- Saudi Arabia

- /

- Energy Services

- /

- SASE:2382

November 2024's Noteworthy Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have been buoyed by expectations of growth and tax reforms, with major indices like the S&P 500 and Nasdaq Composite reaching record highs. Amidst this optimistic climate, investors are keenly searching for stocks that may be trading below their intrinsic value, offering potential opportunities to capitalize on market movements influenced by evolving fiscal policies and economic conditions. Identifying such undervalued stocks requires careful analysis of fundamentals and market trends to ensure alignment with long-term investment goals.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.53 | CN¥18.84 | 49.4% |

| UMB Financial (NasdaqGS:UMBF) | US$123.80 | US$245.87 | 49.6% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.32 | US$99.93 | 49.6% |

| Decisive Dividend (TSXV:DE) | CA$6.18 | CA$12.23 | 49.5% |

| JYP Entertainment (KOSDAQ:A035900) | ₩53700.00 | ₩106760.01 | 49.7% |

| XPEL (NasdaqCM:XPEL) | US$45.62 | US$91.03 | 49.9% |

| Pinterest (NYSE:PINS) | US$29.98 | US$59.53 | 49.6% |

| GRCS (TSE:9250) | ¥1500.00 | ¥2976.24 | 49.6% |

| Medios (XTRA:ILM1) | €14.88 | €29.67 | 49.8% |

| Hotel ShillaLtd (KOSE:A008770) | ₩36900.00 | ₩73388.97 | 49.7% |

We'll examine a selection from our screener results.

ADES Holding (SASE:2382)

Overview: ADES Holding Company, with a market cap of SAR21.98 billion, operates through its subsidiaries to provide oil and gas drilling and production facilities across Egypt, Algeria, Kuwait, Tunisia, Qatar, India, and the Kingdom of Saudi Arabia.

Operations: Revenue Segments (in millions of SAR): The company generates revenue through its subsidiaries by offering oil and gas drilling and production services in Egypt, Algeria, Kuwait, Tunisia, Qatar, India, and Saudi Arabia.

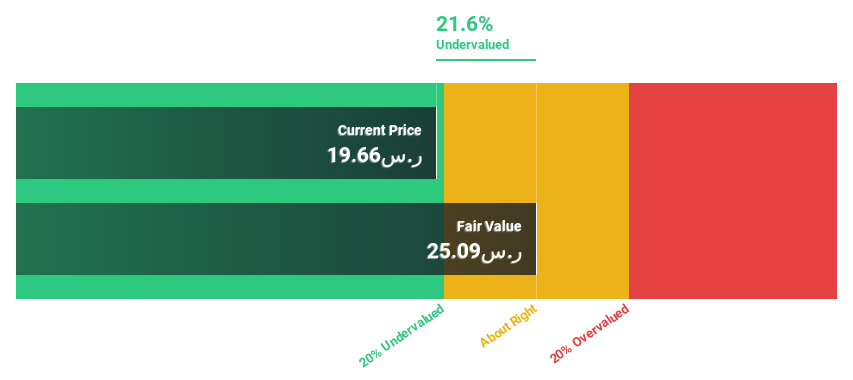

Estimated Discount To Fair Value: 19.9%

ADES Holding reported strong earnings growth, with third-quarter net income rising to SAR 199.62 million from SAR 83.87 million a year ago, and sales increasing to SAR 1.57 billion. The stock trades at approximately 19.9% below its estimated fair value of SAR 24.96, though interest payments are not well covered by earnings and the dividend yield of 2.16% is unsustainable from free cash flows despite significant earnings growth forecasts of over 20% annually.

- Our comprehensive growth report raises the possibility that ADES Holding is poised for substantial financial growth.

- Get an in-depth perspective on ADES Holding's balance sheet by reading our health report here.

WuXi XDC Cayman (SEHK:2268)

Overview: WuXi XDC Cayman Inc. is an investment holding company that functions as a contract research, development, and manufacturing organization across China, North America, Europe, and internationally with a market cap of HK$31.33 billion.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, which amounts to CN¥2.80 billion.

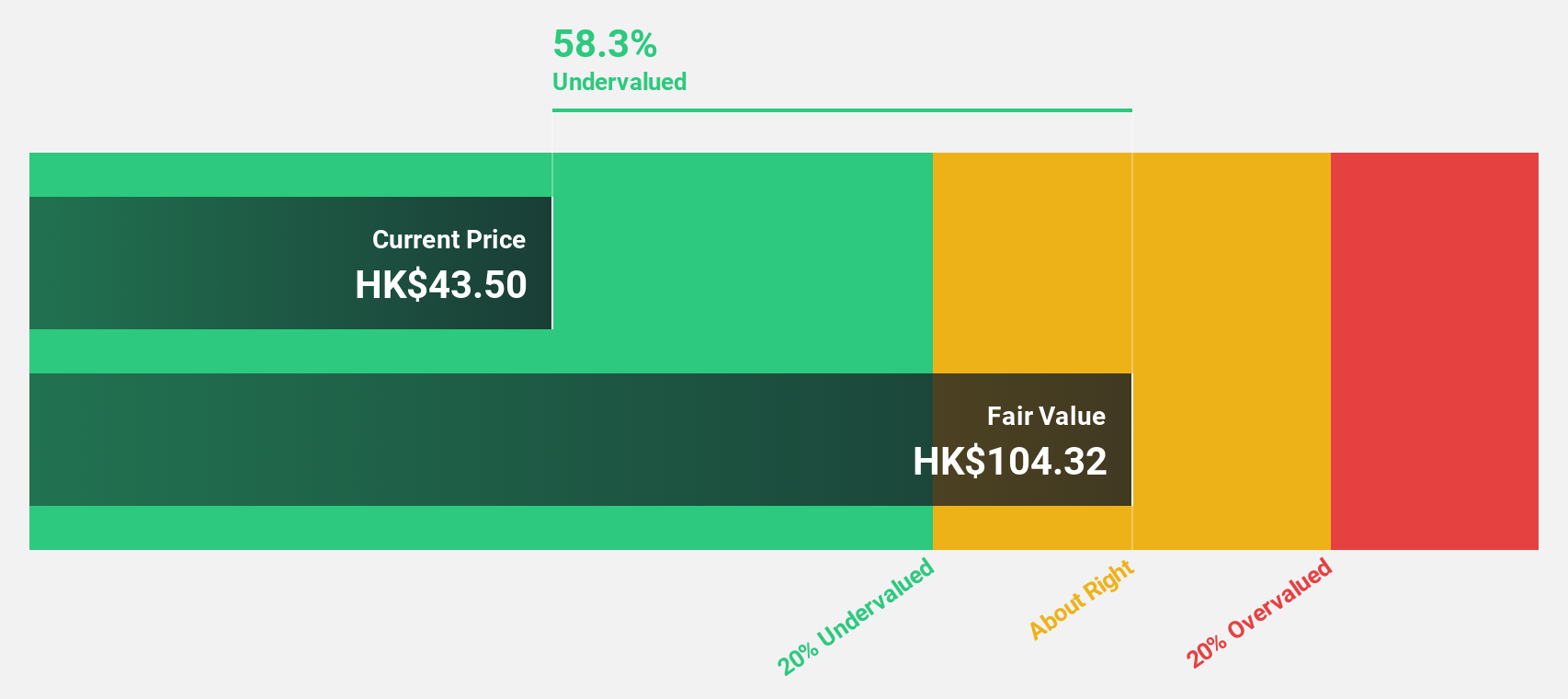

Estimated Discount To Fair Value: 31.5%

WuXi XDC Cayman shows potential as an undervalued stock, trading at HK$26.15, below its fair value estimate of HK$38.2. The company reported significant earnings growth for H1 2024, with net income rising to CNY 488.23 million from CNY 177.21 million a year ago and basic earnings per share increasing to CNY 0.41 from CNY 0.18. Revenue and earnings are forecasted to grow significantly above market rates over the next three years.

- The analysis detailed in our WuXi XDC Cayman growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in WuXi XDC Cayman's balance sheet health report.

Siemens Energy (XTRA:ENR)

Overview: Siemens Energy AG is a global energy technology company with a market capitalization of €36.23 billion.

Operations: The company's revenue segments include Gas Services (€10.85 billion), Siemens Gamesa (€9.52 billion), Grid Technologies (€8.60 billion), and Transformation of Industry (€4.95 billion).

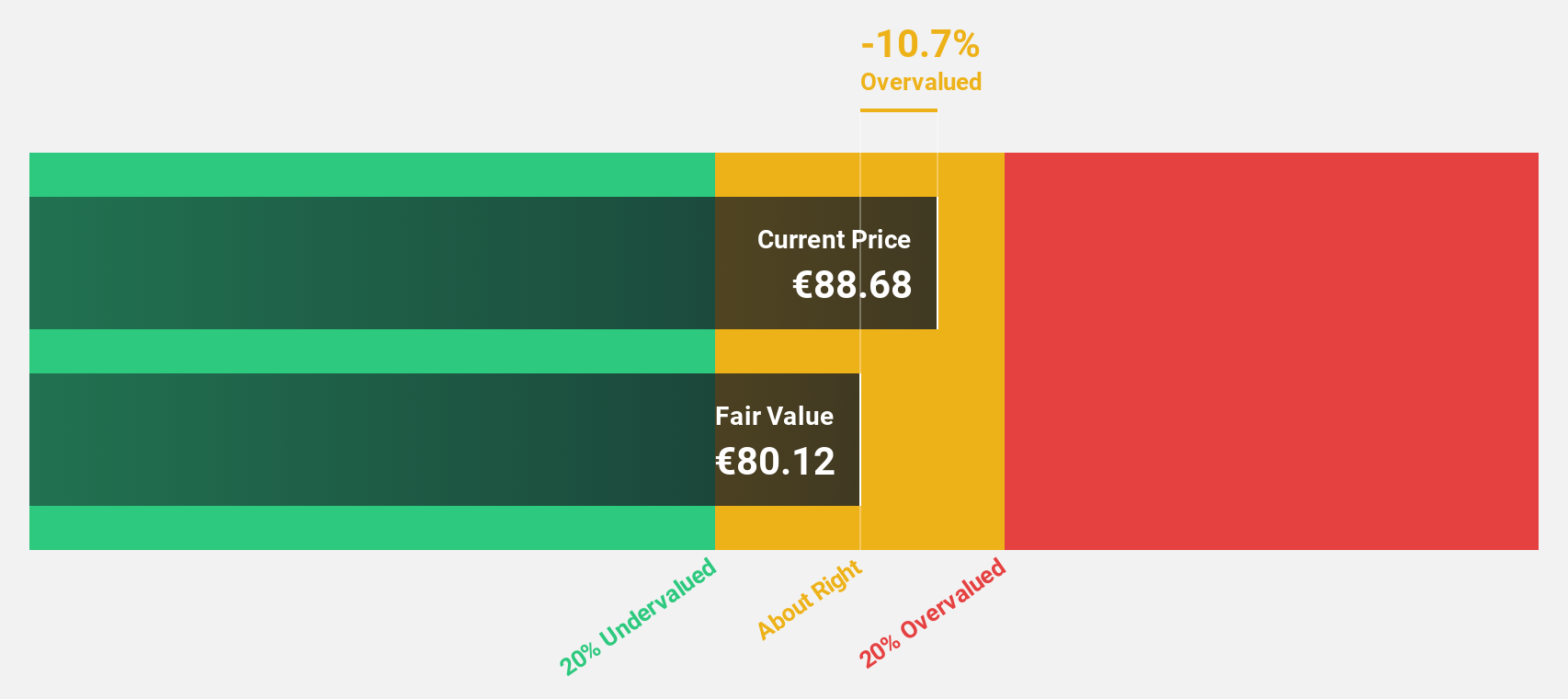

Estimated Discount To Fair Value: 46%

Siemens Energy is trading at €46.33, significantly below its estimated fair value of €85.77, suggesting potential undervaluation based on cash flows. Despite a volatile share price recently, the company reported improved financials with a full-year net income of €1.18 billion compared to a substantial loss last year. Earnings are projected to grow 21.11% annually, outpacing the German market's growth rate and indicating robust future profitability prospects despite slower revenue growth forecasts.

- Our expertly prepared growth report on Siemens Energy implies its future financial outlook may be stronger than recent results.

- Take a closer look at Siemens Energy's balance sheet health here in our report.

Summing It All Up

- Gain an insight into the universe of 906 Undervalued Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2382

ADES Holding

Through its subsidiaries, provides oil and gas drilling and production facilities in Egypt, Algeria, Kuwait, Tunisia, Qatar, India, and the Kingdom of Saudi Arabia.

Solid track record with moderate growth potential.