Traton SE's (ETR:8TRA) Shares Bounce 38% But Its Business Still Trails The Market

Despite an already strong run, Traton SE (ETR:8TRA) shares have been powering on, with a gain of 38% in the last thirty days. The last 30 days bring the annual gain to a very sharp 84%.

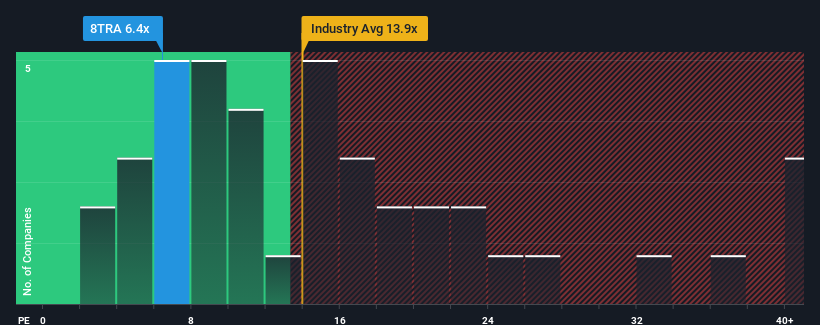

In spite of the firm bounce in price, Traton's price-to-earnings (or "P/E") ratio of 6.4x might still make it look like a strong buy right now compared to the market in Germany, where around half of the companies have P/E ratios above 16x and even P/E's above 34x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for Traton as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Traton

How Is Traton's Growth Trending?

In order to justify its P/E ratio, Traton would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 115%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 3.1% per annum as estimated by the analysts watching the company. With the market predicted to deliver 14% growth each year, the company is positioned for a weaker earnings result.

With this information, we can see why Traton is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Even after such a strong price move, Traton's P/E still trails the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Traton maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Traton is showing 2 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

If you're unsure about the strength of Traton's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Traton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:8TRA

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives