- Germany

- /

- Electrical

- /

- XTRA:NDX1

Could Nordex's (XTRA:NDX1) Latest Wind Contract Reveal More About Its Position in the German Market?

Reviewed by Simply Wall St

- Trianel Erneuerbare Energien GmbH & Co. KG and ABO Energy announced that Nordex has been selected to supply and install eight N149/5.X wind turbines for the 45.6 MW Tasdorf wind farm in Schleswig-Holstein, Germany, with a 20-year Premium Service agreement included as part of the deal.

- This commitment underscores both the ongoing demand for Nordex's products and services in the core German market and the company's role in advancing sustainable energy initiatives across the region.

- To assess the implications for Nordex's investment narrative, we'll consider how this long-term service contract deepens its presence in Germany's growing wind sector.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Nordex Investment Narrative Recap

To be a shareholder in Nordex, you need conviction in long-term wind energy expansion across Europe, especially Germany, and confidence that recurring service contracts like the new Tasdorf project can support steady margin improvement. While this latest 45.6 MW deal reinforces order visibility and highlights service revenue potential, it does not materially shift the most pressing risk facing Nordex, its heavy reliance on the German market, making results sensitive to policy and auction shifts in the near term.

Among recent company news, the August order for TEUT Energieprojekte, the nine-turbine, 51.7 MW Mürow-Neukünkendorf project, stands out as relevant context. Like Tasdorf, it extends Nordex’s contracted project visibility and supports the catalyst of rising service segment revenue, yet both highlight the company’s concentration in core European markets.

Yet even as order wins accumulate, investors should be mindful of what continued market dependence on Germany could mean if...

Read the full narrative on Nordex (it's free!)

Nordex's outlook anticipates €9.0 billion in revenue and €353.9 million in earnings by 2028. This scenario assumes an 8.0% annual revenue growth rate and an increase in earnings of €293.6 million from the current level of €60.3 million.

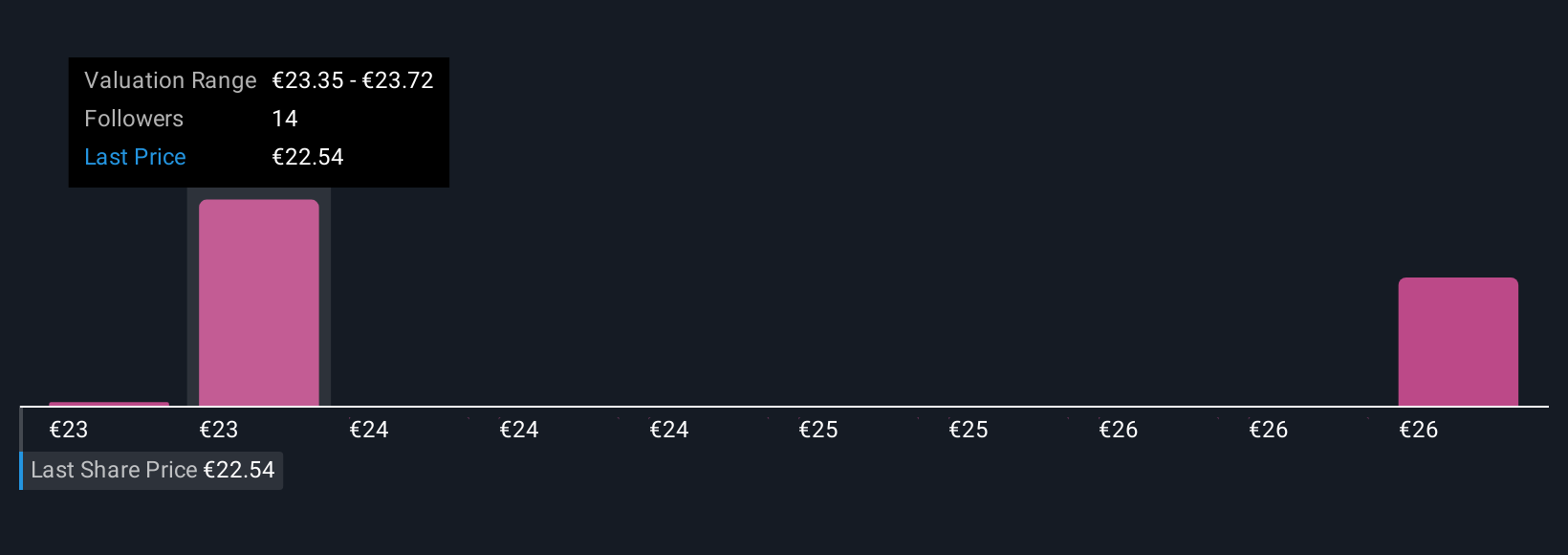

Uncover how Nordex's forecasts yield a €22.98 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Nordex span from €22.98 to €33.77, reflecting a broad spectrum of private investor outlooks. While some see significant upside, recent deals highlight how Nordex remains tied to European demand cycles, which could affect future results as policy or competition evolve.

Explore 3 other fair value estimates on Nordex - why the stock might be worth just €22.98!

Build Your Own Nordex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nordex research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Nordex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nordex's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:NDX1

Nordex

Develops, manufactures, and distributes multi-megawatt onshore wind turbines worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives