The 3.2% return this week takes GEA Group's (ETR:G1A) shareholders three-year gains to 50%

By buying an index fund, investors can approximate the average market return. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. Just take a look at GEA Group Aktiengesellschaft (ETR:G1A), which is up 38%, over three years, soundly beating the market decline of 2.6% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 9.4% , including dividends .

The past week has proven to be lucrative for GEA Group investors, so let's see if fundamentals drove the company's three-year performance.

View our latest analysis for GEA Group

SWOT Analysis for GEA Group

- Earnings growth over the past year exceeded the industry.

- Debt is not viewed as a risk.

- Dividends are covered by earnings and cash flows.

- Earnings growth over the past year is below its 5-year average.

- Dividend is low compared to the top 25% of dividend payers in the Machinery market.

- Expensive based on P/E ratio and estimated fair value.

- Annual earnings are forecast to grow for the next 3 years.

- Annual earnings are forecast to grow slower than the German market.

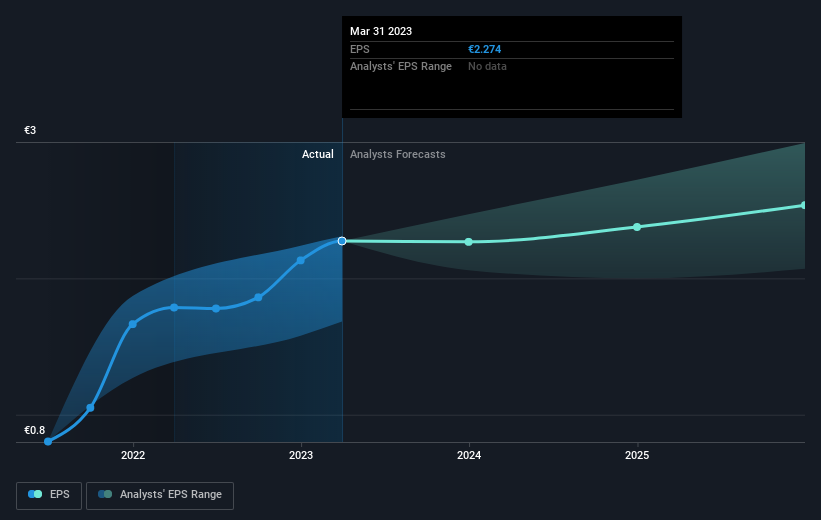

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, GEA Group moved from a loss to profitability. So we would expect a higher share price over the period.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how GEA Group has grown profits over the years, but the future is more important for shareholders. This free interactive report on GEA Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for GEA Group the TSR over the last 3 years was 50%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that GEA Group shareholders have received a total shareholder return of 9.4% over the last year. And that does include the dividend. That's better than the annualised return of 7% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Is GEA Group cheap compared to other companies? These 3 valuation measures might help you decide.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

If you're looking to trade GEA Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:G1A

GEA Group

Produces and supplies systems and components to the food, beverage, and pharmaceutical industries worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives