- Germany

- /

- Construction

- /

- XTRA:HOT

A Look at HOCHTIEF (XTRA:HOT) Valuation Following Strong Q3 and Nine-Month Profit Growth

Reviewed by Simply Wall St

HOCHTIEF (XTRA:HOT) has just released its third quarter and nine-month earnings, with both sales and net income advancing compared to last year. Investors are taking note of the consistent upward trend in profitability.

See our latest analysis for HOCHTIEF.

HOCHTIEF’s share price has kept investors on their toes, surging nearly 29% over the past three months and delivering an eye-catching year-to-date share price return of almost 115%. With long-term momentum also reflected in a remarkable 1-year total shareholder return of 157%, it is clear market confidence in the company’s growth outlook continues to build as solid results roll in.

If this kind of sustained momentum has you thinking bigger, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With HOCHTIEF’s rapid share price appreciation fueled by rising sales and profits, investors may now be wondering if the stock is undervalued or whether recent gains have already incorporated expectations of future growth. Could there still be a buying opportunity?

Most Popular Narrative: 39% Overvalued

HOCHTIEF’s last close of €284.60 sits notably above the most popular narrative’s fair value estimate of €205.53, fueling a sharp debate over the sustainability of its current price. The backdrop is an ambitious outlook, but one that suggests the market may be pricing in continued strength that is challenging to maintain.

The company's aggressive expansion through bolt-on acquisitions in high-growth verticals such as advanced technology engineering, data centers, and critical minerals may be fueling investor beliefs that HOCHTIEF will consistently achieve premium margins and double-digit earnings growth. However, integration, operational complexity, and potential execution risks may ultimately weigh on net margins if current momentum falters.

If you want to uncover the bold calculations behind this valuation, look closer at the projected margin expansion and future earnings power that underpins the narrative. Wondering how high-growth bets and ambitious earnings targets stack up against today’s price? Dive deeper to see the full story.

Result: Fair Value of €205.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global infrastructure demand or successful expansion into high-growth sectors could quickly shift sentiment and challenge assumptions of overvaluation.

Find out about the key risks to this HOCHTIEF narrative.

Another View: DCF Suggests Opportunity Remains

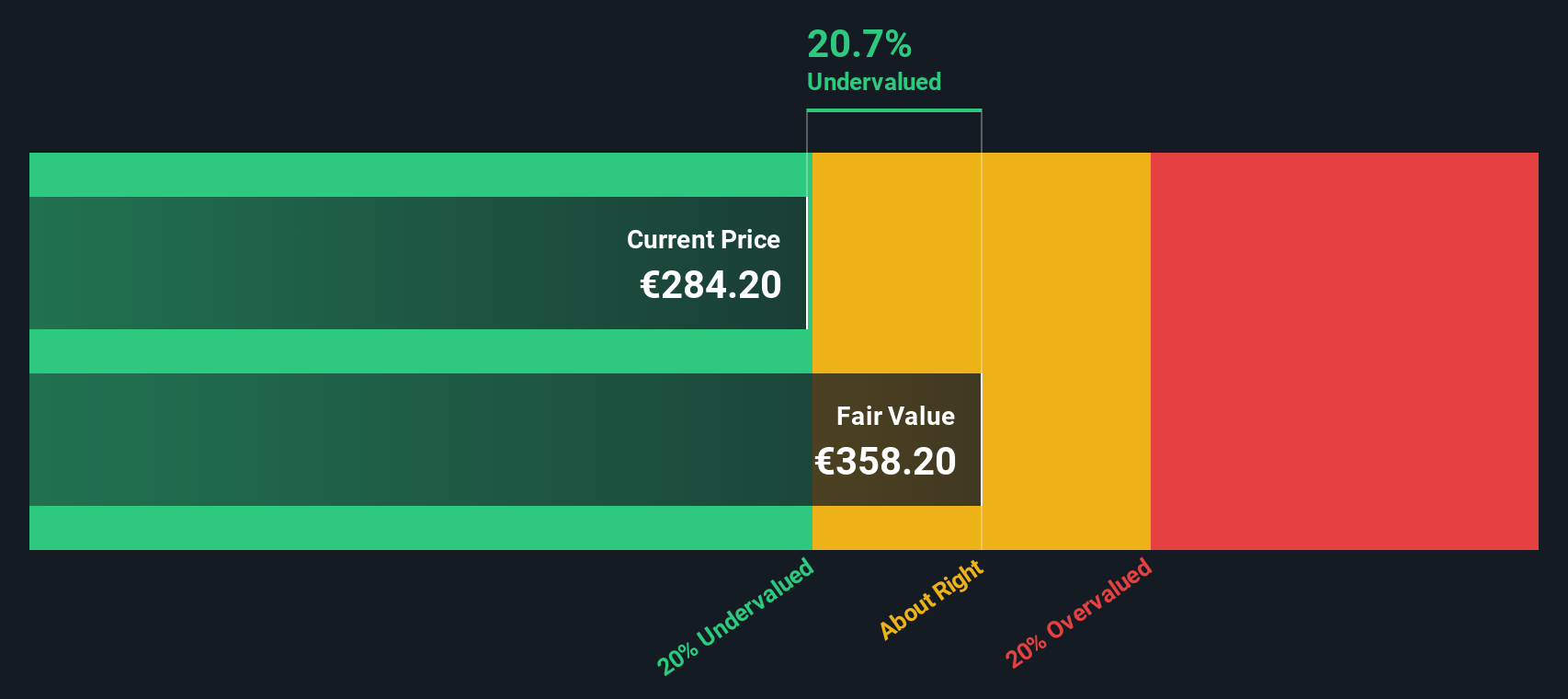

While the most popular narrative and analyst price targets cast HOCHTIEF as overvalued, our DCF model offers an alternative. It places the fair value at €356.32, about 20% above the current trading price. Could fundamentals, rather than market excitement or skepticism, be pointing toward fresh upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own HOCHTIEF Narrative

If you have a different take or want to dig into the numbers yourself, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your HOCHTIEF research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Think bigger than one stock. Broaden your horizons and seize tomorrow’s investment themes right now by handpicking opportunities tailored to your strategy using our screeners.

- Power up your portfolio with consistent, high-yield payouts by checking out these 15 dividend stocks with yields > 3%. These can offer returns above 3% and reward income-focused investors.

- Capitalize on the AI boom ahead of the mainstream by starting your search with these 27 AI penny stocks, which deliver disruptive potential in artificial intelligence-driven sectors.

- Unlock rapid upside by targeting these 870 undervalued stocks based on cash flows where strong cash flows could indicate mispriced shares that the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HOCHTIEF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HOT

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives