- Germany

- /

- Construction

- /

- XTRA:HOT

Why HOCHTIEF (XTRA:HOT) Is Up 10.4% After Posting Robust Q3 2025 Earnings Growth

Reviewed by Sasha Jovanovic

- HOCHTIEF recently reported third-quarter 2025 earnings, posting sales of €9,739.58 million and net income of €174.62 million, both up from the previous year’s results, along with an increase in basic earnings per share to €2.32.

- This release also highlighted continued momentum over the first nine months of 2025, with cumulative sales reaching €28.11 billion and net income of €655.64 million, reflecting improved operational performance across its core business segments.

- We’ll now explore how HOCHTIEF’s robust sales and profit growth could influence the company’s long-term investment outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

HOCHTIEF Investment Narrative Recap

Anyone investing in HOCHTIEF has to believe in the continued surge of global infrastructure demand, especially as digitalization and energy transition themes drive multi-year project pipelines. The company’s third-quarter earnings growth further supports optimism around sector momentum, but the persistence of above-trend expansion remains the most important catalyst while heightened expectations risk disappointment if economic conditions shift; recent results do not materially change this risk profile.

Among recent announcements, HOCHTIEF’s sizable dividend increase earlier this year stands out. This move reinforced confidence in the company’s robust cash generation and long-term earnings stability, key points for those who see recurring returns as central to the investment case in light of the strong operational results highlighted in the latest report.

However, investors should also be aware that if government priorities or economic cycles shift abruptly, the company’s backlog and revenue visibility may not be as secure as it seems...

Read the full narrative on HOCHTIEF (it's free!)

HOCHTIEF's outlook projects €41.7 billion in revenue and €1.0 billion in earnings by 2028. This is based on analysts' assumptions of 4.0% annual revenue growth and an increase in earnings of €179.7 million from the current €820.3 million.

Uncover how HOCHTIEF's forecasts yield a €205.52 fair value, a 29% downside to its current price.

Exploring Other Perspectives

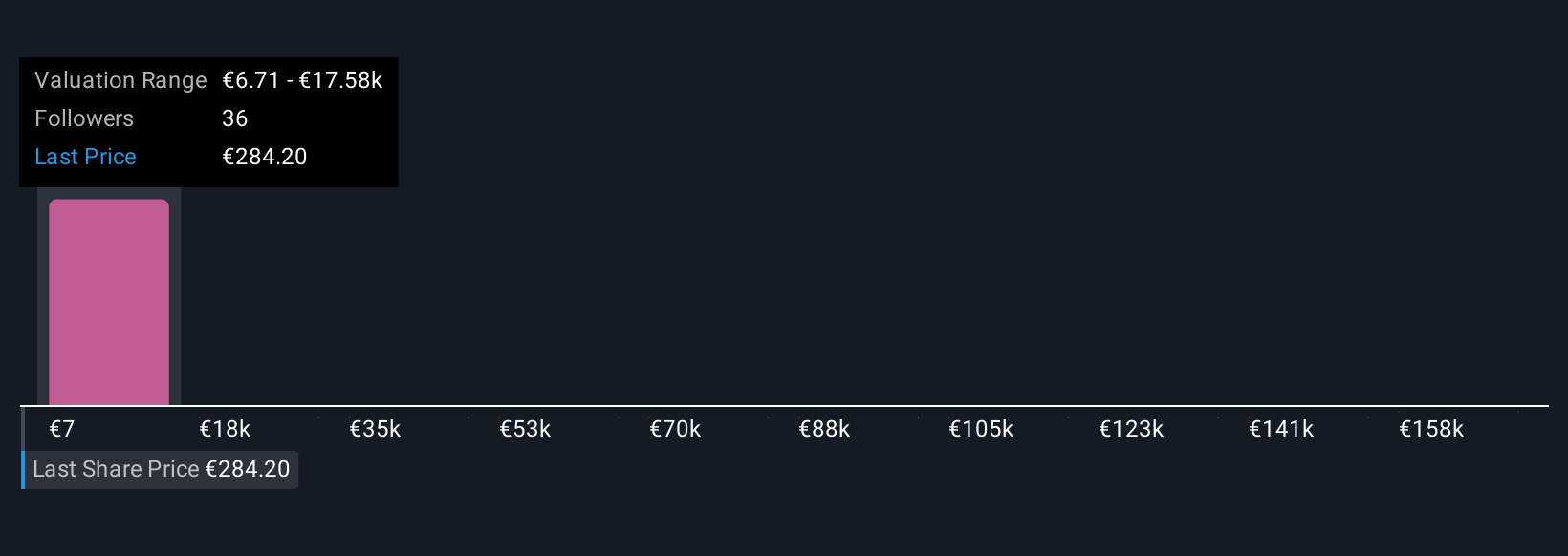

Six fair value estimates from the Simply Wall St Community range from €6.71 to €175,722.36, highlighting divergence in personal valuation models. Some investors see rapid, broad-based sales and order growth as a key driver for future performance, inviting you to consider several competing viewpoints.

Explore 6 other fair value estimates on HOCHTIEF - why the stock might be worth less than half the current price!

Build Your Own HOCHTIEF Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HOCHTIEF research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free HOCHTIEF research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HOCHTIEF's overall financial health at a glance.

No Opportunity In HOCHTIEF?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HOCHTIEF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HOT

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives