Daimler Truck (XTRA:DTG): Are Shares Undervalued After Recent Momentum Shift?

Reviewed by Kshitija Bhandaru

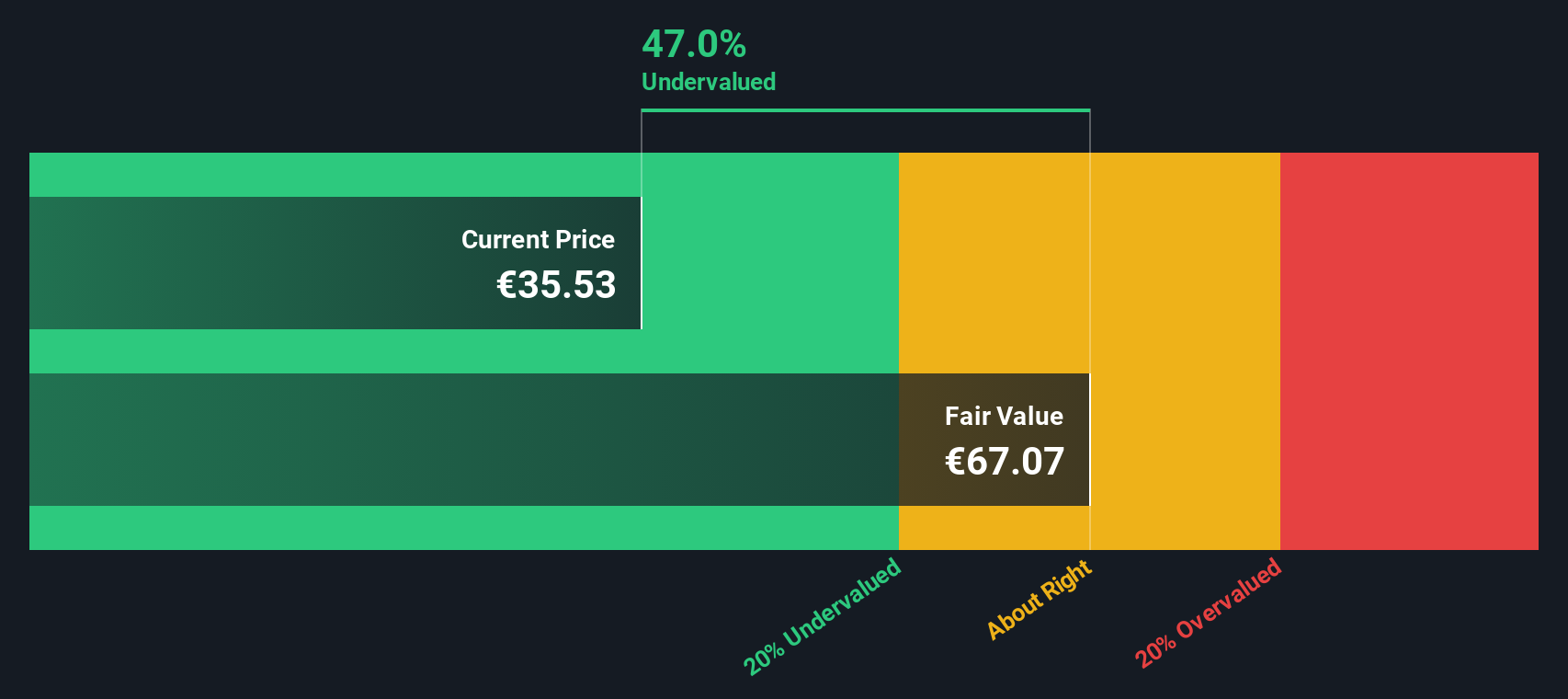

Most Popular Narrative: 18.6% Undervalued

The consensus viewpoint sees Daimler Truck Holding as undervalued, with a fair value set significantly above the current share price, based on a combination of earnings growth, margin expansion, and risk adjustments.

Daimler Truck's leadership in battery-electric and hydrogen truck platforms (e.g., eActros 600, GenH2 Truck) positions it to capitalize on the accelerating shift toward zero-emission vehicles. Especially as decarbonization and emissions regulations increase, this is likely to drive strong long-term revenue growth and support higher gross margins as cost parity with diesel improves and infrastructure develops.

Curious why analysts think Daimler Truck could be trading well below its potential? There is a bold conviction here, backed by ambitious growth and margin targets, plus a future valuation multiple more typical of punchier sectors. What is the cornerstone that makes this narrative tick? The answer might surprise you. The underlying assumptions are anything but conservative.

Result: Fair Value of €44.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent softness in North American demand and delays in zero-emission vehicle adoption could undermine the growth and margin story that supports this optimistic view.

Find out about the key risks to this Daimler Truck Holding narrative.Another View: Sizing Up the SWS DCF Model

While the main viewpoint relies on analyst targets and growth assumptions, our SWS DCF model reaches a similar conclusion using future cash flow estimates. This approach also suggests Daimler Truck Holding is undervalued. However, do both methods interpret future prospects in the same way?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Daimler Truck Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Daimler Truck Holding Narrative

If the current narrative does not match your perspective, or you are someone who likes to dive into the numbers firsthand, you can quickly shape your own view in just a few minutes. Do it your way

A great starting point for your Daimler Truck Holding research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more smart investing moves?

Don’t let opportunities pass you by. The market overflows with trends, undervalued gems, and future disruptors. Put yourself a step ahead with these hand-picked ideas from Simply Wall Street's powerful screener:

- Spot high-potential bargains primed for rebound and growth by using the gateway to undervalued stocks based on cash flows.

- Tap into robust and stable returns by seeking out companies offering dividend stocks with yields > 3% that deliver strong yields above 3%.

- Ride the surge in high-tech health innovation by following advanced breakthroughs shaping tomorrow’s care with our dedicated healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DTG

Daimler Truck Holding

Manufactures and sells light, medium- and heavy-duty trucks and buses in Europe, North America, Asia, Latin America, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives