Investing in Krones (ETR:KRN) three years ago would have delivered you a 71% gain

Krones AG (ETR:KRN) shareholders have seen the share price descend 12% over the month. But don't let that distract from the very nice return generated over three years. After all, the share price is up a market-beating 65% in that time.

So let's assess the underlying fundamentals over the last 3 years and see if they've moved in lock-step with shareholder returns.

See our latest analysis for Krones

SWOT Analysis for Krones

- Earnings growth over the past year exceeded the industry.

- Debt is not viewed as a risk.

- Dividends are covered by earnings and cash flows.

- Dividend is low compared to the top 25% of dividend payers in the Machinery market.

- Annual earnings are forecast to grow faster than the German market.

- Good value based on P/E ratio and estimated fair value.

- Revenue is forecast to grow slower than 20% per year.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

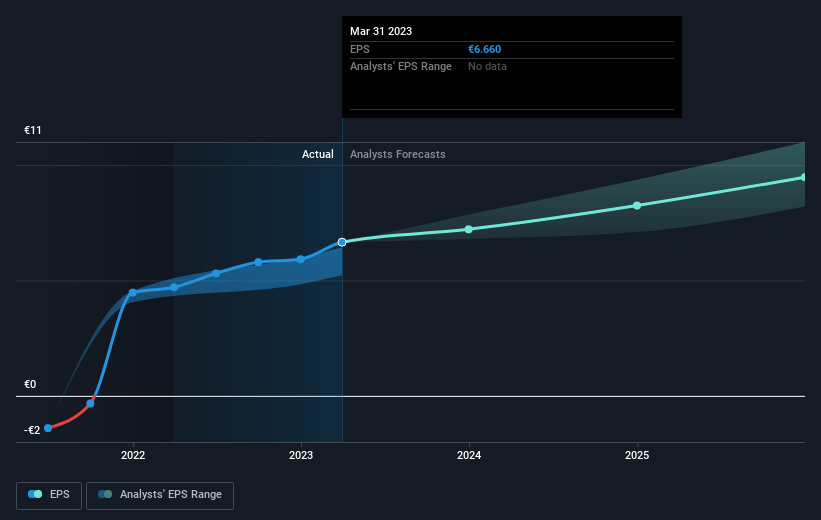

Krones was able to grow its EPS at 158% per year over three years, sending the share price higher. This EPS growth is higher than the 18% average annual increase in the share price. So it seems investors have become more cautious about the company, over time.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Krones has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Krones the TSR over the last 3 years was 71%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Krones has rewarded shareholders with a total shareholder return of 24% in the last twelve months. That's including the dividend. There's no doubt those recent returns are much better than the TSR loss of 0.6% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Krones better, we need to consider many other factors. For example, we've discovered 1 warning sign for Krones that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Krones might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:KRN

Krones

Engages in the planning, development, and manufacture of machines and lines for the production, filling, and packaging technology for the food and beverage industry in Germany and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives