- Germany

- /

- Aerospace & Defense

- /

- XTRA:HAG

Hensoldt AG's (ETR:5UH) 30% Share Price Surge Not Quite Adding Up

Despite an already strong run, Hensoldt AG (ETR:5UH) shares have been powering on, with a gain of 30% in the last thirty days. Looking further back, the 20% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

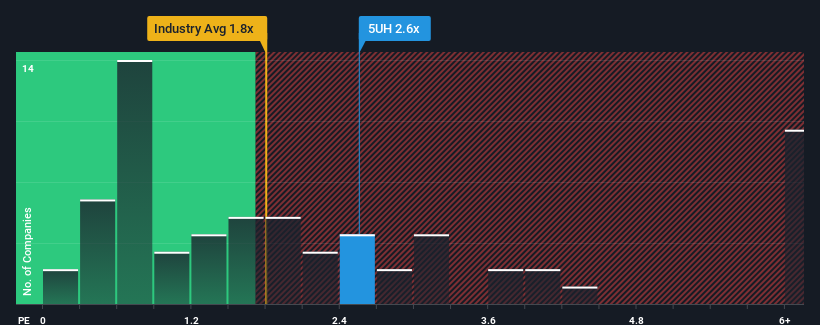

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Hensoldt's P/S ratio of 2.6x, since the median price-to-sales (or "P/S") ratio for the Aerospace & Defense industry in Germany is also close to 2.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Hensoldt

How Hensoldt Has Been Performing

With revenue growth that's inferior to most other companies of late, Hensoldt has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Hensoldt's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Hensoldt would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 8.2% gain to the company's revenues. Pleasingly, revenue has also lifted 53% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 16% per year as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 22% per annum, which is noticeably more attractive.

With this information, we find it interesting that Hensoldt is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

Hensoldt's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Hensoldt's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You always need to take note of risks, for example - Hensoldt has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hensoldt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HAG

Hensoldt

HENSOLDT AG, together with its subsidiaries, provides defense and security electronic sensor solutions worldwide.

High growth potential with solid track record.