If You Had Bought Heidelberger Druckmaschinen's (ETR:HDD) Shares Three Years Ago You Would Be Down 72%

It is a pleasure to report that the Heidelberger Druckmaschinen Aktiengesellschaft (ETR:HDD) is up 45% in the last quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. To wit, the share price sky-dived 72% in that time. Arguably, the recent bounce is to be expected after such a bad drop. Only time will tell if the company can sustain the turnaround.

View our latest analysis for Heidelberger Druckmaschinen

Heidelberger Druckmaschinen isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Heidelberger Druckmaschinen's revenue dropped 4.5% per year. That is not a good result. The share price fall of 20% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. This business clearly needs to grow revenues if it is to perform as investors hope. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

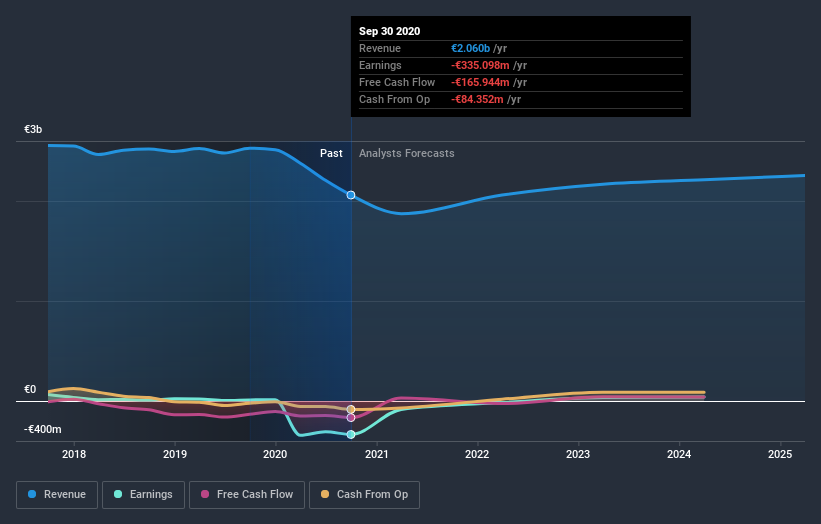

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Heidelberger Druckmaschinen's financial health with this free report on its balance sheet.

A Different Perspective

Heidelberger Druckmaschinen shareholders are down 31% for the year, but the market itself is up 6.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Heidelberger Druckmaschinen better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Heidelberger Druckmaschinen you should know about.

Of course Heidelberger Druckmaschinen may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you decide to trade Heidelberger Druckmaschinen, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Heidelberger Druckmaschinen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:HDD

Heidelberger Druckmaschinen

Manufactures, sells, and deals in printing presses and other print media industry products in Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives