Capital Allocation Trends At Knorr-Bremse (ETR:KBX) Aren't Ideal

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after investigating Knorr-Bremse (ETR:KBX), we don't think it's current trends fit the mold of a multi-bagger.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Knorr-Bremse is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = €812m ÷ (€8.1b - €2.6b) (Based on the trailing twelve months to September 2023).

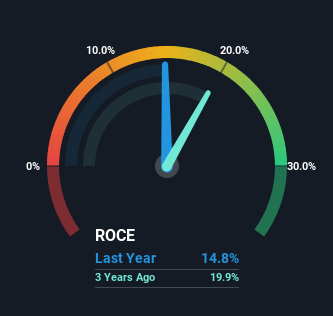

Therefore, Knorr-Bremse has an ROCE of 15%. In absolute terms, that's a satisfactory return, but compared to the Machinery industry average of 11% it's much better.

Check out our latest analysis for Knorr-Bremse

In the above chart we have measured Knorr-Bremse's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

The Trend Of ROCE

On the surface, the trend of ROCE at Knorr-Bremse doesn't inspire confidence. To be more specific, ROCE has fallen from 27% over the last five years. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

Our Take On Knorr-Bremse's ROCE

In summary, despite lower returns in the short term, we're encouraged to see that Knorr-Bremse is reinvesting for growth and has higher sales as a result. And there could be an opportunity here if other metrics look good too, because the stock has declined 26% in the last five years. So we think it'd be worthwhile to look further into this stock given the trends look encouraging.

On a final note, we've found 1 warning sign for Knorr-Bremse that we think you should be aware of.

While Knorr-Bremse isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Knorr-Bremse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:KBX

Knorr-Bremse

Engages in the development, production, marketing, and servicing of braking and other systems for rail and commercial vehicles worldwide.

Outstanding track record with flawless balance sheet.