Ringmetall SE (ETR:HP3A) Looks Like A Good Stock, And It's Going Ex-Dividend Soon

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Ringmetall SE (ETR:HP3A) is about to trade ex-dividend in the next 3 days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. This means that investors who purchase Ringmetall's shares on or after the 26th of June will not receive the dividend, which will be paid on the 28th of June.

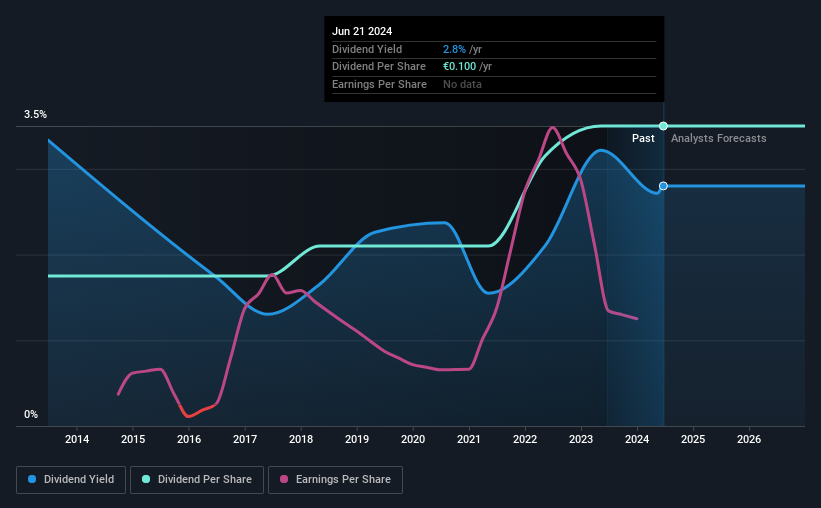

The company's upcoming dividend is €0.10 a share, following on from the last 12 months, when the company distributed a total of €0.10 per share to shareholders. Last year's total dividend payments show that Ringmetall has a trailing yield of 2.8% on the current share price of €3.57. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Ringmetall

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately Ringmetall's payout ratio is modest, at just 50% of profit. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out 20% of its free cash flow as dividends last year, which is conservatively low.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Ringmetall paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're encouraged by the steady growth at Ringmetall, with earnings per share up 3.1% on average over the last five years. Recent growth has not been impressive. Yet there are several ways to grow the dividend, and one of them is simply that the company may choose to pay out more of its earnings as dividends.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past 10 years, Ringmetall has increased its dividend at approximately 7.2% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

Final Takeaway

From a dividend perspective, should investors buy or avoid Ringmetall? Earnings per share growth has been growing somewhat, and Ringmetall is paying out less than half its earnings and cash flow as dividends. This is interesting for a few reasons, as it suggests management may be reinvesting heavily in the business, but it also provides room to increase the dividend in time. We would prefer to see earnings growing faster, but the best dividend stocks over the long term typically combine significant earnings per share growth with a low payout ratio, and Ringmetall is halfway there. There's a lot to like about Ringmetall, and we would prioritise taking a closer look at it.

While it's tempting to invest in Ringmetall for the dividends alone, you should always be mindful of the risks involved. For example, we've found 1 warning sign for Ringmetall that we recommend you consider before investing in the business.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

If you're looking to trade Ringmetall, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HP3A

Ringmetall

Develops, produces, and markets packaging solutions for industrial drums in Germany and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives