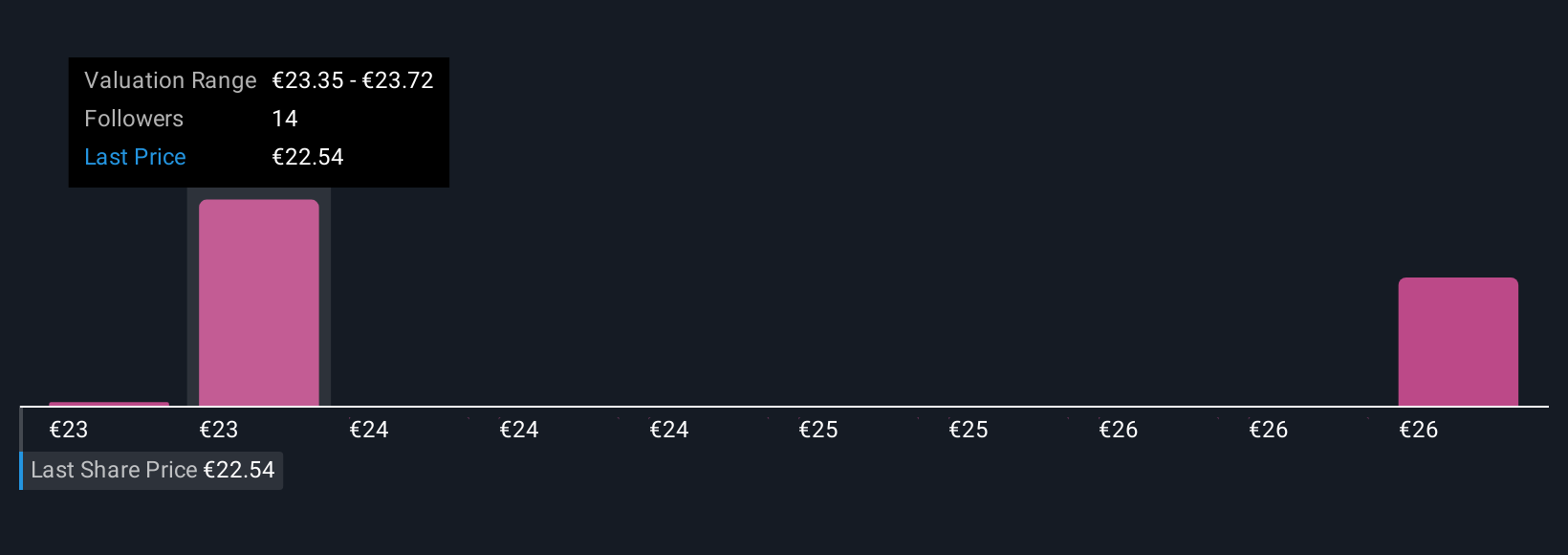

Fair value estimates from three members of the Simply Wall St Community range between €22.99 and €25.95. Against this backdrop, the company’s high exposure to the European market means policy or demand shifts could have broad implications for both order growth and earnings resilience.

Explore 3 other fair value estimates on Nordex - why the stock might be worth just €22.99!

Build Your Own Nordex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nordex research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Nordex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nordex's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:NDX1

Nordex

Develops, manufactures, and distributes multi-megawatt onshore wind turbines worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives