- Germany

- /

- Aerospace & Defense

- /

- XTRA:MTX

3 German Stocks Estimated To Be Undervalued In September 2024

Reviewed by Simply Wall St

The German stock market has shown resilience, with the DAX index recording modest gains despite broader European market caution following the U.S. Federal Reserve's recent rate cut. As investors navigate these fluctuating conditions, identifying undervalued stocks becomes crucial for those looking to capitalize on potential growth opportunities. In this article, we will explore three German stocks estimated to be undervalued in September 2024, offering insights into their potential as strategic investments amidst the current economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| init innovation in traffic systems (XTRA:IXX) | €36.50 | €52.64 | 30.7% |

| technotrans (XTRA:TTR1) | €18.80 | €31.53 | 40.4% |

| Formycon (XTRA:FYB) | €49.90 | €72.11 | 30.8% |

| Gerresheimer (XTRA:GXI) | €97.45 | €192.54 | 49.4% |

| Verbio (XTRA:VBK) | €15.98 | €29.93 | 46.6% |

| elumeo (XTRA:ELB) | €2.14 | €3.88 | 44.8% |

| MTU Aero Engines (XTRA:MTX) | €282.70 | €490.67 | 42.4% |

| LPKF Laser & Electronics (XTRA:LPK) | €8.90 | €12.46 | 28.6% |

| Vectron Systems (XTRA:V3S) | €11.75 | €17.27 | 32% |

| Basler (XTRA:BSL) | €8.44 | €13.85 | 39% |

Here's a peek at a few of the choices from the screener.

MTU Aero Engines (XTRA:MTX)

Overview: MTU Aero Engines AG develops, manufactures, markets, and maintains commercial and military aircraft engines as well as aero-derivative industrial gas turbines globally with a market cap of approximately €15.22 billion.

Operations: The company's revenue segments include €4.45 billion from the Commercial Maintenance Business (MRO) and €1.32 billion from the Commercial and Military Engine Business (OEM).

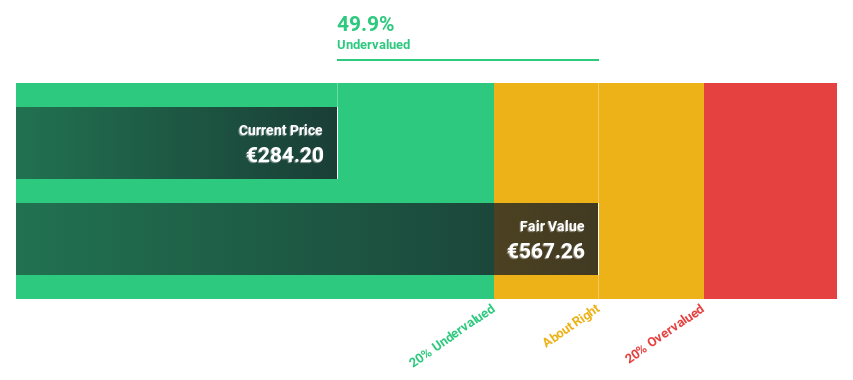

Estimated Discount To Fair Value: 42.4%

MTU Aero Engines is trading at 42.4% below its estimated fair value of €490.67, with a current price of €282.7. Recent earnings show sales of €3.39 billion and net income of €285 million for the first half of 2024, reflecting solid growth from the previous year. The company completed a fixed-income offering worth approximately €745.88 million on September 18, 2024, enhancing its financial flexibility while maintaining strong cash flows and profitability forecasts above market averages.

- According our earnings growth report, there's an indication that MTU Aero Engines might be ready to expand.

- Take a closer look at MTU Aero Engines' balance sheet health here in our report.

Deutsche Pfandbriefbank (XTRA:PBB)

Overview: Deutsche Pfandbriefbank AG is a financial institution that offers commercial real estate and public investment financing in Europe and the USA, with a market cap of €789.37 million.

Operations: The company's revenue segments include Real Estate Finance (REF) at €223 million and Non-Core (NC) at €103 million.

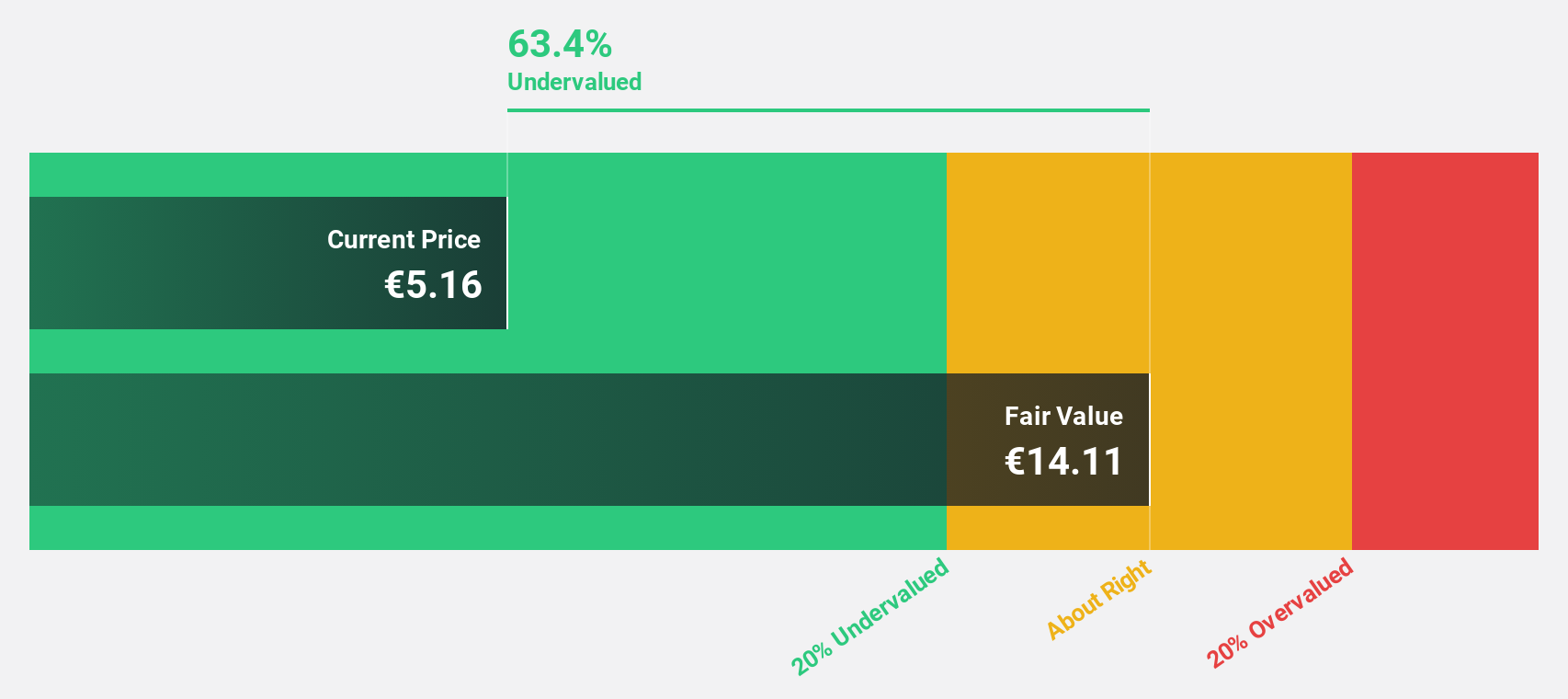

Estimated Discount To Fair Value: 15.4%

Deutsche Pfandbriefbank is trading at €5.87, below its estimated fair value of €6.94. Despite a drop in net income to €40 million for the first half of 2024 from €69 million last year, earnings are forecast to grow significantly at 40.15% annually over the next three years, outpacing the German market's 20.1%. However, with a high level of bad loans (4.1%) and low return on equity forecast (3.6%), risks remain evident.

- Our earnings growth report unveils the potential for significant increases in Deutsche Pfandbriefbank's future results.

- Navigate through the intricacies of Deutsche Pfandbriefbank with our comprehensive financial health report here.

SAP (XTRA:SAP)

Overview: SAP SE, along with its subsidiaries, offers applications, technology, and services globally and has a market cap of approximately €240.64 billion.

Operations: SAP's revenue from applications, technology, and services amounts to €32.54 billion.

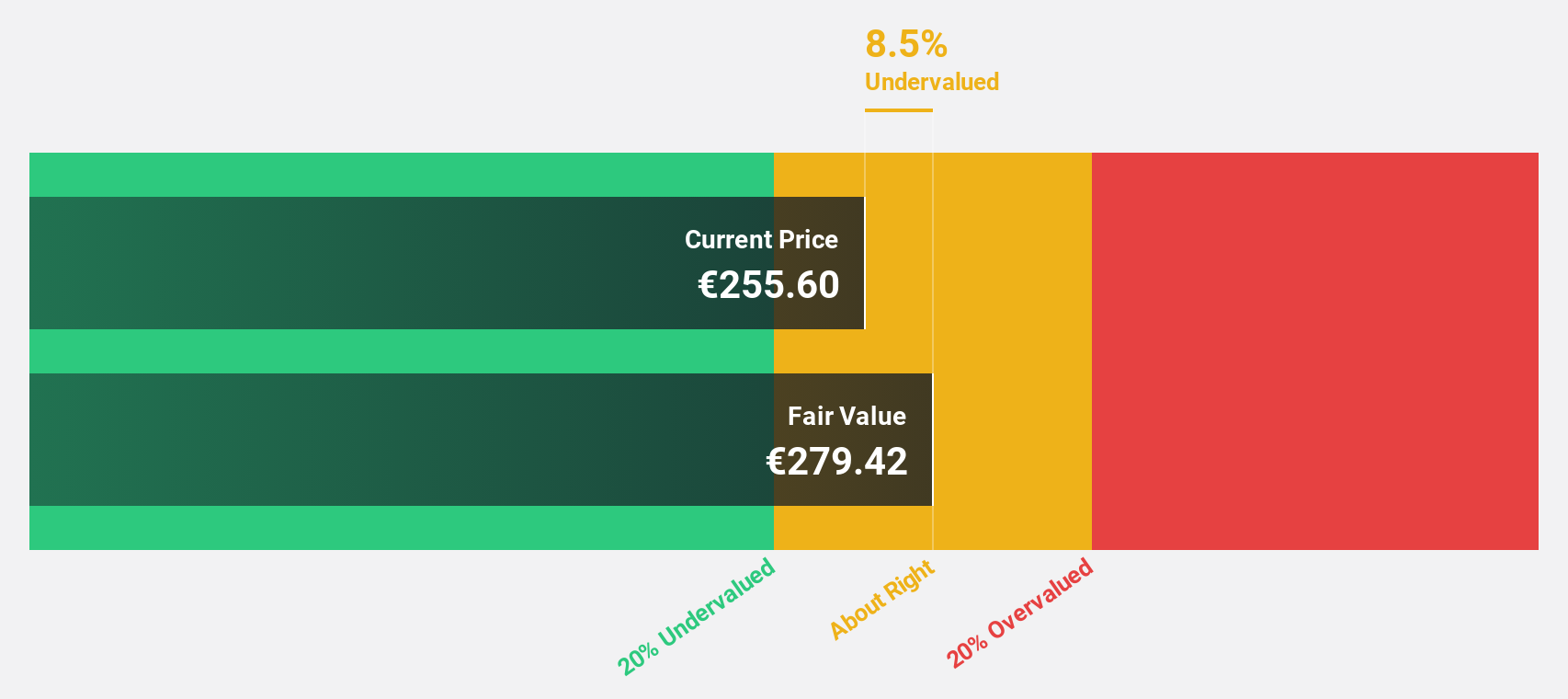

Estimated Discount To Fair Value: 14.3%

SAP is trading at €206.85, below its estimated fair value of €241.48, indicating it may be undervalued based on cash flows. Despite recent executive changes and a shelf registration filing of $60.93 million, SAP's earnings are forecast to grow significantly at 37.93% annually over the next three years, outpacing the German market's 20.1%. However, its return on equity is expected to be low at 16.4%, presenting some concerns for investors.

- In light of our recent growth report, it seems possible that SAP's financial performance will exceed current levels.

- Click here to discover the nuances of SAP with our detailed financial health report.

Make It Happen

- Take a closer look at our Undervalued German Stocks Based On Cash Flows list of 18 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade MTU Aero Engines, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MTX

MTU Aero Engines

Engages in the development, manufacture, marketing, and maintenance of commercial and military aircraft engines, and aero-derivative industrial gas turbines in Germany, other European countries, North America, Asia, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives