- Germany

- /

- Industrials

- /

- XTRA:MBB

Discovering Three Promising Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

In the current economic landscape, global markets have experienced moderate gains despite a dip in U.S. consumer confidence and mixed signals from key economic indicators. As large-cap stocks lead the charge, small-cap stocks like those in the S&P 600 are drawing attention for their potential resilience and growth opportunities amid these fluctuating conditions. In such an environment, identifying small-cap stocks with strong fundamentals can be crucial for investors seeking to capitalize on undervalued opportunities that may offer robust long-term prospects.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hong Ho Precision TextileLtd | 7.48% | 36.01% | 84.13% | ★★★★★★ |

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

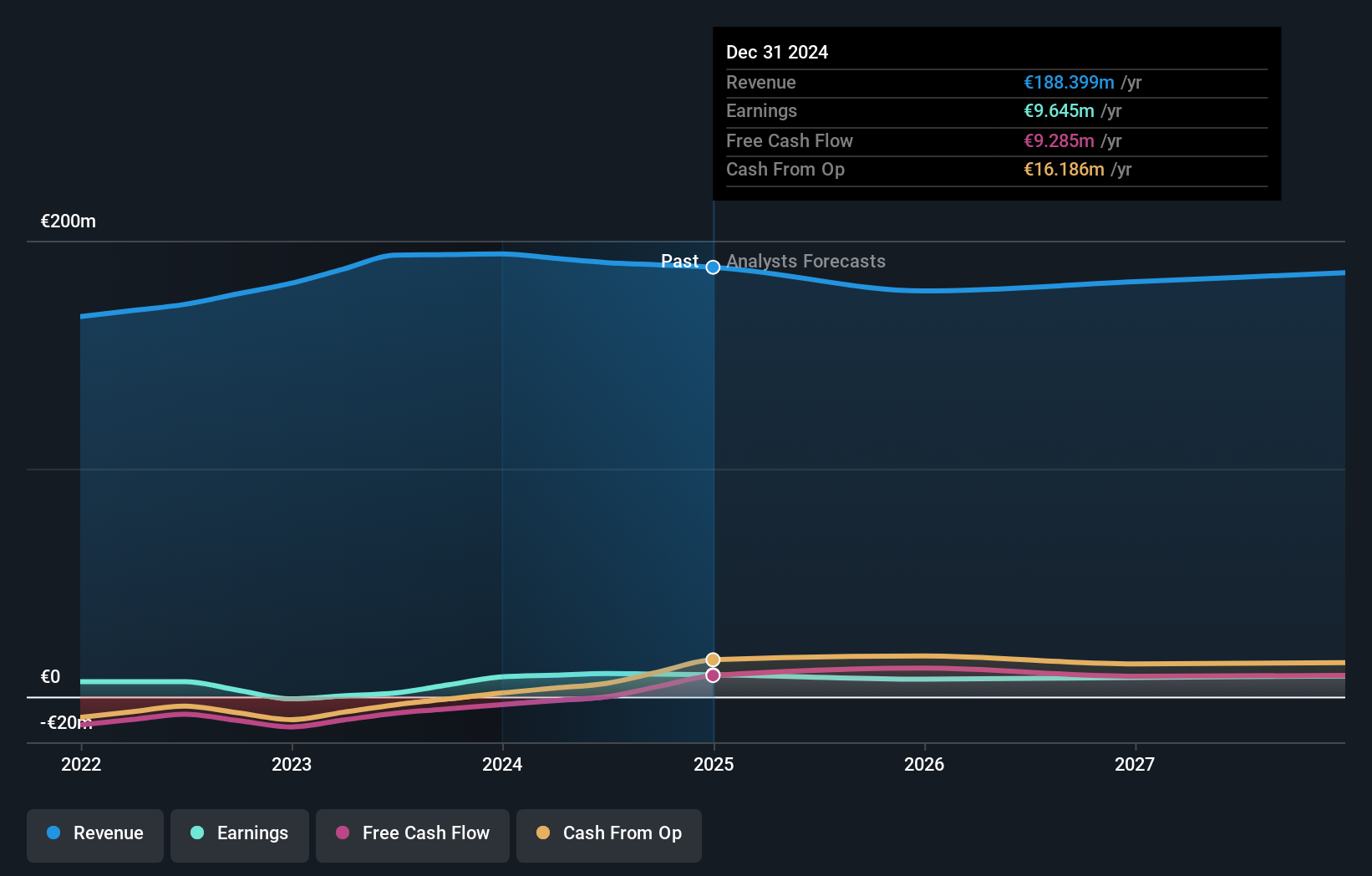

Marie Brizard Wine & Spirits (ENXTPA:MBWS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marie Brizard Wine & Spirits SA is involved in the production, marketing, and sale of wines and spirits across various regions including France, Europe, Africa, the Americas, and the Asia Pacific with a market capitalization of approximately €436.35 million.

Operations: Marie Brizard Wine & Spirits generates revenue primarily from its operations in France (€83.80 million) and international markets (€106.60 million).

Marie Brizard Wine & Spirits, a smaller player in the beverage sector, has shown remarkable earnings growth of 517% over the past year, outpacing its industry which saw a -22% change. This surge is partly attributed to a significant one-off gain of €3M. The company seems financially sound with more cash than total debt and an improved debt-to-equity ratio from 66% to 2% over five years. Despite these positives, future earnings are projected to decrease by about 1.2% annually for the next three years, suggesting cautious optimism for potential investors.

- Click here and access our complete health analysis report to understand the dynamics of Marie Brizard Wine & Spirits.

Gain insights into Marie Brizard Wine & Spirits' past trends and performance with our Past report.

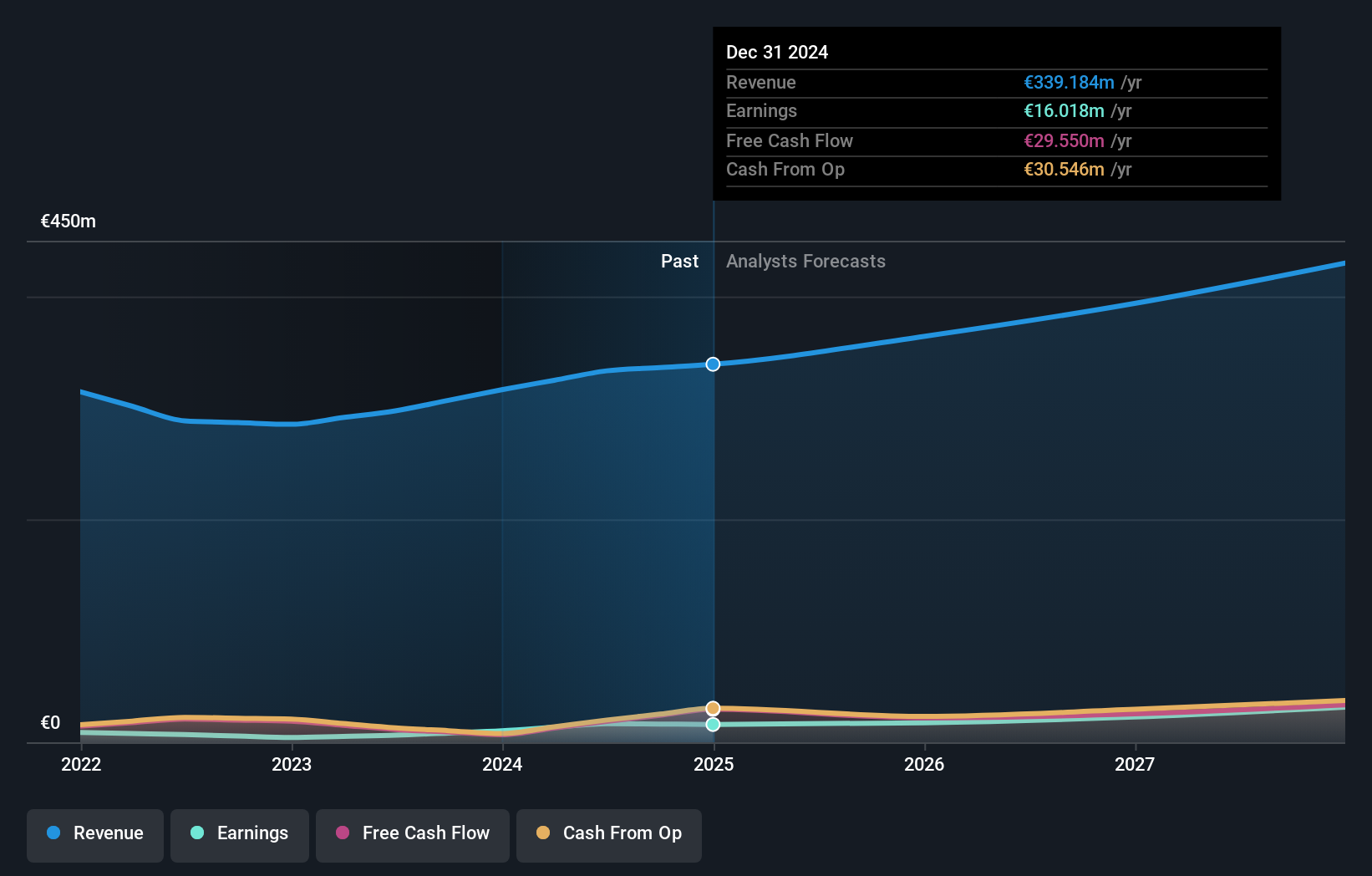

M1 Kliniken (XTRA:M12)

Simply Wall St Value Rating: ★★★★★☆

Overview: M1 Kliniken AG, along with its subsidiaries, offers aesthetic medicine and plastic surgery services across several countries including Germany, Austria, and the United Kingdom, with a market cap of €304.30 million.

Operations: M1 Kliniken generates revenue primarily through its Trade segment (€251.09 million) and Beauty segment (€82.23 million). The company's revenue streams are diversified across these segments, reflecting its focus on aesthetic medicine and plastic surgery services in multiple countries.

M1 Kliniken, a healthcare player with a modest market presence, seems to offer intriguing prospects. Trading at 71% below its estimated fair value, it appears undervalued compared to industry peers. The company's earnings grew by 164% last year, outpacing the broader healthcare sector's 36%. With a satisfactory net debt to equity ratio of 1%, financial stability is apparent. Recent strategic moves include repurchasing over one million shares for €13.9 million between July 2023 and June 2024. This combination of robust growth and strategic buybacks suggests potential for future appreciation in value.

- Delve into the full analysis health report here for a deeper understanding of M1 Kliniken.

Explore historical data to track M1 Kliniken's performance over time in our Past section.

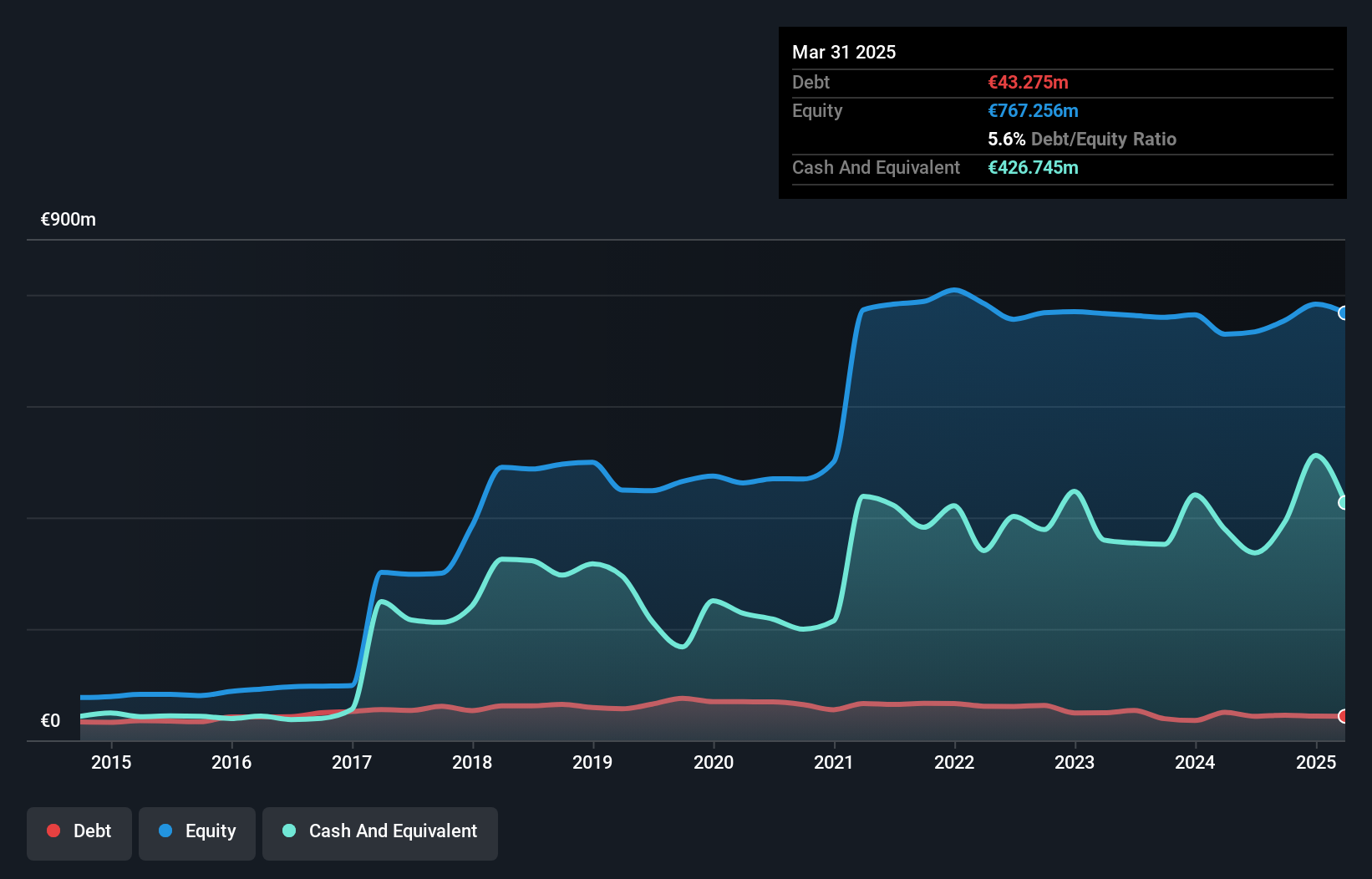

MBB (XTRA:MBB)

Simply Wall St Value Rating: ★★★★★★

Overview: MBB SE, with a market cap of approximately €541.99 million, focuses on acquiring and managing medium-sized companies mainly in the technology and engineering sectors both in Germany and internationally.

Operations: MBB SE generates revenue from three primary segments: Consumer Goods (€95.32 million), Technical Applications (€391.22 million), and Service & Infrastructure (€542.03 million). The company's financial performance is influenced by its diverse portfolio across these sectors, with the Service & Infrastructure segment contributing the most to total revenue.

MBB, a promising player in the financial sector, has shown remarkable growth with earnings surging by 587.7% over the past year, far outpacing the Industrials industry average of 3.7%. The company is trading at 28.9% below its estimated fair value, suggesting potential for appreciation. Its debt to equity ratio has impressively decreased from 16.2% to just 6% over five years, reflecting prudent financial management. Recent earnings reports highlight a significant rise in net income to €4.05 million for Q3 compared to €1.37 million last year, with basic EPS climbing from €0.24 to €0.76 per share for continuing operations.

- Click here to discover the nuances of MBB with our detailed analytical health report.

Examine MBB's past performance report to understand how it has performed in the past.

Taking Advantage

- Click this link to deep-dive into the 4644 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MBB

MBB

Engages in the acquisition and management of medium-sized companies primarily in the technology and engineering sectors in Germany and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives